You might be considering downgrading your HDB from a 5-Room flat to a 4-Room or an Executive Condo (EC) to a 3-Room, etc. for plenty of reasons. It could be to support your retirement, to pay off your child’s tuition fee or simply because you don’t need the space anymore!

Incidentally, HDB calls it “right-sizing” when you decide to buy a smaller HDB flat from the open market or a 2 to 3-Room flat directly from them.

This is a complex move and you might have a lot of questions on your mind such as, “Can I get grants for buying my second HDB flat?”, “Can I avoid paying a resale levy?”, “What’s the Silver Housing Bonus?”, etc. In this article, we’ll answer every question you might have on downgrading an HDB.

- What eligibility conditions apply to sell my HDB flat before downgrading?

- Will I incur any costs when selling my HDB flat to downgrade?

- How do I calculate my HDB flat sale proceeds before downgrading?

- How to plan which HDB to buy and when?

- What steps do I need to take to downgrade my HDB flat?

1. What eligibility conditions apply to sell my HDB flat before downgrading?

Selling your HDB flat to downgrade is unfortunately not as straightforward as hiring a property agent and putting it up for sale. You first have to see if you qualify for selling and find out if any of the below restrictions apply to you:

- Minimum Occupation Period (MOP)

- Ethnic Integration Policy (EIP) quota

- Singapore Permanent Resident (SPR) quota

a. Minimum Occupation Period (MOP)

The Minimum Occupation Period (MOP) is the minimum number of years you need to have physically occupied your HDB flat before you can sell it. The MOP is calculated from the date you collected the keys to your flat and excludes any period where you did not occupy it (such as, if you were overseas for a year and hence could not occupy it). Typically, you need to have been living in your HDB flat for a minimum period of 5 years before you can sell it. However, this number can vary if you purchased your HDB flat under special conditions such as the Selective Enbloc Redevelopment Scheme (up to 7 years), the Fresh Start Housing Scheme (up to 20 years), bought a flat without a housing grant (can vary from 0 – 5 years) and so on, but in majority of the cases, it is 5 years.

So, if you have not completed the MOP, you will not be eligible to sell your HDB.

To find out if you’ve completed your MOP, you can visit HDB’s site or contact us so we can help you through the process of checking this.

b. Ethnic Integration Policy (EIP) quota

If you have completed your MOP, there may be a further restriction on your sale such as the Ethnic Integration Policy (EIP) quota. EIP restricts the sale of your HDB flat to buyers of specific ethnicities only. HDB does this to promote ethnic integration in a neighbourhood and in the HDB block itself, to ensure there is a balance of different communities.

For example, Swami and Latha, husband and wife respectively, are the owners of an HDB flat in the Bukit Merah area. Their block is restricted by the EIP quota and can only be sold to buyers from a non-Chinese race. In this case, Swami and Latha can sell their flat only to buyers who are Malay, Indian or others by ethnicity.

However, note that this does not apply to all HDB owners. To find out if your flat falls under this quota, visit HDB’s EIP quota service or ask us to check for you. While this quota makes it harder to sell your HDB (due to smaller market size), it does not prevent it entirely and you would still be able to downgrade your HDB.

Note: your property agent should be checking this for you before marketing your property.

c. Singapore Permanent Resident (SPR) quota

If you are a Non-Malaysian Singapore Permanent Resident (SPR), you need to check if your flat falls under the SPR quota. This basically means you can sell your flat only to non-Malaysian SPR buyers.

However, note that this does not apply to all SPR HDB owners. To find out if your flat falls under this quota, visit HDB’s SPR quota service or ask us to check for you. Similar to EIP, while this quota makes it harder to sell your HDB (due to smaller market size), it does not prevent it entirely and you would still be able to downgrade your HDB.

Note: your property agent should be checking this for you before marketing your property.

2. Will I incur any costs when selling my HDB flat to downgrade?

After you’ve found out that you (hopefully) qualify to sell your HDB, you’re likely to wonder what kind of costs or fees you will incur during this process. We’ll break this down for you below.

- Outstanding bank loan

- Outstanding HDB loan

- Return of CPF funds used along with accrued interest

- Upgrading Programme Costs

- Upgrading Levy

- Resale Levy

- Other fees

a. Outstanding bank loan

When you sell your HDB, if you have any outstanding loan on it from a bank, you will have to pay it off. If the sale price of the HDB does not cover the outstanding loan, you would have to top it up with cash and can even use the deposit from the buyer for it.

Keep in mind the notice period and lock-in period for your bank loan.

Notice Period

Typically, you need to give your bank 3 months notice that you will be paying your loan off early. If you provide less than 3 months notice, they may charge you a fee that is anywhere between $3,000 to a percentage (%) of your outstanding loan, for the shortfall in the notice period. However, this varies from contract to contract.

Lock-in Period

This is usually the first few years (1-5 years) of your loan during which the bank would give you specific interest rates (which could be flat, discounted or something else), but would also not allow you to pay it off early or switch banks. If you are still in your lock-in period for your loan, you may incur some prepayment penalties from your bank, which is typically 1.5% of the outstanding amount. If you are paying it off after your lock-in period, you do not have to pay any penalties. Note that the numbers and terms can vary from one contract to the next, so please check these in the Letter of Offer for your loan.

b. Outstanding HDB Loan

If you have an outstanding HDB loan, you need to give your HDB branch a written notice of at least one month in advance to make the repayment. You need to have repaid the outstanding HDB loan amount on your existing HDB flat at the time of its sale. If the sale price of the HDB flat does not cover the full amount of loan, the balance needs to be paid in cash.

c. Return of CPF funds used along with accrued interest

After selling your existing HDB flat, you have to return all the CPF funds used for the purchase of the HDB you are selling, including the down payment and the monthly installments, back to your CPF Ordinary Account (OA). Furthermore, you also have to pay the accrued interest on the CPF monies used. However, note that it is still your money.

In case of a negative sale, that is, when the sale price of your existing HDB flat is less than the outstanding loan and CPF funds owed, you need not refund the balance funds to CPF in cash if the unit is sold at current market price.

You can check the details on CPF monies used by logging into your CPF account here. Select ‘My Statement’ > Under Section C, select ‘Property’ > Select ’My Public or Private Housing Withdrawal Details’.

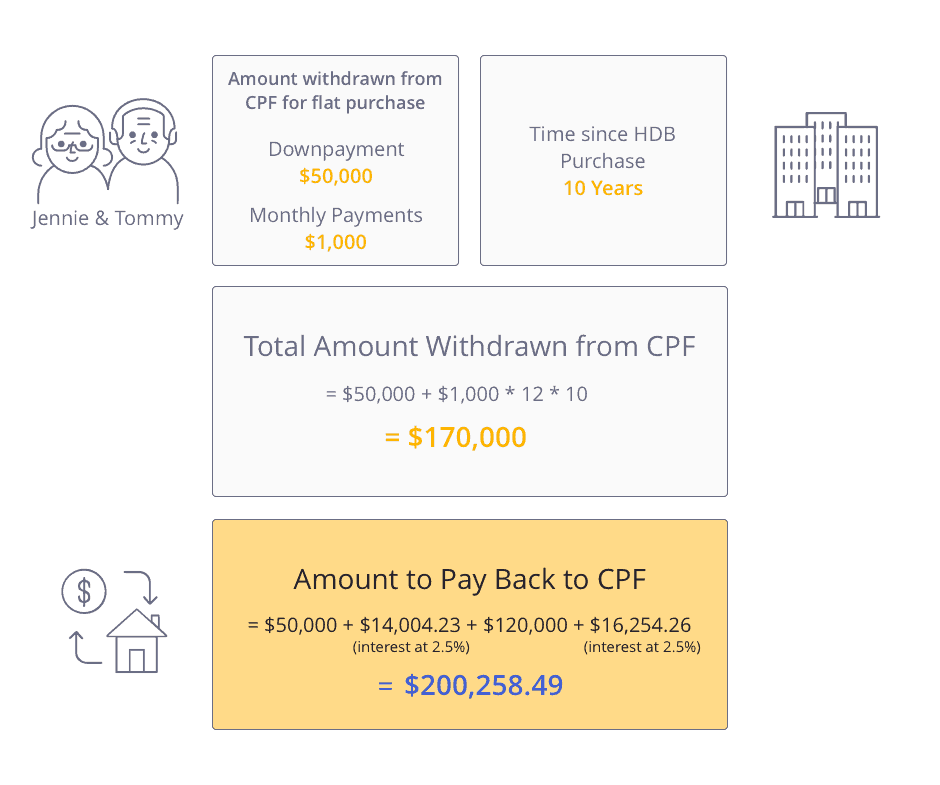

Case Study:

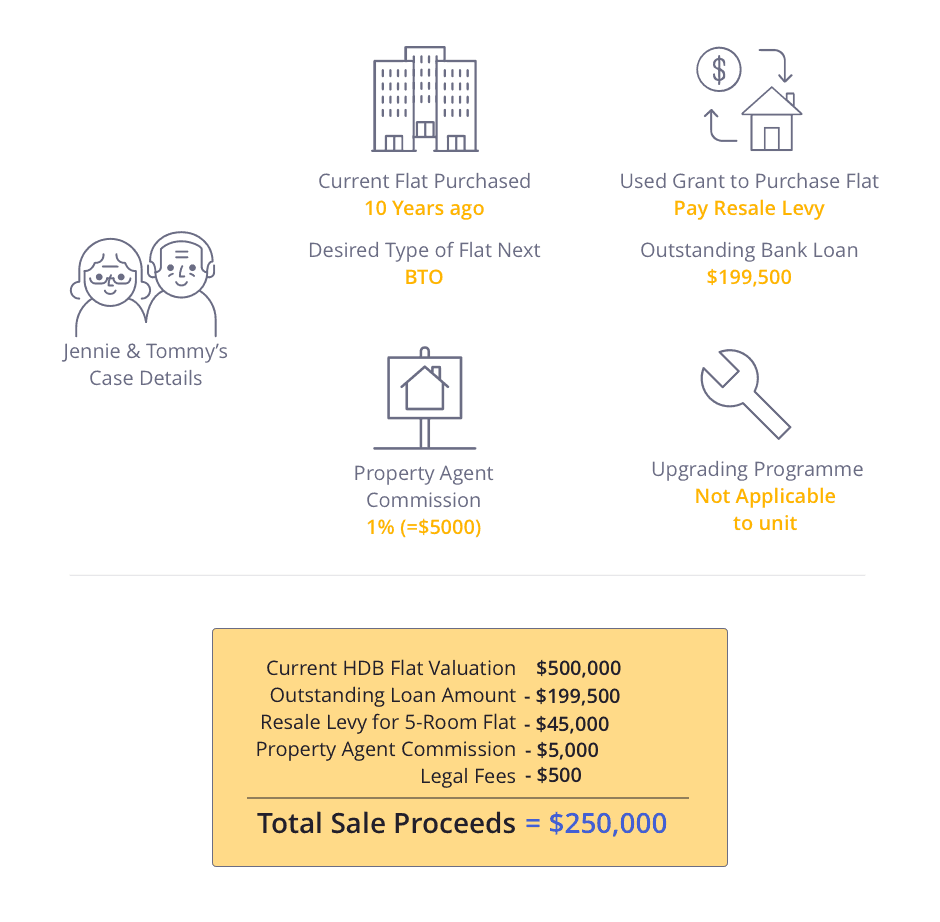

Tommy and Jenny currently own a 5-Room HDB flat and want to downgrade to a 4-Room. They purchased their flat 10 years ago.

While selling their HDB, Tommy and Jenny have to not only return the withdrawn downpayment that they took from their CPF and the monthly payments they made using it for paying off their mortgage, but also the interests accrued on the withdrawn amount.

d. Upgrading Programme Costs

HDB undertakes upgrading programmes such as adding lifts in old HDB blocks that don’t have them or implementing maintenance works for old HDBs with issues, to minimise inconvenience to its residents.

When such an upgrading programme is undertaken in a block, the residents have to pay the upgrading costs. If a particular upgrading programme’s bill was issued while you were the owner of the flat, you have to pay for the upgrading cost before the sale.

You can pay for it with your sale proceeds, cash or CPF.

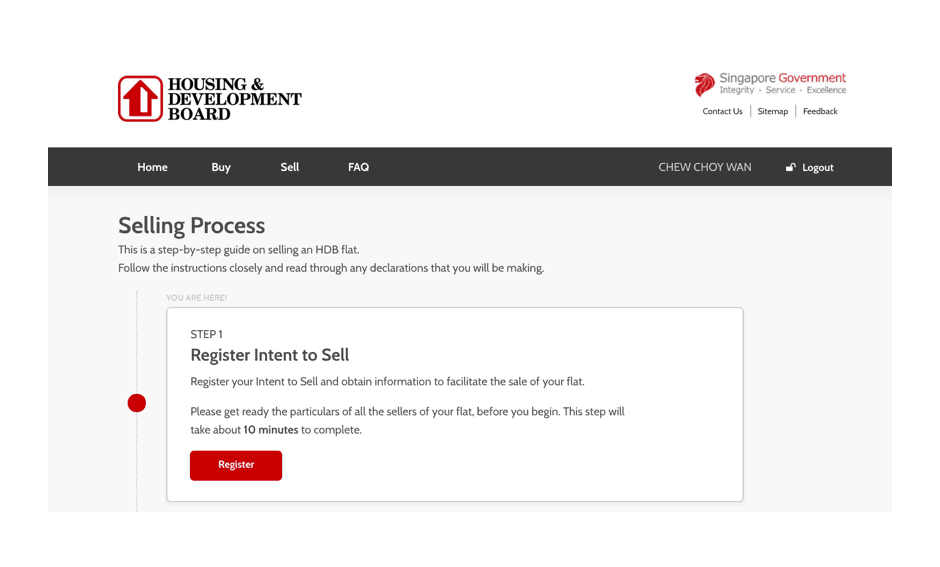

You can find the amount you owe for upgrading on the HDB Resale Portal when you register your “Intent to Sell”.

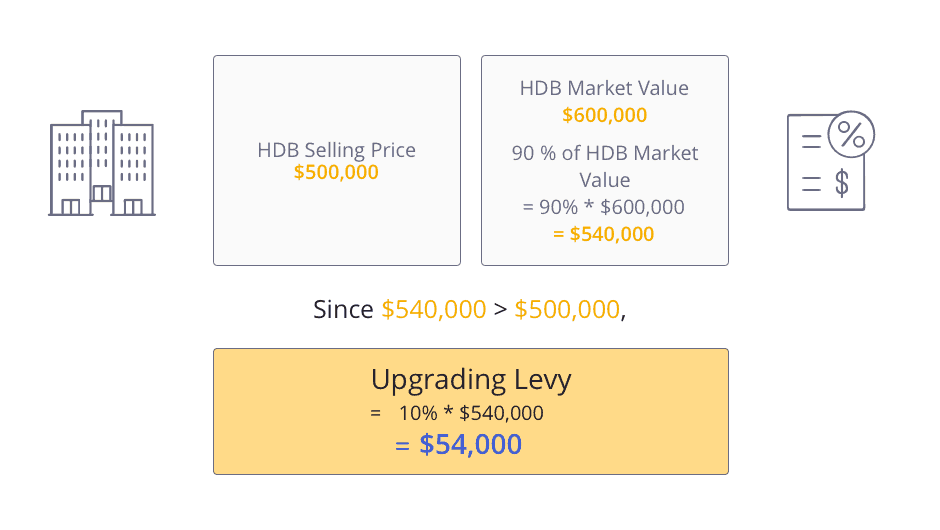

e. Upgrading Levy

This is different from Upgrading Programme Costs. If you live in an HDB unit that was upgraded, you would have to pay an Upgrading Levy upon selling that flat. Basically, the Upgrading Programme Costs is to pay for the upgrading work itself, and the Upgrading Levy is a kind of “fee” to pay when you sell an HDB flat that has been upgraded.

This levy will be either 10% of the selling price of the flat, or 10% of 90% of the market value of the flat, whichever is higher.

Case Study:

Mark and Vivian’s unit underwent upgrading in the past. They are currently looking to downgrade their HDB flat. Their HDB’s market value was greater than the selling price. The calculation below shows how the upgrading levy to be paid is computed.

Who needs to pay the Upgrading Levy?

The Singapore Government started upgrading HDB flats in 1992 under the Main Upgrading Programme, more commonly known as MUP. The initial MUP was discontinued in August 2007, and various other programmes were started – such as Lift Upgrading Programme, Home Improvement Programme and Neighbourhood Renewal Program. The upgrading costs are subsidised by the Singapore Government. Every upgrading programme for a block is given a ‘Batch’ number. The following groups need to pay for the Upgrading Levy:

- Singapore Citizen (SC) owners who benefitted twice or more from the now-defunct Main Upgrading Programme or MUP

- Singapore Permanent Resident (SPR) owners whose HDB flats were upgraded under MUP Batch 6 or before

Who does not need to pay the Upgrading Levy?

When you are selling your existing HDB flat and you fall under the following groups, you do not need to pay an upgrading levy:

- If you are SC owners and are selling your second or subsequent HDB flat that was upgraded under MUP Batch 7 and later Batches

- If you are SPR owners and are selling your HDB flat upgraded under MUP Batch 7 and later Batches

f. Resale Levy

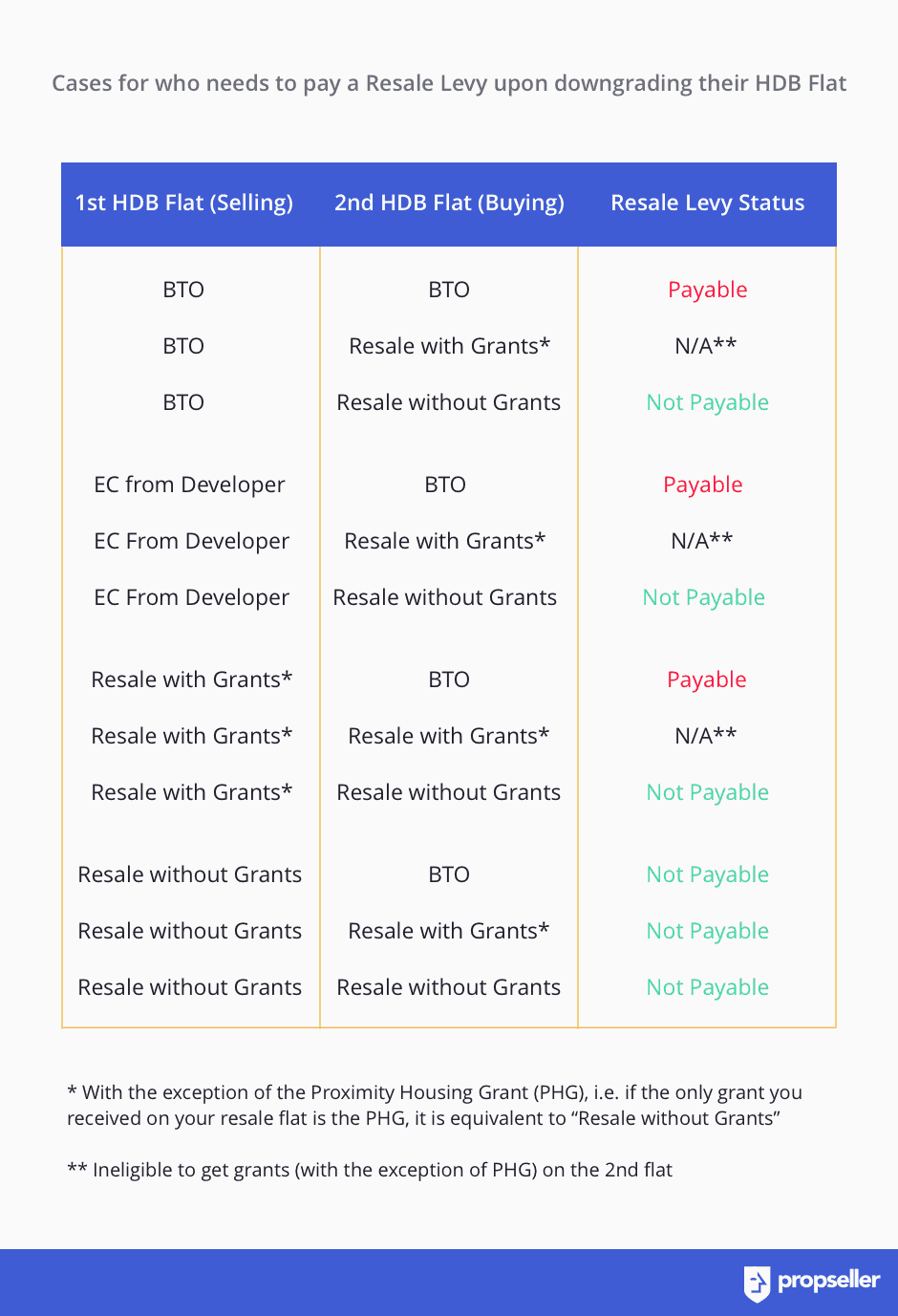

You may be liable to pay a resale levy, but first, let us explain who it applies to and what it means for you.

Who needs to pay a resale levy?

You only have to pay a resale levy for the cases marked as “Payable” in the image below.

In this image, the “1st HDB flat” refers to your current flat and the “2nd HDB flat” refers to the one you intend to buy next.

How much is the Resale Levy?

This depends on the type of the HDB flat you are selling.

|

Your current HDB type |

Applicable Resale Levy for Households |

|

2-Room HDB flat |

$15,000 |

| 3-Room HDB flat |

$30,000 |

|

4-Room HDB flat |

$40,000 |

| 5-Room HDB flat |

$45,000 |

| Executive (EC) HDB flat |

$50,000 |

What if I received a Singles Grant for purchasing my current HDB?

If you received a Singles Grant from CPF while purchasing your HDB, and are now buying another subsidised HDB, you need to pay only half the resale levy amount.

Example:

Mark purchased a 3-Room HDB flat with the Singles Grant. He has decided to sell this flat to downgrade from a 3-Room HDB to a 2-Room HDB.

Mark’s Resale Levy = $30,000 / 2 = $15,000

How can I avoid paying the resale levy?

You do not need to pay a resale levy if you are receiving any subsidy for the first time. You are considered to have received a subsidy if you buy a BTO flat or if you have received any CPF grant for your resale flat. The exception to this rule is if you only received the Proximity Housing Grant (PHG), which does not count as having received a subsidy. So if you only received the PHG on your first or second resale flat, you do not have to pay a Resale Levy upon selling the first and buying the second. See the table in the image above titled “Cases for who needs to pay a Resale Levy upon selling their HDB flat” to find out if you do or do not have to pay a resale levy in your case.

Have more questions about the resale levy? Read this ultimate guide on the HDB and EC Resale Levy to find out more.

g. Other fees

There are a few other fees which can apply when you sell your current HDB.

i. Resale application administrative fees

ii. Legal fees

iii. Seller’s Stamp Duty

iv. Property tax

v. Service & Conservancy Charges

vi. Property Agent fees

i. Resale application administrative fees

Both the buyer and seller will each pay a non-refundable administrative fee for the submission of the resale application.

| Flat type | Administrative fee |

| 1 and 2-Room flats | $40.00 |

| 3-Room flats and bigger | $80.00 |

ii. Legal fees

Everyone needs a lawyer to help with their HDB sale transaction. The lawyers recommended by HDB typically cost lesser than privately engaged lawyers. If you would like to engage HDB lawyers, you can estimate the legal fee using the Legal Fee Enquiry service on HDB’s website. It estimates your legal fees based on the type of your HDB (i.e. 2-Room, 5-Room, etc.) and the selling price. This would typically cost you a few hundreds of dollars.

If you decide to engage your own lawyers, they will advise you on the legal fees applicable. This would typically cost you a few thousands of dollars depending on the law firm you’re hiring.

iii. Seller’s Stamp Duty (SSD)

Since in most of the cases you can sell your HDB only after completing the Minimum Occupancy Period (MOP), you do not need to pay any Seller’s Stamp Duty (SSD). However, in the case of a transfer of ownership, such as inheriting an HDB from your deceased family member or parents, you could be liable to pay for SSD depending on the holding period. The applicable SSD rates can be found here.

If you inherited an HDB, read this article to find out the 9 things you need to know about inheriting an HDB in Singapore.

iv. Property Tax

You need to pay for property tax until the end of the year when you are selling your HDB flat. Following that, you need to submit your receipt of property tax payment at the time of the sale completion appointment with HDB.

You can find the details of your property tax on IRAS mytax Portal.

v. Service & Conservancy Charges

Service and Conservancy Charges are similar to the maintenance fees for condominiums. These charges are for the maintenance of the common facilities in your HDB block. You must pay the service and conservancy charges for your HDB flat up to the HDB completion appointment date and submit the receipt of your payment to the HDB officer at your sale completion appointment. You can find the details of your service and conservancy charges through your Town Council.

vi. Property Agent Commission

An agent will typically cost you 2% of your HDB’s selling price (this is the standard market practice). However, at Propseller you can find agents who charge a commission of 1%.

Note: downgrading is an intricate and life-changing process, considering the price tag of the home you are selling. When downgrading, it is important to hire an experienced HDB property agent who knows all the intricacies of the downgrading process, can check your eligibility, calculate your sales proceeds and advise you on your property and financial needs. Consequently, a bad agent can cost you more than they can save you. Since this is one of the largest financial transactions of your life, make sure that your decision is informed and is the right one.

If you don’t already have a property agent, you can find top HDB agents experienced in downgrading in your HDB town on Propseller.

3. How do I calculate my HDB flat sale proceeds before downgrading

Before you make big decisions on which HDB flat you want to downgrade to, you first need to calculate your current HDB flat’s sale proceeds and compute your affordability.

It is very important to understand your financials and have a clear idea of how much money you make from downgrading and how much you need to buy your next HDB, save for retirement, etc.

Your estimated sale proceeds from selling your current HDB can be calculated as follows:

Potential Sale Proceeds =

HDB flat Sale Price

– Outstanding Bank Loan Amount

– Outstanding HDB Loan Amount

– Upgrading Costs

– Upgrading Levy

– Resale Levy

– Other fees (Legal, Property Agent etc.)

Case Study:

Tommy and Jennie currently own a 5-Room HDB flat and want to downgrade to a 4-Room. These are some details of their case:

Note: while their sale proceeds are $250,000, it is not all in cash. They had used $200,258.49 from their CPF as seen in the previous section, meaning, their cash proceeds are actually $250,000 – $200,258.49 = $49,741.51.

4. How to plan which HDB to buy and when?

Sellers can often overestimate how much money they can really make from the sale of their HDB, and how much of it is actually in cash. So it is critical that you finish the step above to calculate your sale proceeds, and then subtract the amount to be returned to CPF so that you can calculate your cash proceeds.

After that, you can proceed to see which grants and loans you qualify for and calculate your affordability for the new HDB flat.

- Schemes, grants and loans for buying your HDB flat

- Costs & fees for buying your HDB flat

- Calculate HDB Affordability

- Should I buy a BTO or a Resale HDB flat next?

- Should I sell first or buy first when downgrading my HDB?

a. Schemes, grants and loans for buying your HDB flat

Depending on your eligibility criteria, you may be able to get your new HDB at a subsidised price or find some alternatives to how you can pay for it. Let’s go through some of the possible schemes, grants and loans below.

Silver Housing Bonus (SHB) scheme – for elderly, low-income households

The Silver Housing Bonus scheme was introduced to help elderly households with low-income, to supplement their retirement income.

If you belong to a household with:

- At least one SC owner aged 55 years or above

- An income of $12,000 or less per month

- Owners who do not own any other property

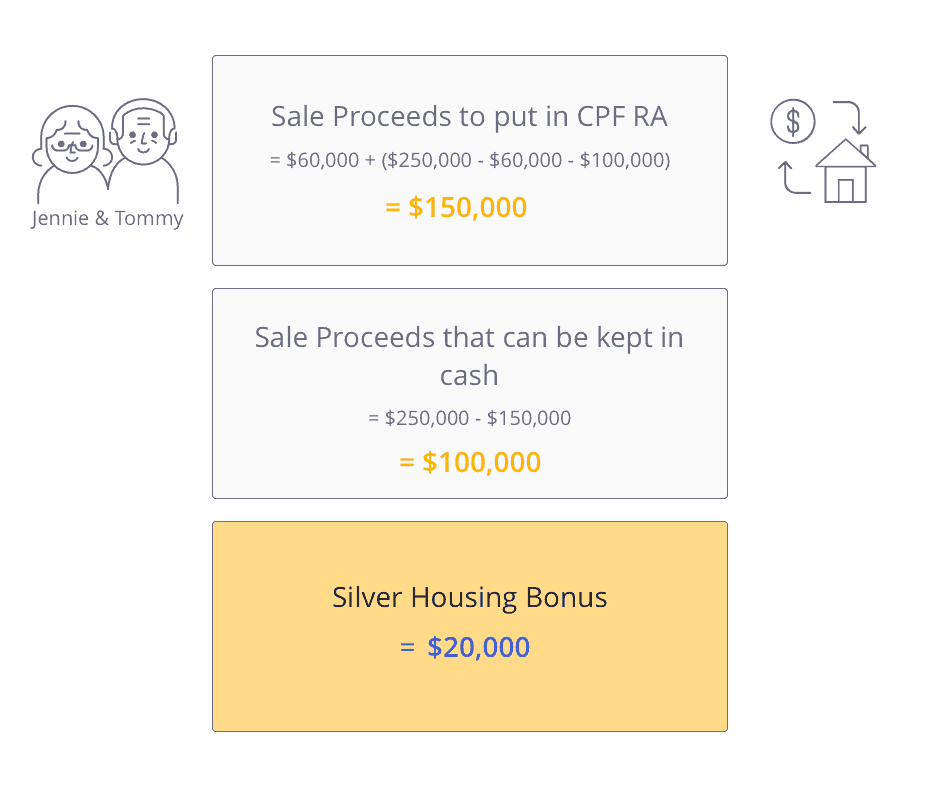

You may receive up to $20,000 in your CPF Retirement Account (RA) upon downgrading to a 3-Room flat or something smaller than that. To receive this cash, you would have to transfer some of your HDB sale proceeds into your CPF RA account.

| Net HDB Sale Proceeds | Sale Proceeds you need to put in CPF RA | Sale Proceeds you can keep in Cash | Silver housing bonus amount |

| <= $60,000 | All net sale proceeds | $0 | 3x of the total top-up |

| $60,000 – $160,000 | $60,000 | $0 – $100,000 | $20,000 |

| > $160,000 | $60,000 + Further Top-up* | $100,000 + Remaining after Further Top-up* | $20,000 |

Further Top-up = Net Sale Proceeds – $60,000 – $100,000

Case Study:

If Jennie and Tommy sold their HDB flat to make sale proceeds of $250,000, and qualify for the SHB criteria, the below shows how much SHB they can get.

If you are eligible for the above, visit HDB’s site for more info on the Silver Housing Bonus Scheme.

Temporary Loan Scheme (TLS) – for those who do not want long term loans

The Temporary Loan Scheme (TLS) was created to help buyers who want to pay off the entire purchase amount for their new flat with the net sale proceeds from the HDB they are downgrading from, and who do not want to take any long-term mortgage loan for their purchase. Hence, you can apply for a temporary loan when you want to buy your new flat first while the sale of the HDB you are downgrading from is still ongoing.

You can pay off your temporary loan with the proceeds from your sold flat once it is completed.

To be eligible for the TLS, you need to have:

- Booked a new HDB flat and the keys are now ready for collection

- Submitted an application to sell the existing HDB flat you want to downgrade from

- Have sufficient CPF / cash proceeds from the sale of the existing flat to completely redeem the temporary loan

You can visit HDB’s site to read more about the Temporary Loan Scheme.

If you’re not sure whether you will have enough sale proceeds to opt for this, ask us for a free consultation. We can also recommend you a property agent experienced in HDB downgrading cases to help value your property and calculate your financials if you don’t already have one.

Proximity Housing Grant (PHG) – for those who want to live close to family members

If you are going to buy a resale flat within a 4 km distance from your parents/children or have decided to move in with them, you could be eligible to get a Proximity Housing Grant (provided you have not received this previously).

| To live WITH parents/children | To live NEAR parents/children | |

| For Families | $30,000 | $20,000 |

| For Singles | $15,000 | $10,000 |

You can visit HDBs site for more info on the Proximity Housing Grant.

Enhanced Contra Facility (ECF) – for those who want to sell and buy almost concurrently

ECF can be summarised as: When you are selling your current HDB flat (Flat 1) and purchasing a smaller resale HDB flat (Flat 2), you can make use of ECF to make the purchase almost immediately (i.e. sell and buy on the same day) and have the option to stay an extra 3 months in Flat 1.

The main benefits of ECF are:

- Speed: you can have a home to move into (Flat 2) as soon as you conclude the sale on your current flat (Flat 1)

- Lower cash outlay: ECF facilitates the usage of CPF returns from Flat 1 immediately for the purchase of Flat 2, including the insurance premiums for the CPF Home Protection Scheme, thus reducing the amount of mortgage loan needed

- Flexibility: You can potentially get a 3-month extension to stay in Flat 1 after its sale has been concluded (rental amount for this stay can be decided with the buyers of Flat 1)

Here are some of the terms and conditions that apply to use ECF:

- If you want to make use of ECF, the buyer of your existing Flat 1, and the seller of resale Flat 2 should not have applied for the contra facilities

- You must complete the sale of your existing HDB Flat 1 before or on the same day as the completion of the resale Flat 2 that you are purchasing

- The home loan or mortgage for Flat 2 must not be from a bank

- There should not be any outstanding mortgage on Flat 1 or Flat 2

- You should not have engaged private lawyers

- You should not be selling only a partial share of Flat 1

- All of the current balance in your CPF Ordinary Account (OA) must be used

- All of the CPF money refunded to your CPF OA from the sale of Flat 1 needed for the purchase of Flat 2 must be used

- The refunded CPF monies cannot be used for the payment of stamp duty or conveyancing fees

You can visit HDB’s site to read more about the Enhanced Contra Facility.

HDB Loan

The HDB Loan interest rate is pegged at 0.1% above the CPF OA interest rate – as of February 2019, this would mean 2.6%. Furthermore, if you have taken the HDB loan previously:

- You have to use up all your CPF OA money first, including the CPF refunded from the sale of your previous property (you may retain up to $20,000 in your OA)

- You have to use up to 50% of the cash proceeds from the sale of your unit to repay the loan

This is to facilitate financial prudence and prevent over-borrowing. The HDB loan eligibility is summarised here for your reference.

- Citizenship: At least one of the buyers is a Singapore citizen

- Income ceiling: The average gross monthly household income shall not exceed:

- Families: $12,000

- Extended families: $18,000

- Singles: $6,000

- Household Status:

- Have not already availed 2 or more HDB loans

- Have availed only 1 HDB loan and did not previously own

- Private property – in Singapore or overseas

- HUDC flat

- Property acquired as a gift

- Inherited property

- Property owned/acquired/disposed off through nominees

- Interest in a property:

- Do not own more than 1 market/hawker stall or commercial/industrial property

- If only 1 market/hawker stall or commercial/industrial property is owned, you must be operating the business there, and have no other sources of income.

You can check your eligibility for an HDB loan by submitting an HDB loan eligibility application (HLE) here.

Bank Loan

When downgrading your HDB flat, there’s only one main thing to keep in mind when it comes to bank loans – depending on whether you are buying first or selling first, your approved loan amount will differ.

| Sell First | Buy First | |||

| Sum of Tenure and Age of Borrower | <= 65 Years | > 65 Years | <= 65 Years | > 65 Years |

| Loan-to-Value (LTV) | 75% | 55% | 45% | 25% |

| Cash Downpayment | 5% | 10% | 25% | 25% |

| CPF / Cash Downpayment | 20% | 35% | 30% | 50% |

Bank loan LTV limits are as of July 6, 2018. The above table assumes you do not own any additional properties. If you own more properties, check the rates with your bank.

So far, we have highlighted some options that you need to know about when it comes to schemes, grants and loans for your HDB downgrade. You can find some other grants and schemes for buying a new flat here and for a resale flat here on HDB’s site.

b. Costs and fees for buying your HDB flat

You will incur a few costs and fees for buying your HDB flat.

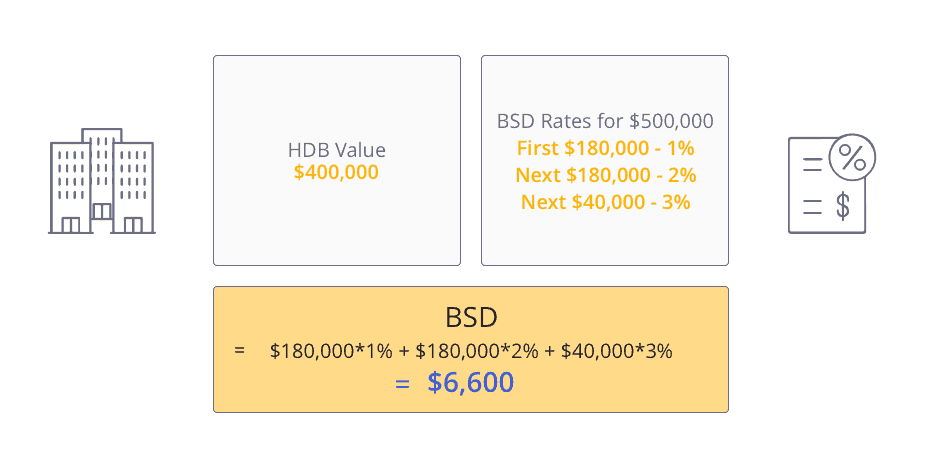

Buyer’s Stamp Duty (BSD)

You will have to pay a Buyer’s Stamp Duty (BSD) when you buy your HDB, which will be based on the purchase price or market value of the HDB you end up buying (whichever is higher). Find out everything to know about Buyer’s Stamp Duty here.

|

Purchase Price or Market Value of Property |

BSD Rates |

| First $180,000 |

1% |

|

Next $180,000 |

2% |

| Next $640,000 |

3% |

|

Remaining Amount |

4% |

The rates above were updated on February 20, 2018.

Case Study:

Jennie & Tommy want to know how much the BSD will cost them if they buy an HDB worth say $400,000.

Jennie and Tommy need to pay $6,600 as BSD to purchase an HDB worth $400,000. Find out more on BSD here.

Additional Buyer’s Stamp Duty (ABSD)

As confirmed by IRAS, you do not have to pay ABSD when downgrading your HDB flat.

Property Agent Commission

Unlike the way it is for private property buyers, HDB buyers have to pay their agents a commission. This is because HDB seller-agents do not practice co-broking (co-broking means to split the commission paid by the seller between the seller-agent and the buyer-agent), which is commonly practised only for private properties.

Typically, the commission for HDB buyer-agents is 1%. However, if you use the same agent for selling and buying, this can be negotiated.

If you intend to buy a BTO flat, you do not need a property agent.

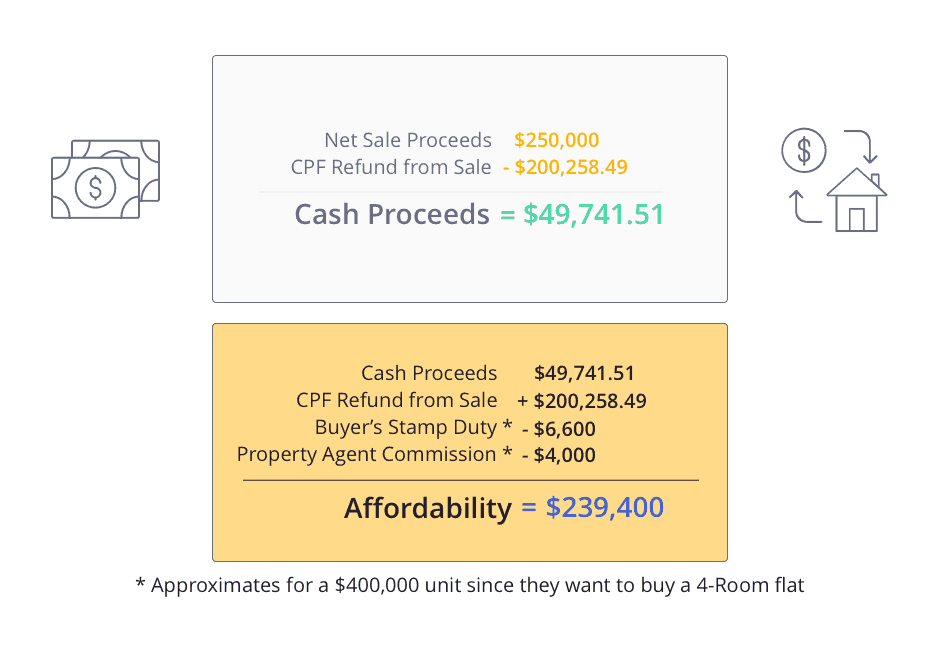

c. Calculate HDB Affordability

For the most part, calculating your affordability or budget will help guide your decisions on which HDB you can afford to buy and consequently, what size the HDB can be. It will also help with guiding your decisions on whether you should get a BTO or a resale flat upon downgrading your HDB flat.

Amount Available for Purchase =

Total CPF Balance Amount

+ Previous HDB Sale’s Cash Proceeds

+ Loan / Grant

– Buyer’s Stamp Duty (BSD)

– Property Agent Commission

– Other financial commitments

Case Study:

Tommy and Jennie are both Singapore Citizens and want to downgrade from their 5-Room HDB flat. Here are some facts of their case. They:

- Have decided to move into the same HDB town as their son Mark, so they would be eligible for the Proximity Housing Grant

- Ideally want to buy a 4-Room flat next

- Are willing to use cash proceeds from the sale for purchasing the new flat

- Do not want to dip into other cash/CPF savings and only want to use the proceeds from their HDB sale

- Do not want to take any bank loan for their purchase

In the article above, we have found that:

Their Sale Proceeds = $250,000

Amount to be Refunded to their CPF OA = $200,258.49

With this budget, they would neither be able to afford a BTO nor a resale 4-Room flat, without dipping into their cash savings of their own or taking a loan. Therefore, they have decided to downgrade from their 5-Room flat to a 3-Room flat (BTO or resale flat).

Now that you know your budget, you are ready to make other purchasing decisions such as the type and size of the unit you want to buy.

d. Should I buy a BTO or a Resale HDB flat next?

Should you get a BTO or a resale flat? Which one is better? This really depends on your preferences, but to help you with the decision, we’ve made a list of differences below:

| Buy a BTO flat | Buy a resale flat |

| Limited availability | Island-wide availability |

| Can only buy during the HDB launch exercise | Can buy anytime |

| Subjected to income ceiling criteria | Not subject to any income ceiling criteria |

| Eligible to buy a BTO only twice | No such restriction |

| Resale levy applies | Resale levy does not apply |

| No CPF grant for second timers in this case | Can get Proximity Housing Grant |

| Buy at a heavily subsidised price | Buy at the market (or slightly subsidised) price |

| HDB has 99 years lease, in general | HDB has variable remaining lease ( < 99 years) |

| Can apply for Temporary Loan Scheme | Cannot apply for Temporary Loan Scheme |

If you are planning to downgrade to a BTO, sale of balance flat or re-offer of balance flat directly with HDB, check your eligibility here. If you’re buying a resale flat, check your eligibility here.

If you’re not sure and need advice, talk to a property agent experienced with HDB downgrade cases because they have a wider knowledge of the matter and can advise you on all aspects – practical, financial and personal preferences.

e. Should I sell first or buy first when downgrading my HDB?

This depends a lot on your cashflow. We’ve noted a few differences below to help guide your decision.

| Sell First | Buy First |

| No timeline to sell the property | 6-month time limit to sell |

| Can wait for a preferred selling price | May feel pressured to sell at a lower price due to time limit |

| Can benefit from recycled CPF in OA from the sale | Can still use CPF, but need a higher balance or more cash at hand |

| Get higher LTV from bank loan | Get lower LTV from bank loan |

| Need less cash for downpayment | Need more cash for downpayment |

| Can potentially use Enhanced Contra Facility | Cannot use Enhanced Contra Facility |

| Stress of buying a house quickly | Can wait and buy your preferred house |

| May have to stay in a rented house if your desired house is not available in time | Can take your time to move into the new house |

5. What steps do I need to take to downgrade my HDB flat?

Now that you’ve done your due diligence, it is time to take some action!

- Hire an experienced property agent

- Steps on how to sell your current HDB flat

- Steps on how to buy your new HDB flat

- (Infographic) Timeline of events for downgrading your HDB flat

a. Hire an experienced property agent

We at Propseller exist because we truly believe that a (good) property agent who is experienced in your area is needed to complete a sale quickly, profitably and without hassle. Once you hire an agent, they will proceed to follow the below steps to downgrade from your current HDB flat.

Here, it is important to get an agent experienced in your area and in downgrading cases, so that they know how to calculate your financials, understand the regulations to keep in mind, sell in your required timeline, submit the necessary documents, etc.

If you already have an agent, great! In the case that you don’t have one, we can recommend a property agent experienced with cases similar to yours. Find your match here or ask us using the chat icon on the bottom right of your screen.

b. Steps on how to sell your current HDB flat

For selling your existing HDB so you can downgrade to a smaller one later, the steps that you and your property agent will follow will be as shown below:

- Register your ‘Intent to Sell’ on HDB’s website

- Calculate your flat’s sale and cash proceeds

- Start marketing your property for sale

- Grant an Option to Purchase (OTP) to the buyer for $1,000

- Wait for the buyer to exercise the OTP for another $4,000

- Submit the sale application to HDB

- Endorse the resale documents

- Pay the relevant fees online

- Receive the approval of the sale

- Attend the HDB appointment for the sale

Generally, it would take around 8 weeks from submitting the sale to getting an appointment with HDB.

c. Steps on how to buy your new HDB flat

For buying your next flat, the steps will vary based on whether it is a BTO or a resale flat.

- Calculate your affordability

- Decide on BTO vs. resale HDB

- If you’re buying a resale HDB:

- Register your ‘Intent to Buy’ on HDB’s website

- Apply for the HDB loan or a bank loan if needed

- Start viewing HDBs to buy

- Ask the HDB seller to issue an OTP for $1,000

- Obtain a Letter of Offer for your loan from HDB or a bank if needed

- Obtain a valuation report from HDB

- Exercise the OTP for $4,000

- Submit the resale application to HDB

- Book your HDB appointment

- Complete the documentation for grants if needed

- Attend the HDB appointment and collect your keys!

- If you’re buying a BTO flat:

- Ballot for your flat online

- Apply for an HDB loan or a bank loan if needed

- Select your flat and pay $500 – $2,000 for the OTP

- Exercise the OTP

- Collect your keys!

- If you’re buying a resale HDB:

The resale process can take you between 8-12 weeks and the BTO process could take 3-4 years.

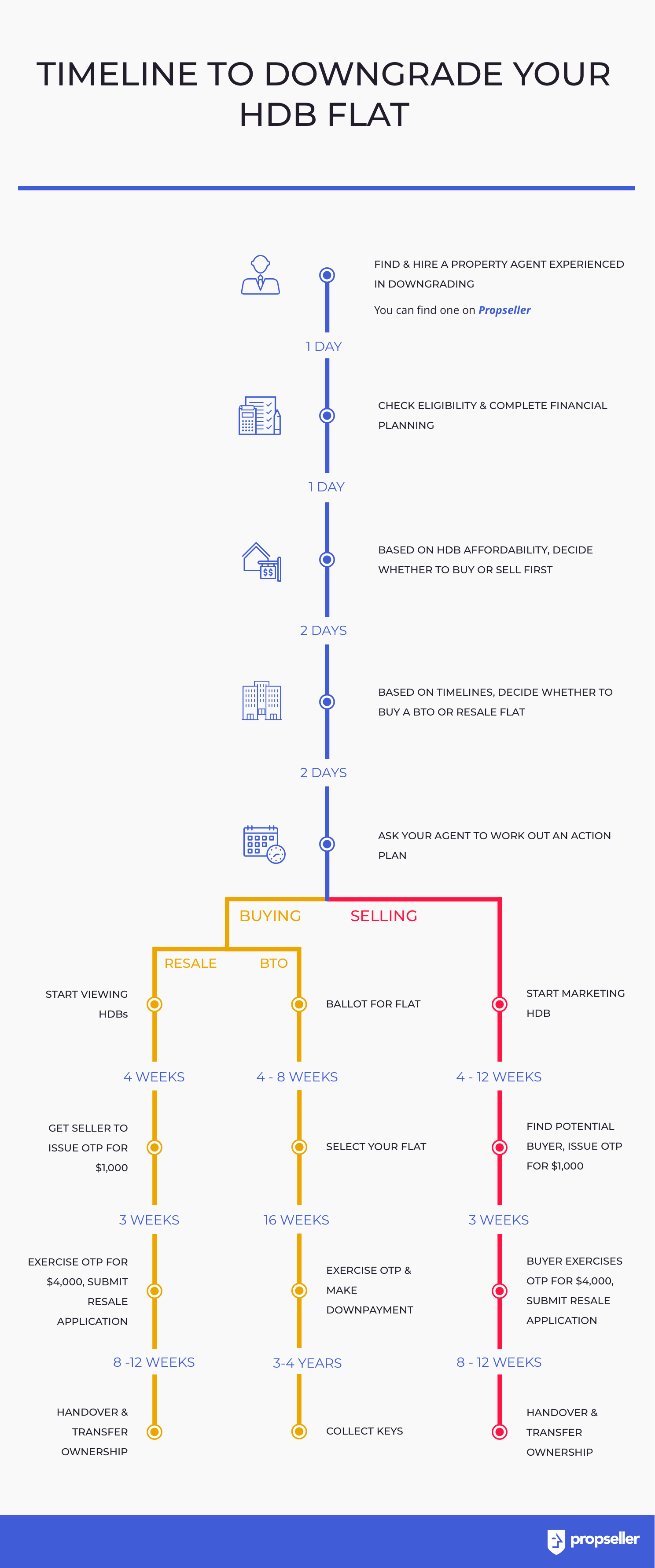

d. Timeline of events for downgrading your HDB flat

You can find the timeline of events for downgrading your HDB flat as shown in the infographic below.

Conclusion

In conclusion, while downgrading your HDB flat is not straightforward, using this guide will give you some direction on how to go about it. First, check all the eligibility criteria for selling your HDB. Second, check for all the fees you have to pay and the grants you may be eligible for. Third, calculate your sale and cash proceeds, your CPF balances and your affordability. Fourth, based on your affordability, determine the type and size of the unit you want to purchase next. Lastly, hire an experienced property agent to help you successfully downgrade from your existing HDB flat with minimal stress.

Have any questions about downgrading your HDB? Ask us in the comments or on the chat icon on the bottom right of your screen!

Don’t have an agent yet? Contact an agent experienced in downgrading HDB flats to start your journey.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.