You may have seen a lot of ads on Facebook selling you the dream of upgrading from an HDB to a condo, “Sell your HDB and buy two condos for a secure future in Singapore!”, “Upgrading from an HDB to a condo with the same salary? Easy!” and so on.

Let’s not beat around the bush, this is clickbait.

There is one crucial question to answer when it comes to upgrading from an HDB to a condo: can you afford to keep the HDB you own as an investment, or do you need to sell it before upgrading to a condo?

In this article, we’re not trying to convince you to do one thing or the other. Instead, we want to guide you so you can calculate your affordability, identify the benefits and prepare for the pitfalls of selling vs keeping your HDB before upgrading to a condo. We will also delve into the timeline involved in transitioning from an HDB to a condo, equipping you with a good understanding of the process. By the end of this article, you will be able to make your own informed decisions. It is unlike anything you’ve read on the subject so far. We’ll cover the below topics:

- Am I eligible to upgrade to a private property if I currently own an HDB?

- What are the financial implications if I sell my HDB and upgrade to a condo?

- Can I afford to sell my HDB and upgrade to a condo?

- What are the financial implications if I keep my HDB as an investment and upgrade to a condo?

- Can I afford to keep my HDB and upgrade to a condo?

- Summary: side by side comparison between selling and keeping the HDB

- When upgrading, should I buy a new launch or a resale condo?

- What are the pros and cons of upgrading to a condo?

- What are the steps to upgrade from an HDB to a condo?

- (Infographic) Timeline for upgrading from an HDB flat to a condo

- Frequently Asked Questions

There is a lot to consider, but we are ready to advise you on this decision and work out your timeline. Schedule a call with Propseller for a free, no-obligation consultation.

1. Am I eligible to upgrade to a private property if I currently own an HDB?

Before you can find out if you can afford to upgrade to a private property, you need to check if you’re even eligible to do so. There are two criteria to check for this: the MOP of your HDB flat and your citizenship.

a. Minimum Occupation Period (MOP)

To be able to upgrade to a condo or landed property from your HDB flat, you need to have completed the Minimum Occupation Period (MOP) for your HDB flat. Typically, you need to have been living in your HDB flat for a minimum period of 5 years before you can upgrade to private property. The MOP is the minimum number of years you need to have physically occupied your HDB flat before you can buy a private property or sell the HDB.

In the case of upgrading from an HDB flat to a condo the MOP is calculated differently for resale or new-launch:

- Resale; MOP is calculated from the date you collected the keys to your HDB flat to the date of exercising the OTP.

- New-launch; MOP is calculated from the date you collected the keys to your HDB flat to the date of signing the Sale and Purchase Agreement, regardless of whether it is still under construction or ready for possession, and excludes any period where you did not occupy it.

To find out if you’ve completed your MOP, you can visit HDB’s site or contact us so we can help you through the process of checking this.

b. Citizenship

If at least one of the owners of your HDB is a Singapore citizen, then you can keep the HDB and also the condominium that you intend to buy next. However, if all of your HDB flat’s owners are Singapore Permanent Residents (SPRs), then you cannot keep the HDB after buying a private property. You must sell it within 6 months of buying the condominium in Singapore. Provided that your eligibility is not a concern, your ability to keep the HDB flat or the need to sell it before upgrading will depend on your finances. Hence, we will share everything you need to know in terms of affordability to determine which one makes sense for you.

2. What are the financial implications if I sell my HDB and upgrade to a condo?

There are several financial implications to take into account when upgrading from your HDB to a condo.

a. CPF

Depending on whether you buy a condo first or sell your HDB first, the CPF amount you can use for buying is impacted.

Unsure of how much CPF you can use? Schedule a call with us for a free, no-obligation consultation.

If you buy a condo first

If you buy a condo before selling your HDB, it will be considered your “second property”. Due to this, some restrictions apply on the amount of CPF you can withdraw for the purchase.

-

- You can withdraw up to a maximum of 100% of the condo’s Valuation Limit (VL) from your CPF Ordinary Account (Valuation Limit = The lower of the market value or the purchase price of the property).

- Example: Let’s say the condo you want to purchase has a market value of $1,005,000 and the price you purchased it for is $1,000,000. In this case, the VL = $1,000,000 (lower of the two). So you can withdraw up to $1,000,000 from your CPF Ordinary Account.

- You need to set aside a Basic Retirement Sum (BRS) in your CPF, before being allowed to withdraw any money for the condo purchase. What this means is that you need to keep a certain amount of money in your combined CPF accounts, and can only withdraw the amount in excess of that. This minimum amount to be set aside is stated on CPF’s site, and varies based on your age.

- Example: Let’s say you turn 55 years old in 2019, your BRS is $88,000 as per CPF’s site. So if you have a total of $100,000 in your CPF (from your Ordinary Account + Special Account + Retirement Account) then you can withdraw $100,000 – $88,000 = $12,000 from your CPF OA account for buying the second property.

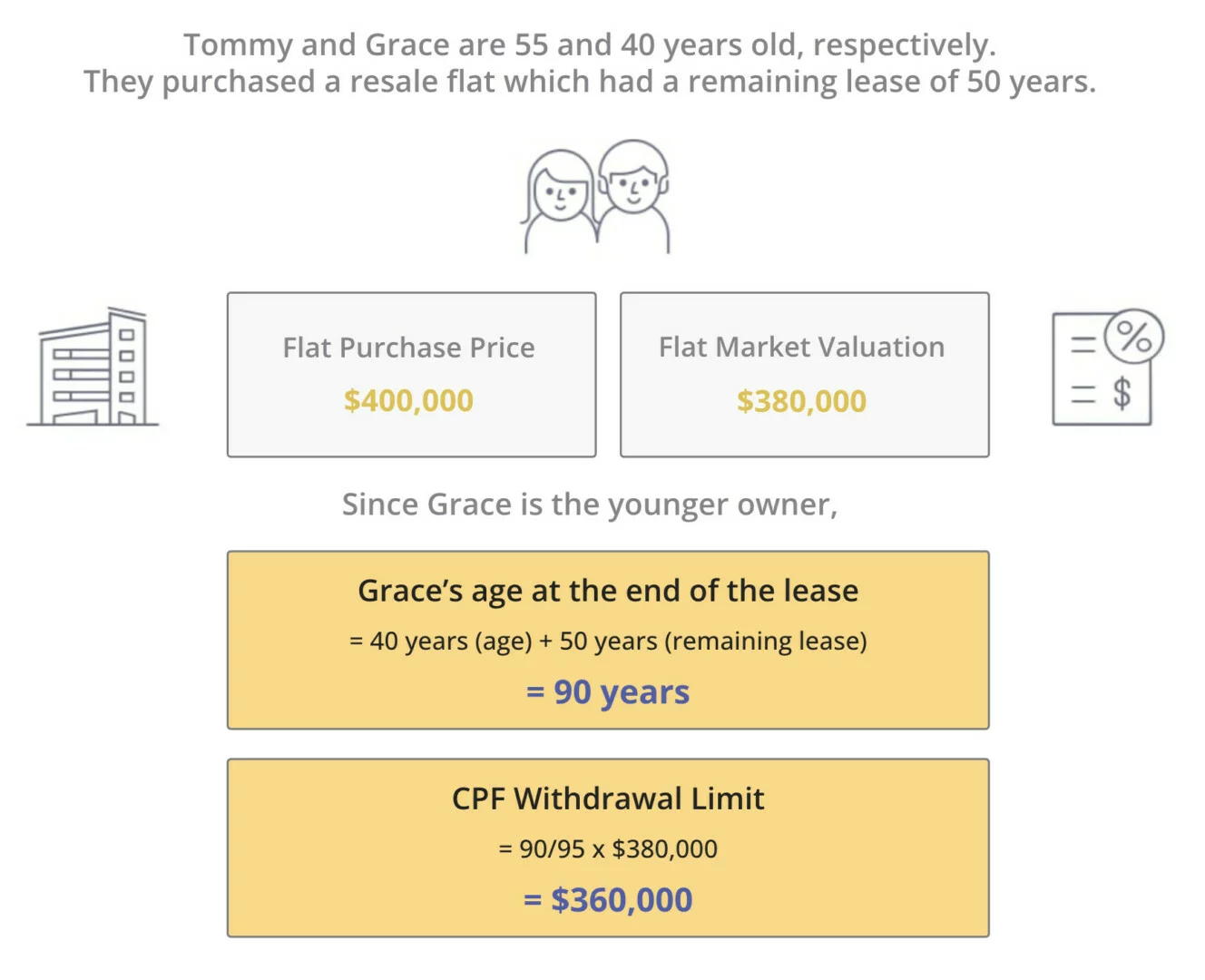

- The CPF withdrawal limit might be lower based on your age and remaining lease.

- Example: If the leasehold of the property allows the youngest owner of the property to live up to the age of 95 years in it, you can withdraw up to 100% of the market value or the purchase price of the property from your CPF Ordinary Account (OA), whichever is lower. If such a term can not be met, the amount of CPF available to be withdrawn will be pro-rated based on the extent the remaining lease of the property can cover the youngest buyer to the age of 95.

- You can withdraw up to a maximum of 100% of the condo’s Valuation Limit (VL) from your CPF Ordinary Account (Valuation Limit = The lower of the market value or the purchase price of the property).

If you sell your HDB first

If you’re selling your HDB before buying a condo, the entire process is more straightforward for you. After the sale, you have to return the amount of money borrowed for your HDB purchase (CPF Principal Amount) and the interest it may have accrued over the years back to your CPF Ordinary Account (OA). You have to do this even if you buy a condo first, it is simply a matter of when you do it.

Furthermore, when buying your condo, you will be allowed to withdraw up to 120% of the Valuation Limit of the condo (Valuation Limit is the lower of your condo’s market value and purchase price) instead of 100%.

However, note that the limitations stated above on the withdrawal amount based on the condo’s remaining lease still applies.

b. HDB Loan

When you sell your HDB before upgrading to a condo, the proceeds from the sale of the flat will be used to pay off the outstanding HDB loan amount. In the case where the sale price of the HDB flat does not cover the full outstanding loan amount, you need to pay the balance in cash. Make sure you give your HDB branch a written notice at least one month in advance to make the repayment.

c. Bank Loan

If you’ve already paid off the loan on your HDB flat, it doesn’t matter whether you sell the HDB first or buy a condo first. You would get the rate for “First Housing Loan” for the condo purchase in either case.

Assuming your HDB flat’s loan is not yet paid off, it matters whether you buy your condo first or sell your HDB first. Buying first means you would already have a housing loan at the time of applying for one for the condo, so you would get the Loan-to-Value (LTV) for “Second Housing Loan” from the table below. If you sell first, then the proceeds from your sale will be used to pay off your existing housing loan. Hence, when buying the condo afterwards, it would be your “First Housing Loan”.

| First Housing Loan | Second Housing Loan | |||

| Sum of Tenure and Age of Borrower | <= 65 Years | > 65 Years | <= 65 Years | > 65 Years |

| Loan-to-Value (LTV) | 75% | 55% | 45% | 25% |

| Cash Downpayment | 5% | 10% | 25% | 25% |

| CPF / Cash Downpayment | 20% | 35% | 30% | 50% |

How does my age impact the loan amount?

People can sometimes forget that their age matters a lot for their next loan! The monthly mortgage and loan tenure for the property they want to buy next will be calculated based on it, and given that they have fewer years to pay off the loan, they will have to either borrow less or pay more per month based on their age.

If your age + the loan tenure is ≤ 65 years, the LTV is higher than when it is > 65 years.

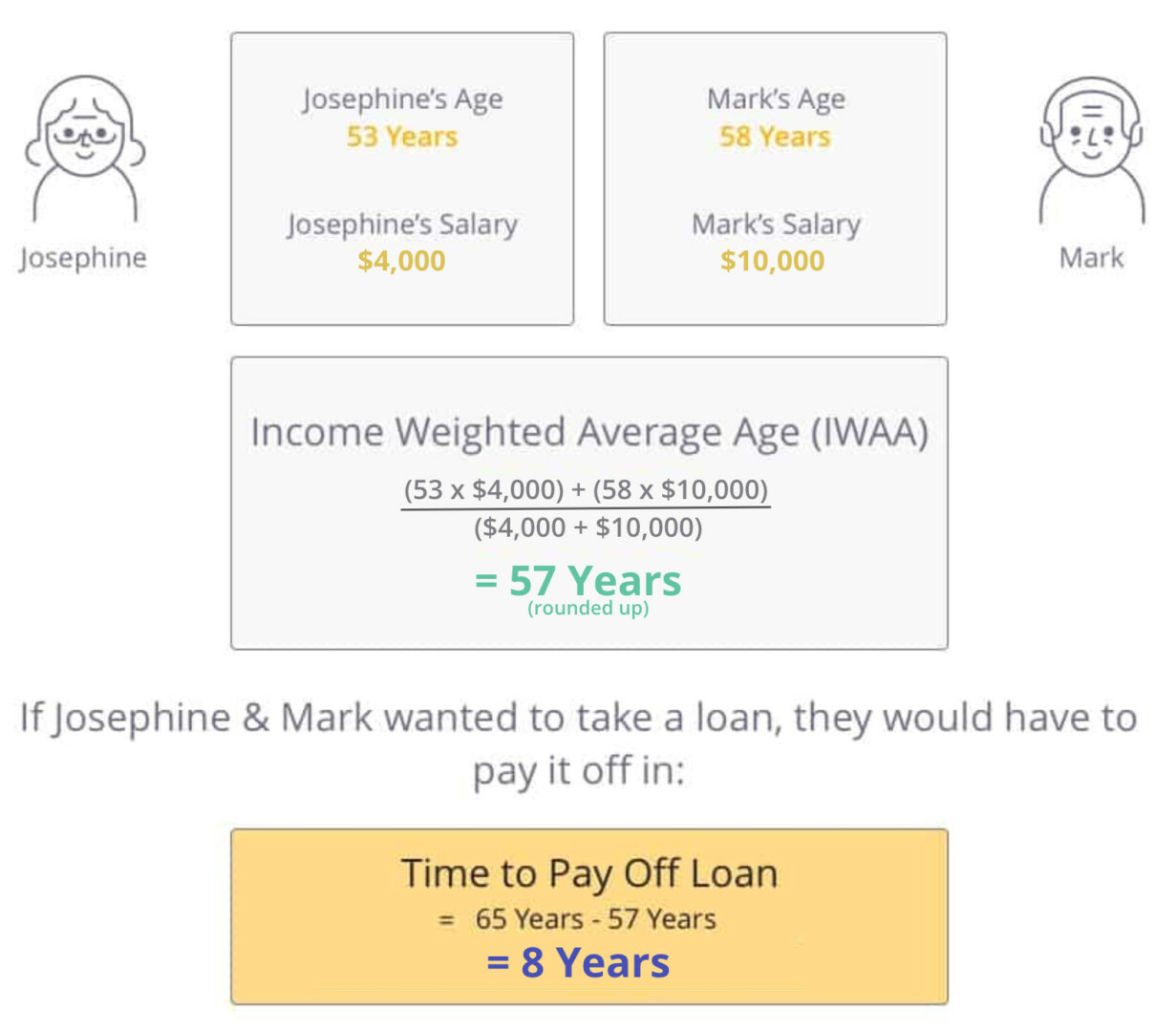

If the “borrower” is actually a couple, for example, you and your spouse, your combined age is taken based on your income. It is called your Income Weighted Average Age (IWAA).

Case Study:

Josephine and Mark’s “couple age” or their Income Weighted Average Age (IWAA) is based on their combined income and age as shown below:

Hence, even if the loan amount they are eligible for is higher, their time to pay it off is much shorter, thus increasing the amount they need to pay per month.

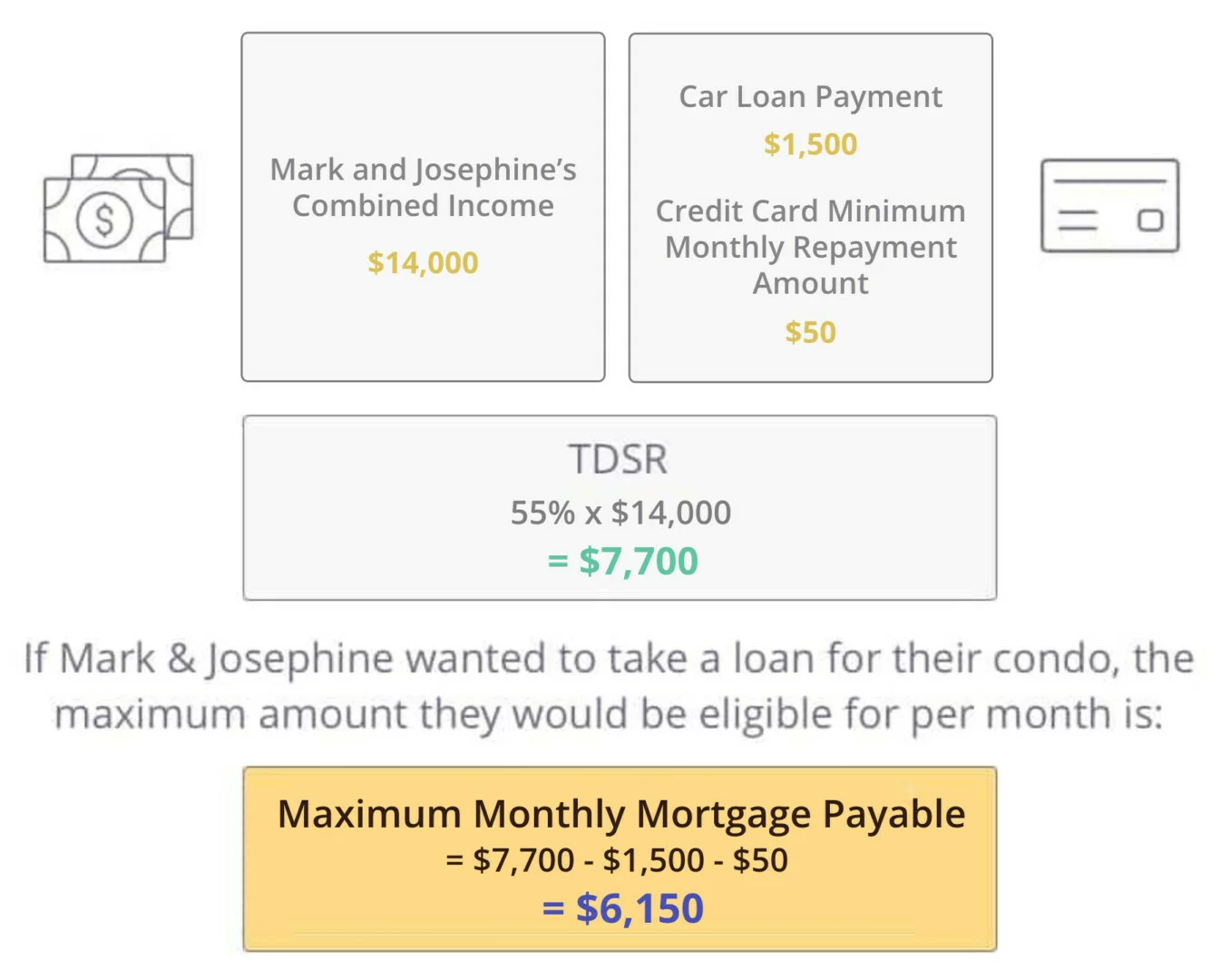

d. Total Debt Servicing Ratio (TDSR)

The Total Debt Servicing Ratio states that you cannot use more than 55% of your monthly income to service your debts. This TDSR was set on December 16, 2021. This includes your home loan, car loan, student loan, credit cards, etc. So how does this impact you? If you were to take a loan for buying a condominium in Singapore, the maximum loan amount you can take is subject to TDSR restrictions, meaning that even if the LTV for your bank loan is high, the amount of money you can get as a loan depends on your income and any other debt obligations you have outstanding.

Case Study:

Mark and Josephine have a combined salary of $14,000. They have sold their HDB and want to purchase a condominium. They currently service two debts – their car loan and their credit cards. The values below are based on monthly income and expenses.

For credit card debts, only the minimum monthly payment amount is taken into consideration when calculating your TDSR. In Singapore, this is usually 3% of your total outstanding balance or $50, whichever is higher. For Mark and Josephine, their minimum payment amount would be $50 given a $1000 debt.

By utilising CPF’s mortgage calculator, you can compute a maximum loan amount based on your ability to service the loan. It calculates the loan amount based on your maximum monthly mortgage payable, interest rate and loan repayment period.

MAS has stated that banks will use the higher of a 4% medium-term interest rate floor or the thereafter rate to compute a borrower’s TDSR. This approach ensures that households borrow prudently for their property purchases in a time of rising interest rates. As the interest rate varies across different banks and economic climates, do check with your preferred bank on the exact rate to be used for TDSR calculation. For simplicity’s sake, we will use the interest rate floor of 4% per annum in our calculations.

Given Mark and Josephine’s IWAA (57 years) calculated above, they only qualify for an 8 year loan tenure and they can only borrow $504,542 (calculated using CPF’s calculator) from the bank. Since the loan tenure does not extend beyond their 65th birthday, they can get a LTV of 75% for their loan as seen in the previous section. This would constitute 75% of their maximum condominium purchase value, which would be $672,723 if they have enough cash and CPF to make the downpayment of $168,180 (remaining 25% of their maximum condo purchase value).

Alternatively, if we assume that Mark and Josephine’s IWAA is 40 years, they would be young enough to get a 25 year loan tenure and can borrow $1,165,133 (calculated using CPF’s calculator) from the bank. The longer loan tenure results in a higher loan value. Given an LTV of 75%, their maximum condominium purchase value would now be $1,553,510 if they have enough cash and CPF to make the downpayment of $388,377 (remaining 25% of their maximum condo purchase value).

e. Upgrading Programme Costs

The definition of “Upgrading” here is different from that in the rest of the article. Here it refers to the Upgrading Programme by HDB, whereas in the rest of the article it refers to buying a more expensive property.

HDB undertakes Upgrading Programmes such as adding lifts in old HDB blocks that don’t have them or implementing maintenance works for old HDBs with issues, to minimise the inconvenience caused to its residents. When such an Upgrading Programme is undertaken in a block, the residents have to pay the Upgrading Programme’s Costs.

If a particular Upgrading Programme’s bill was issued while you were the owner of the flat, you still have to pay for the Upgrading Programme’s Costs before selling the HDB.

f. Upgrading Levy

Following the previous point, if you live in an HDB unit that went through an Upgrading Programme, you would have to pay an Upgrading Levy upon selling the flat. This is different from Upgrading Programme Costs. Basically, the Upgrading Programme Costs are to pay for the Upgrading work itself, whereas the Upgrading Levy is a kind of “fee” to pay when you sell an HDB flat that previously participated in the Upgrading Programme.

If your unit was Upgraded, you will have to pay an Upgrading Levy of 10% of the selling price or 90% of the market value of your flat, whichever is higher. You can read more about who needs to pay an Upgrading Levy and examples of how to calculate it here.

g. Resale Levy

A resale levy only applies when you’re selling a subsidised HDB flat to buy another subsidised HDB flat. Since you are buying a private property next, it will not apply to you even if you sell your new/resale HDB.

Want to find out more about the resale levy and how it works? Check out our ultimate guide on the HDB and EC Resale Levy which covers everything you need to know about it.

h. Seller’s Stamp Duty (SSD)

Barring exceptional cases, you need to have completed your MOP before you can buy a condo or sell your HDB. This MOP is typically 5 years. Since your property’s “Holding Period” is at least 5 years, you do not have to pay any Seller’s Stamp Duty (SSD) (which is only applicable when selling properties with holding periods of 4 years or less).

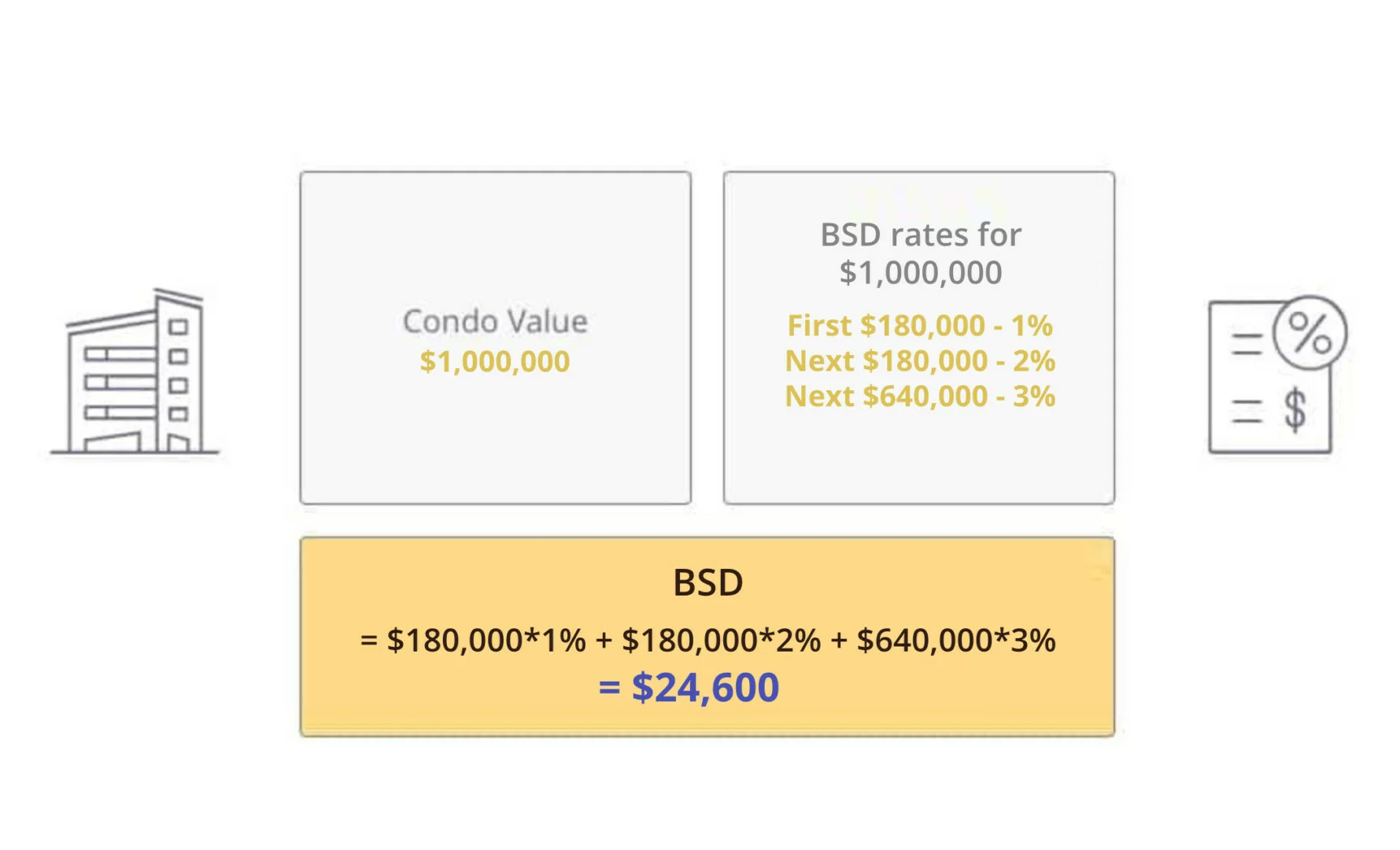

i. Buyer’s Stamp Duty (BSD)

Irrespective of whether you keep your HDB flat or sell it, you need to pay a Buyer’s Stamp Duty (BSD) when you buy a condo. Find out everything to know about Buyer’s Stamp Duty (BSD) here.

| Purchase Price or Market Value of Property | BSD Rates |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Next $500,000 | 4% |

| Next $1,500,000 | 5% |

| Remaining Amount | 6% |

The rates above were set on February 14, 2023.

Case Study:

Mark and Josephine want to purchase a condo worth $1,000,000. In this case, their BSD would be calculated as shown below:

j. Additional Buyer’s Stamp Duty (ABSD)

If you sell your HDB flat first, you do not have to pay any ABSD. But, if you buy a condo first, it would be your “additional” or “2nd” property (assuming you don’t have any others), so you will be liable to pay an ABSD. However, if you sell your HDB flat within 6 months of the completion of your purchase for a resale condo (or the TOP issue date if you’re getting a newly launched condo), you are eligible to apply for a remission (provided either you or your spouse is a Singapore Citizen). Find out everything there is to know about Additional Buyer’s Stamp Duty (ABSD) here.

k. Property Tax

Considering that you are an HDB owner, you already know how Property Tax works. It is charged based on the “Annual Value” (AV) of the property you are living in.

The AV is based on the estimated gross annual rent of the property if it were to be rented out, excluding furnishings and maintenance fees. Example, if your unit had an estimated market rental value of $2,000 per month, your AV is $2,000 * 12 = $24,000.

You will need to pay property tax on the condo you purchase in a similar way. If you’re not sure what the AV of the condo you intend to buy is, you can find it on IRAS’ site. Below, you can find the property tax rate for a property that you own and occupy i.e. you live in it.

| Owner-Occupied Tax Rates (Effective 1 Jan 2023) | |||

| Annual Value (AV) ($) | Tax Structure | Tax Rates | Property Tax Payable |

| <= $30,000 | First $8,000 | 0% | $0 |

| Next $22,000 | 4% | $880 | |

| $30,000 – $40,000 | First $30,000 | – | $880 |

| Next $10,000 | 5% | $500 | |

| $40,000 – $55,000 | First $40,000 | – | $1,380 |

| Next $15,000 | 7% | $1,050 | |

| $55,000 – $70,000 | First $55,000 | – | $2,430 |

| Next $15,000 | 10% | $1,500 | |

| $70,000 – $85,000 | First $70,000 | – | $3,930 |

| Next $15,000 | 14% | $2,100 | |

| $85,000 – $100,000 | First $85,000 | – | $6,030 |

| Next $15,000 | 18% | $2,700 | |

| > $100,000 | First $100,000 | – | $8,730 |

| Above $100,000 | 23% | 23% x Remaining Amount | |

So for an AV of $24,000, you would pay nothing on the first $8,000 and pay 4% on the remaining ($24,000 – $8,000 = ) $16,000 which would come up to $640.

Effective 1 Jan 2024, further adjustments in tax rates will be implemented.

| Owner-Occupied Tax Rates (Effective 1 Jan 2024) | |||

| Annual Value (AV) ($) | Tax Structure | Tax Rates | Property Tax Payable |

| <= $30,000 | First $8,000 | 0% | $0 |

| Next $22,000 | 4% | $880 | |

| $30,000 – $40,000 | First $30,000 | – | $880 |

| Next $10,000 | 6% | $600 | |

| $40,000 – $55,000 | First $40,000 | – | $1,480 |

| Next $15,000 | 10% | $1,500 | |

| $55,000 – $70,000 | First $55,000 | – | $2,980 |

| Next $15,000 | 14% | $2,100 | |

| $70,000 – $85,000 | First $70,000 | – | $5,080 |

| Next $15,000 | 20% | $3,000 | |

| $85,000 – $100,000 | First $85,000 | – | $8,080 |

| Next $15,000 | 26% | $3,900 | |

| > $100,000 | First $100,000 | – | $11,980 |

| Above $100,000 | 32% | 32% x Remaining Amount | |

For an AV of $24,000, there is no change and you will still pay $640. The increase in tax rates from 1 Jan 2024 will affect properties with AV of $30,00 and higher.

l. Other costs

Some other costs that can apply are:

i. Resale application administrative fees

This is a non-refundable administrative fee for the submission of the HDB resale application. It is $40 for 1 and 2-Room flats and $80 for 3-Room and bigger flats.

ii. Legal fees

If you are using HDB lawyers for your sale, you can estimate the legal fee using the Legal Fee Enquiry service on HDB’s website, which estimates your legal fees based on the type of your HDB (i.e. 2-Room, 5-Room, etc.) and the selling price. This would typically cost you a few hundred dollars. If you decide to engage your own lawyers, they will advise you on the legal fees applicable.

You would need to hire private lawyers for your condo purchase which would typically cost you a few thousand dollars depending on the law firm you’re hiring and the value of the property you are buying.

iii. Service & Conservancy Charges / Maintenance Fee

Service and Conservancy Charges are charges for the maintenance of the common facilities in your HDB block. You must pay the service and conservancy charges for your HDB flat up to the HDB sale completion appointment date. You can find the details of your service and conservancy charges through your Town Council.

Similarly, when you upgrade to a condo, you will need to pay monthly maintenance fees for the upkeep of the common facilities in your condo. It can be as little as $200 or as much as $1,200, depending on the condo.

iv. Property Agent Commission

For selling your HDB, an agent will typically charge you 2% of the HDB’s selling price (this is the standard market practice). However, at Propseller you can find top agents who charge a commission of 1%.

For buying a private property, you do not have to pay any property agent fee i.e. it is a free service.

When selling, it is important to hire an experienced HDB property agent. A bad agent can cost you more than they can save you, and considering that this is one of the largest financial transactions of your life, look out for a good and experienced one. If you don’t already have such an agent, you can find a 5-star agent on Propseller. And if you are looking for guidance on selecting the best agent for your property, check out our helpful tips for choosing an agent here.

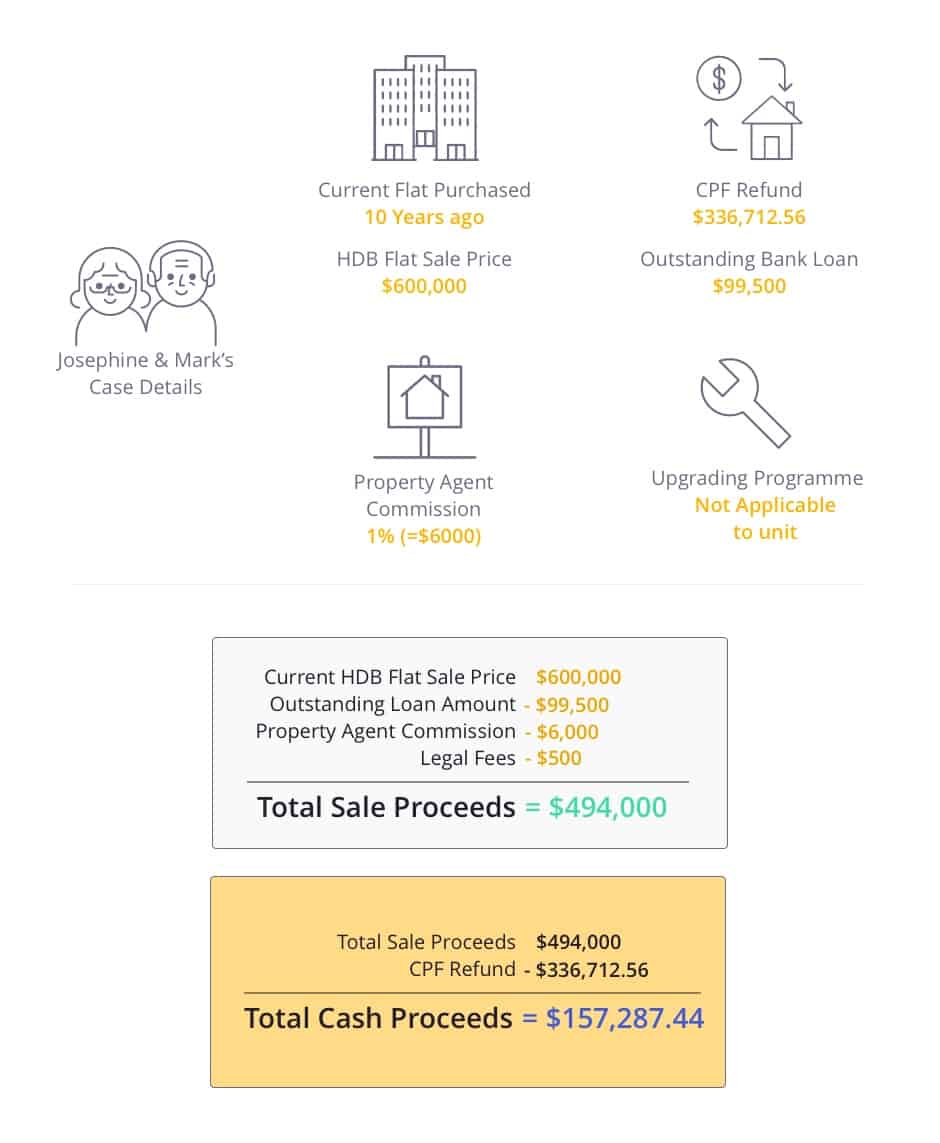

3. Can I afford to sell my HDB and upgrade to a condo?

You have to calculate two things here: the proceeds from your HDB sale and your affordability.

a. Sale & Cash Proceeds

It’s important to calculate your sale proceeds so that you can determine the cash proceeds and your affordability for a condo.

Potential Sale Proceeds =

HDB flat Sale Price

– Upgrading Costs

– Upgrading Levy

– Outstanding Bank Loan Amount

– Outstanding HDB Loan Amount

– Extension Rental

– Differential Property Tax

– Bank Penalties

– Other costs (Legal, Property Agent etc.)

Potential Cash Proceeds =

Sale Proceeds

– CPF Refund

Case Study:

Mark and Josephine own a 5-Room HDB flat and want to upgrade to a condo. They bought their flat 10 years ago, and want to estimate their potential sale proceeds.

If Josephine and Mark manage to sell their HDB at $600,000, they make almost $500,000 in sale proceeds which also consists of $157,287 in cash proceeds. They next have to see if this is enough for them to afford a condominium.

b. Affordability

To calculate your affordability, you can use the formula below:

Affordability =

CPF Withdrawable Amount

+ Previous HDB Sale’s Cash Proceeds

+ Cash savings

– Buyer’s Stamp Duty (BSD)

– Additional Buyer’s Stamp Duty (ABSD)

– Other costs (Legal, Property Agent etc.)

Another way to calculate if you can afford it is by seeing the upfront cash+CPF outlay needed, and determining whether you can afford it.

Upfront Cash/CPF Needed =

Downpayment

+ Buyer’s Stamp Duty (BSD)

+ Additional Buyer’s Stamp Duty (ABSD)

+ Other costs (Legal, Property Agent etc.)

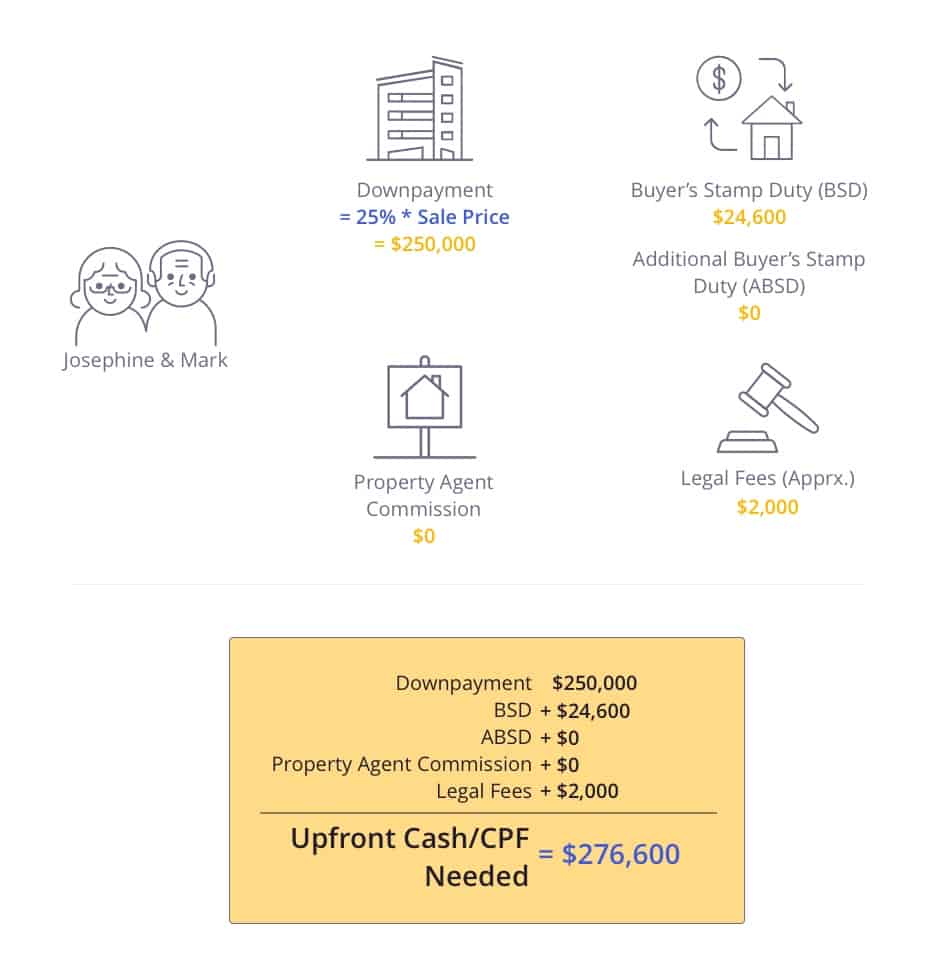

Case Study:

Since Mark and Josephine want to buy a condo, they want to determine the upfront cash/CPF needed for buying a condo worth $1,000,000.

You can see from here that their sale and cash proceeds from the HDB sale more than cover this amount, hence it should be entirely feasible for them to purchase such a condo (using both cash and CPF, or CPF only) without dipping into additional savings if they take a loan for 75% of the condo’s value.

4. What are the financial implications if I keep my HDB as an investment and upgrade to a condo?

Keeping the HDB you own as an investment property and upgrading to a condo definitely sounds tempting to many Singaporeans, especially if the rental income is close to or more than the mortgage payable every month. There are however some other financial considerations to think about to see if you can afford it. Below, we list all the implications of keeping your HDB and buying a private property in Singapore.

Note that by right, you need to be occupying your HDB after you buy a private property, but you can ask for permission from HDB to be allowed to rent out your HDB flat.

a. CPF

Since you are keeping your HDB, the condo you are buying will be your second property (assuming you don’t own any other properties). Thus, you will be subject to the same rules as “buying a condo first” stated above, i.e.

- You can withdraw up to a maximum of 100% of the condo’s Valuation Limit from your CPF Ordinary Account (Valuation Limit = The lower of the market value or the purchase price of the property).

- You need to set aside a Basic Retirement Sum (BRS) in your CPF, before being allowed to withdraw any money for the condo purchase. What this means is that you need to keep a certain amount of money in your combined CPF accounts, and can only withdraw the amount in excess of that. This amount is stated on CPF’s site, and varies based on your age.

- The CPF withdrawal limit might be lower based on your age and remaining lease.If the leasehold of the property allows the youngest owner of the property to live up to the age of 95 years in it, you can withdraw up to 100% of the market value or the purchase price of the property from your CPF Ordinary Account (OA), whichever is lower. If such a term can not be met, the amount of CPF available to be withdrawn will be pro-rated based on the extent the remaining lease of the property can cover the youngest buyer to the age of 95.

Case Study:

Unlike Mark and Josephine, Tommy and Grace want to upgrade to a condo while keeping their current HDB flat as an investment.

b. HDB Loan

It is okay for you to have an outstanding HDB loan on your current HDB flat when you buy a condo and want to keep both of them. Thus, buying a condo does not affect your HDB loan in any way.

c. Bank Loan

Assuming you don’t have any property other than the HDB flat you own, the new condo will be your second property. If your HDB’s loan is not yet paid off, the Loan-to-Value (LTV) that you can get for your “second housing loan” is much lesser than that of your first. However, if the housing loan for your HDB is already paid off, then the condo loan counts as your “first housing loan” and not the second. The rates are based on how many housing loans you have at the time of applying for the condo loan. You can see the rates for the first housing loan vs the second in this previous section of the article.

You can see from that table that if the loan for the new condo you are purchasing is considered a second home loan, then you will be allowed to borrow only 45% of the value of the condominium, meaning that you need to pay the remaining 55% using cash or CPF. This could be a huge undertaking for a lot of people, but if you have the necessary savings, you are good to proceed.

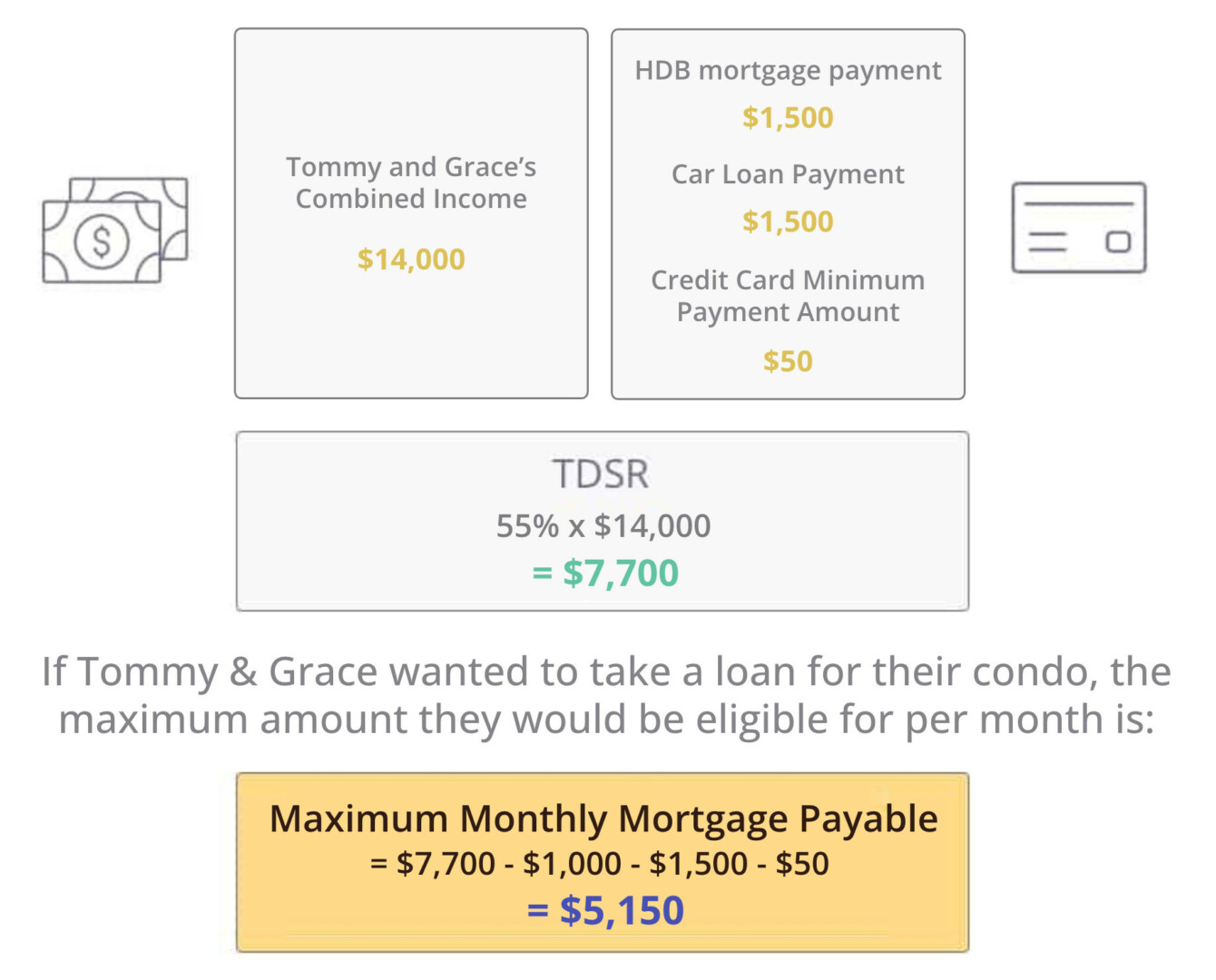

d. Total Debt Servicing Ratio (TDSR)

As stated before, the Total Debt Servicing Ratio states that you cannot use more than 55% of your monthly income to service your debts, including your existing home loan, car loan, student loan, credit cards, etc. Since this is your second property and assuming it is also your second loan, this could have a huge impact on how much you can borrow per month and consequently, overall for your condo.

Case Study:

Let’s assume that Tommy and Grace have the same income and costs as Mark and Josephine of a $14,000 combined income, $1,500 car loan payment and $50 credit card payment. Additionally they have a monthly mortgage payment of $1,000 for their existing HDB. The values below are based on monthly income and expenses.

If Tommy and Grace had sold their HDB, their maximum monthly mortgage payable per month would have been $6,150 which is the same as Mark and Josephine in the previous section. But since they are keeping it and have an outstanding loan that requires a payment of $1,000 per month, their maximum loan amount to buy a condo is $5,150. This means, assuming their loan tenure is 8 years, they can borrow a maximum of $422,503. This can cover up to only 45% of the value of their condo purchase, as this is their second home loan. Assuming they have enough cash and CPF to pay $516,393 for the remaining 55%, the maximum value for the condo is $938,896.

If they wanted to buy the condo priced at $672,723 as shown in the previous section, they can take a loan for up to $302,725 (45% of condo price) and the remaining amount of $369,998 (55% of condo price) will have to be paid in cash and CPF.

We can see a side-by-side comparison between selling and keeping the HDB with the same income and loan tenure for the same property value, below:

| Sell the HDB | Keep the HDB | |

| Property Value of Condo | $672,723 | $672,723 |

| Maximum Bank Loan as a % of Property Value | 75% | 45% |

| Maximum Bank Loan Value | $504,542 | $302,725 |

| Cash and CPF Needed | $168,180 | $369,998 |

You can see that there is an additional $201,818 of cash and CPF needed when you sell the HDB compared to when you keep the HDB with a loan outstanding.

e. Upgrading Programme Costs

As mentioned before, the definition of “Upgrading” here is different from that in the rest of the article. Here it refers to the Upgrading Programme by HDB, whereas in the rest of the article it refers to buying a more expensive property.

The Upgrading Programme is conducted by HDB to improve the facilities in certain older HDBs, such as adding lifts or implementing maintenance work. Since you are keeping your HDB, if the block it is in becomes a part of an Upgrading Programme, you have to pay for it.

f. Upgrading Levy

Following the previous point, if you live in an HDB unit that went through an Upgrading Programme and sell it, you have to pay an Upgrading Levy or fee for selling it. Since you are keeping your HDB, you do not have to worry about this.

g. Resale Levy

A resale levy only applies when you’re selling a subsidised HDB flat to buy another subsidised HDB flat. Since that is not the case for you, you do not have to worry about it.

Still interested to understand more about the resale levy? Read this ultimate guide on the HDB and EC Resale Levy to find out more.

h. Seller’s Stamp Duty (SSD)

Since you are not selling any property, you do not have to worry about Seller’s Stamp Duty (SSD)

i. Buyer’s Stamp Duty (BSD)

Buyer’s Stamp Duty (BSD) applies to all property purchases in Singapore. Thus, you will be liable to pay it for the condominium you are purchasing.

To see the rates and an example of how BSD is calculated based on the property price, you can see this earlier section in the article.

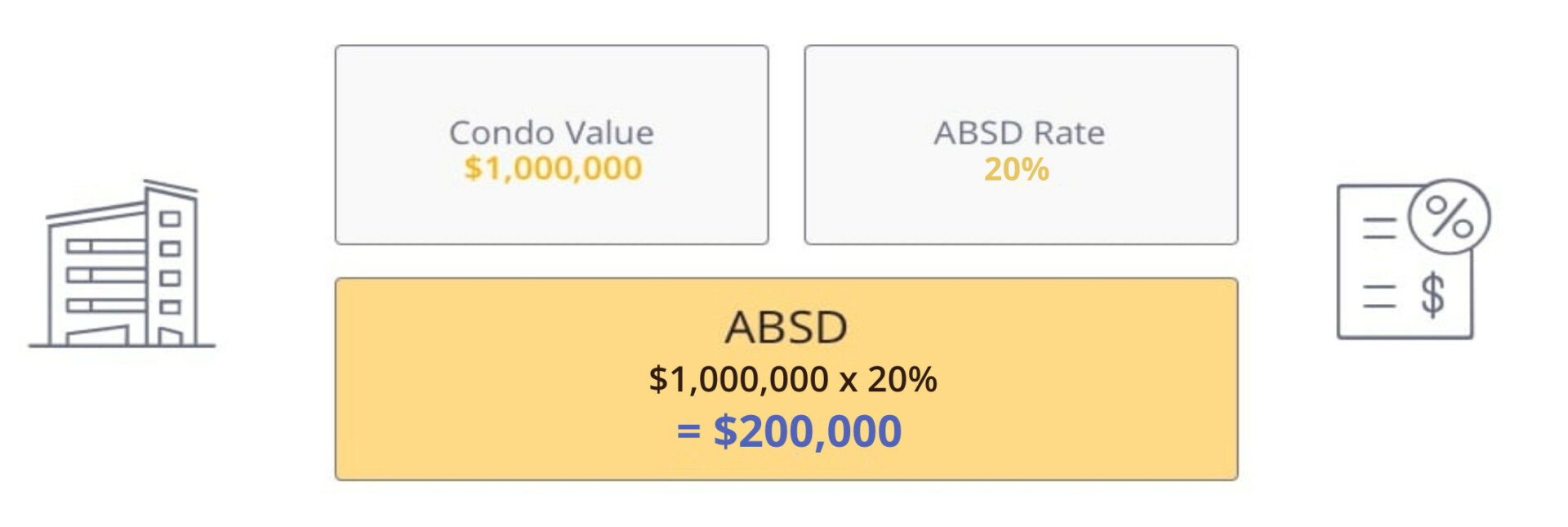

j. Additional Buyer’s Stamp Duty (ABSD)

Ah, the thorn on every 2nd home buyer’s side – Additional Buyer’s Stamp Duty (ABSD).

Since the condo you purchase will be at least your second property, you will have to pay an ABSD. The rates are as shown below for a second property purchase.

| Couple’s Citizenship Status | ABSD Rate (%) |

| Both are Singapore Citizens | 20% |

| One Singapore Citizen and One Singapore Permanent Resident | 30% |

| One Singapore Citizen and One Foreigner | 60% |

The rates above were set on April 27, 2023. If this is your 3rd property or higher, check the ABSD rates here.

Case Study:

Tommy and Grace are both Singapore Citizens who currently own only one property which is their HDB flat. Hence, the ABSD Rate that applies is 20%. If they buy a condo worth $1,000,000, the ABSD would be calculated as shown below:

k. Property Tax

Property tax is payable on both properties – the one that you live in as well as the one that’s rented out, based on the “Annual Value” (AV) of the property. However, the percentage to pay as tax is different for Owner-Occupied properties compared to Non-Owner-Occupied properties. The table for Owner-Occupied Tax Rates was covered in an earlier section of the article, and the table for Non-Owner-Occupied Tax Rates (effective 1 Jan 2023) is shown below:

| Non-Owner-Occupied Tax Rates (Effective 1 Jan 2023) | |||

| Annual Value ($) | Tax Structure | Tax Rates | Property Tax Payable |

| <= $45,000 | First $30,000 | 11% | $3,300 |

| Next $15,000 | 16% | $2,400 | |

| $45,000 – $60,000 | First 45,000 | – | $5,700 |

| Next $15,000 | 21% | $3,150 | |

| > $60,000 | First $60,000 | – | $8,850 |

| Next $60,000 | 27% | 27% x Remaining Amount | |

The rates above were announced on February 18, 2022 during the Singapore Budget 2022. Effective 1 Jan 2024, further adjustments in tax rates will be implemented.

| Non-Owner-Occupied Tax Rates (Effective 1 Jan 2024) | |||

| Annual Value ($) | Tax Structure | Tax Rates | Property Tax Payable |

| <= $45,000 | First $30,000 | 12% | $3,600 |

| Next $15,000 | 20% | $3,000 | |

| $45,000 – $60,000 | First 45,000 | – | $6,600 |

| Next $15,000 | 28% | $4,200 | |

| > $60,000 | First $60,000 | – | $10,800 |

| Next $60,000 | 36% | 36% x Remaining Amount | |

As you can see, the minimum payment for Owner-Occupied property is 0-4% whereas for Non-Owner-Occupied properties it jumps to 11%, which could be a significant chunk of the rental income. So for an AV of $24,000 for a non-owner-occupied property, the property tax would be $2,640 (when it is owner-occupied, it is $640).

l. Other costs

Some other costs such as the ones stated below can apply.

i. Legal fees

It will cost you ~$2,000 or more (based on the law firm you hire) to hire lawyers for a private property purchase.

ii. Property Agent Commission

You would have to pay a property agent for renting out your HDB. The fee is usually ½ month’s rental for a 1-year lease and 1 month’s rental for a 2-year lease. Example, if your HDB’s monthly rental is $2,000, you have to pay the agent $1,000 if they find you a tenant who signs a 1-year lease and $2,000 if they sign a 2-year lease.

However, you do not have to pay anything to use a property agent’s services for buying a condominium in Singapore.

It is important to get an agent experienced with renting out HDBs in your area to ensure you get the highest possible rental amount and in the shortest amount of time, so that you do not have many weeks of vacancy, which could impact your overall income from the unit. If you don’t already know of such an agent, you can find one on Propseller.

5. Can I afford to keep my HDB and upgrade to a condo?

If you retain your HDB flat and purchase a condo, you have to pay an Additional Buyer’s Stamp Duty (ABSD), on top of the Buyer’s Stamp Duty (BSD). Both ABSD and BSD have to be paid in cash first but can be reimbursed from CPF later. This is because CPF will not release the funds in time to meet the deadline for ABSD payment.

The payment deadline for ABSD and BSD depends on where the purchase agreement is signed. If you sign the contract in Singapore, the deadline is 14 days. If you sign the contract overseas, you have 30 days after the agreement is received in Singapore.

We will calculate the affordability based on upfront cash/CPF outlay needed to determine whether it is feasible, using the formula below:

Upfront Cash/CPF Needed =

Downpayment

+ Buyer’s Stamp Duty (BSD)

+ Additional Buyer’s Stamp Duty (ABSD)

+ Other costs (Legal, Property Agent etc.)

Case Study:

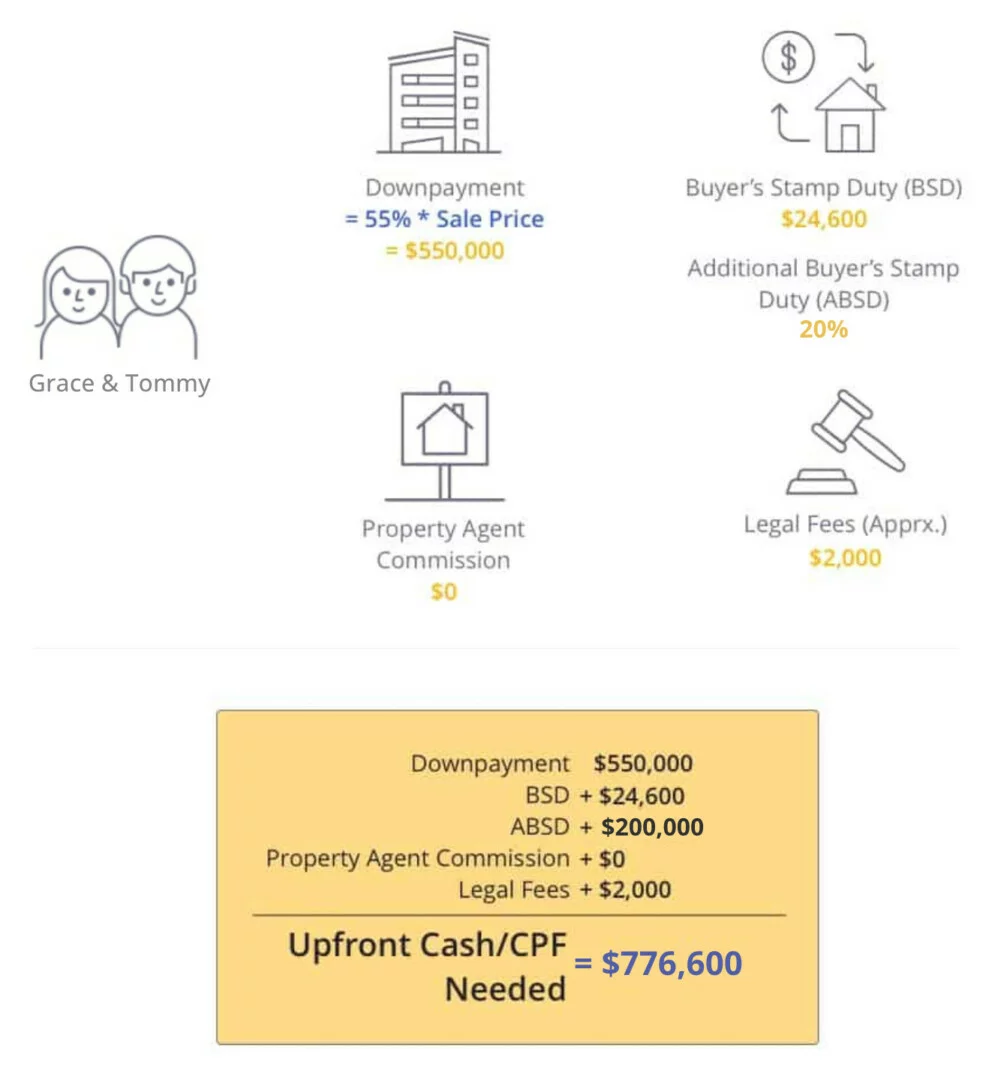

Tommy and Grace want to buy that $1,000,000 condominium without selling their HDB, and want to determine the upfront cash/CPF needed to be able to do so.

You can see here that instead of $276,600, which is how much Mark and Josephine needed in cash or CPF if they sold their HDB before buying a condo in the previous section, Tommy and Grace would need $776,600 to buy a $1,000,000 condo if they keep their HDB.

6. Summary: side by side comparison between selling and keeping the HDB

Below, we summarise the main differences between selling and keeping the HDB before upgrading to a condominium (or any private property in Singapore for that matter). For the table below, we are assuming that in the case of “sell the HDB”, the sale of the HDB is made before the purchase of the condominium for simplicity sake.

| Sell the HDB | Keep the HDB | |

| CPF | Can use up to 120% of Valuation Limit | Can use up to 100% of the Valuation Limit |

| Basic Retirement Sum (BRS) | Does not need to be set aside if you’re below 55 years old | Needs to be set aside even if you’re below 55 years old |

| Bank Loan | Can obtain a maximum of 75% LTV | Can obtain a maximum of 45% LTV |

| Downpayment | Minimum 25% | Minimum 55% |

| Maximum Loan Amount per Month | Could be higher | Could be lower if there is an outstanding HDB loan |

| Additional Buyer’s Stamp Duty (ABSD) | 0% | 20% |

| Property Tax | Taxed on Owner-Occupied Rates | Taxed on both Owner-Occupied and Non-Owner-Occupied Rates |

| Property Agent Commission | Higher for selling | Lower for renting |

7. When upgrading, should I buy a new launch or resale condo?

There are two important differences when buying a new launch vs a resale condo.

a. Property Agent commission by the seller

Before we go into the specific differences for you between buying a new launch or a resale condo, one very important thing to note is this – property agents make tremendously different amounts of money when they bring a buyer for the sale of a new launch condo vs a resale condo. For a new launch, they could make anywhere between 3-6% of the property value, whereas for a resale, they make between 0.5-1%. To put these numbers into perspective, for a $1M condo, getting you to buy a new launch could potentially make them $60,000 whereas if you buy a resale condo, it could only (in relative terms) get them up to $10,000.

That’s not to say that buying a new launch is a bad deal, it means that developers are simply able to pay more than individual sellers are to property agents. Because of this huge gap in commission, it leads to a bias in what (some) property agents would recommend to you and shift your interests towards. Therefore, just make sure that if you buy a new launch, it is because you like it and it fits your requirements, and not because it is being hard sold to you.

b. Differences between a new launch and resale condo

Now, let’s list the differences between a new launch and a resale condo below.

| New Launch Condo | Resale Condo |

| Need to wait a few years until it is ready to be lived in | Can start living in immediately |

| Paying mortgage on condo as well as HDB without any rental income for a few years | Can move into condo and sell or rent out HDB immediately |

| Cannot gauge potential issues with the unit from before (such as loud noise from upstairs neighbour) | Can gauge potential issues before buying, with a thorough inspection |

| Purchase price will almost always be close to fair market value | Purchase price can go below the real property value based on some sellers’ reasons (such as moving out of the country) |

| Riskier due to a larger number of unknowns | Less risky due to greater control and knowledge of what you’re purchasing |

| Timeframe for deciding on unit is determined by ballot number | Can follow your own timeline for deciding on committing to a resale flat |

| Brand new furnishing, flooring and fittings | May incur renovation costs |

| Newer features and facilities | Can have fewer and more worn down facilities |

| Lower maintenance costs since it is brand new | Higher maintenance costs as the condo gets older |

| Early bird discounted rates | No such discount, in case there is no seller looking to sell below market value |

| Can choose unit on your preferred floor, facing and feng shui | Can only buy from what’s available for sale |

Keeping these in mind, resale condos may be a safer bet for several buyers due to the certainty and knowledge of knowing what you’re getting. In any case, whether you choose a resale or new launch condominium, make sure that it is what fits your requirements and that you are not being convinced into making a less favourable purchase.

8. What are the pros and cons of upgrading to a condo?

As with any decision to be made, there are benefits and drawbacks that come with upgrading to a condominium.

a. Benefits of upgrading

More options for a specific location

You may be considering being close to your childrens’ schools, older family members, or your workplace. Location is, therefore, one of the top criteria, and condos open up more options for moving to, or within, a specific location, if budget allows.

In some cases, condos are also younger than the surrounding HDB flats; in many cases, the land parcels for condos were released for sale at a later stage after the estate had a sizable base of residents, transport links and amenities. This holds true for condos built on land plots close to MRT stations for example, and the reason can be found in the following excerpt from the report “Government Land Sales Program: Turning Dreams into Reality”.

“It is [important] that the land sales process is well-coordinated with the development of public infrastructure so that these amenities are readily available once development is completed. Hence, the GLS (Government Land Sales) schedule has to be rolled out in tandem with supporting infrastructure development programmes such as the construction of road and Mass Rapid Transit (MRT) networks. “

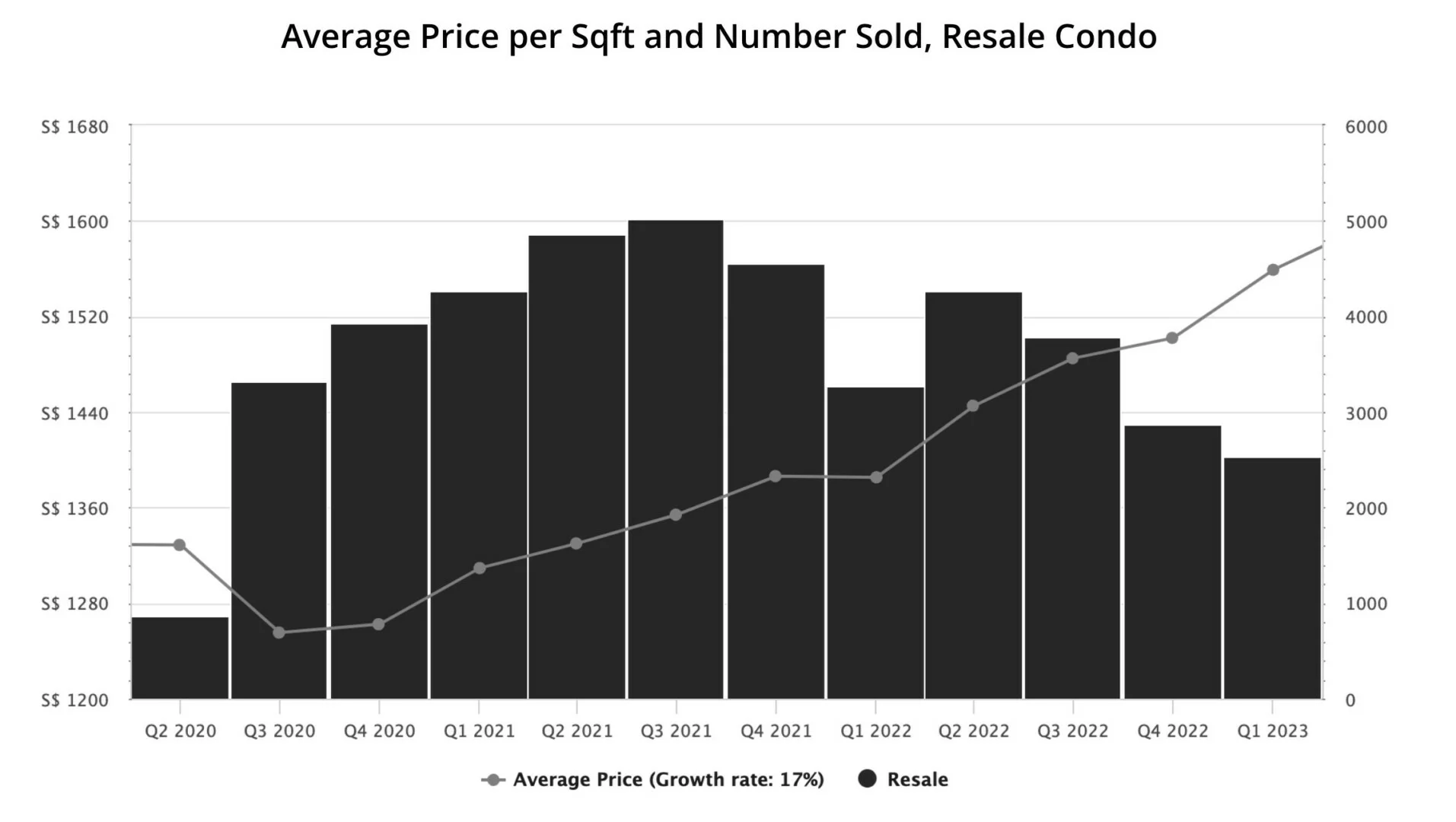

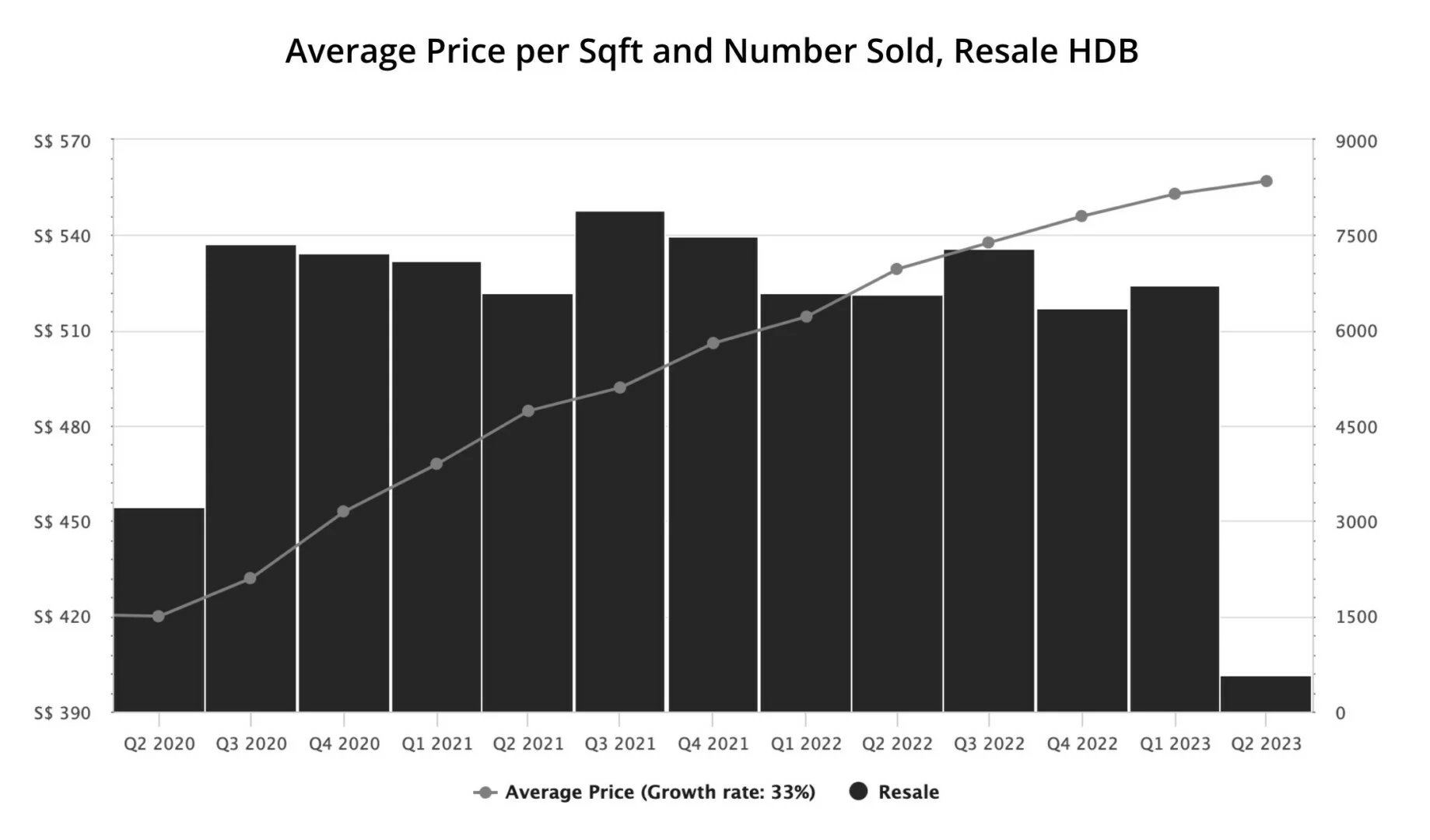

Appreciation on a higher value base

Both HDBs and condos have appreciated in the last 5 years. Resale condo average price per sqft has surged by 17% since April 2020, while resale HDB average price per sqft has grown by 33% over the same period.

On average, condos have seen a higher absolute increase in value compared to HDB, as the table below illustrates using an example of a 1,000 sqft flat:

| Resale HDB | Resale Condo | |

|

Size of Property |

1,000 sqft |

1,000 sqft |

|

Average Price per Sqft in Q2 2020 |

$420 |

$1329 |

|

Average Price per Sqft in Q1 2023 |

$553 |

$1559 |

|

Change in Price per Sqft |

+$133 |

+$230 |

| Change in Value of Property | +$133,000 |

+$230,000 |

You can see here that a similar-sized resale condo gained +$230,000 while the resale HDB gained +$133,00 over the same period, despite the resale condo having lower price growth.

Avoid paying the Resale Levy

Another advantage of upgrading to a condominium from an HDB flat is the opportunity to avoid paying the Resale Levy. A resale levy is applicable only when one is buying another HDB flat. However, transitioning from an HDB flat to a private property such as a condo exempts you from this additional cost. By avoiding the Resale Levy, you can reduce your expenses and unlock more savings that can be allocated towards the purchase of your dream condominium.

You can find out more about the resale levy and how it works from our ultimate guide on the HDB and EC Resale Levy which covers everything you need to know about it.

b. Downsides of upgrading

More limited by nearby amenities

Amenities such as coffee shops, supermarkets, hawker centers and sheltered walkways can often be found amidst HDB blocks. When HDB estates are planned, the surrounding amenities are built into the overall estate design, leading to a concentration of amenities around HDB flats. Condo developments tend to be further away from these amenities and can have fewer late-night options. For those who are used to cheaper dining or spur-of-the-moment suppers, you may need to drive out in order to fulfill those needs.

Inconsistent functionality across different condo layouts

HDB flat layouts are known to be very efficient. Condos, on the other hand, are sometimes subject to the unfathomable design whims of developers. Bay windows, extra-large balconies that can fit a bed, expanded air-conditioning ledges, and long corridors are some of the design quirks that result in less usable space.

Looking for condos with nearby amenities and more efficient layouts? Contact a Propseller Agent to help you.

9. What are the steps to upgrade from an HDB to a condo?

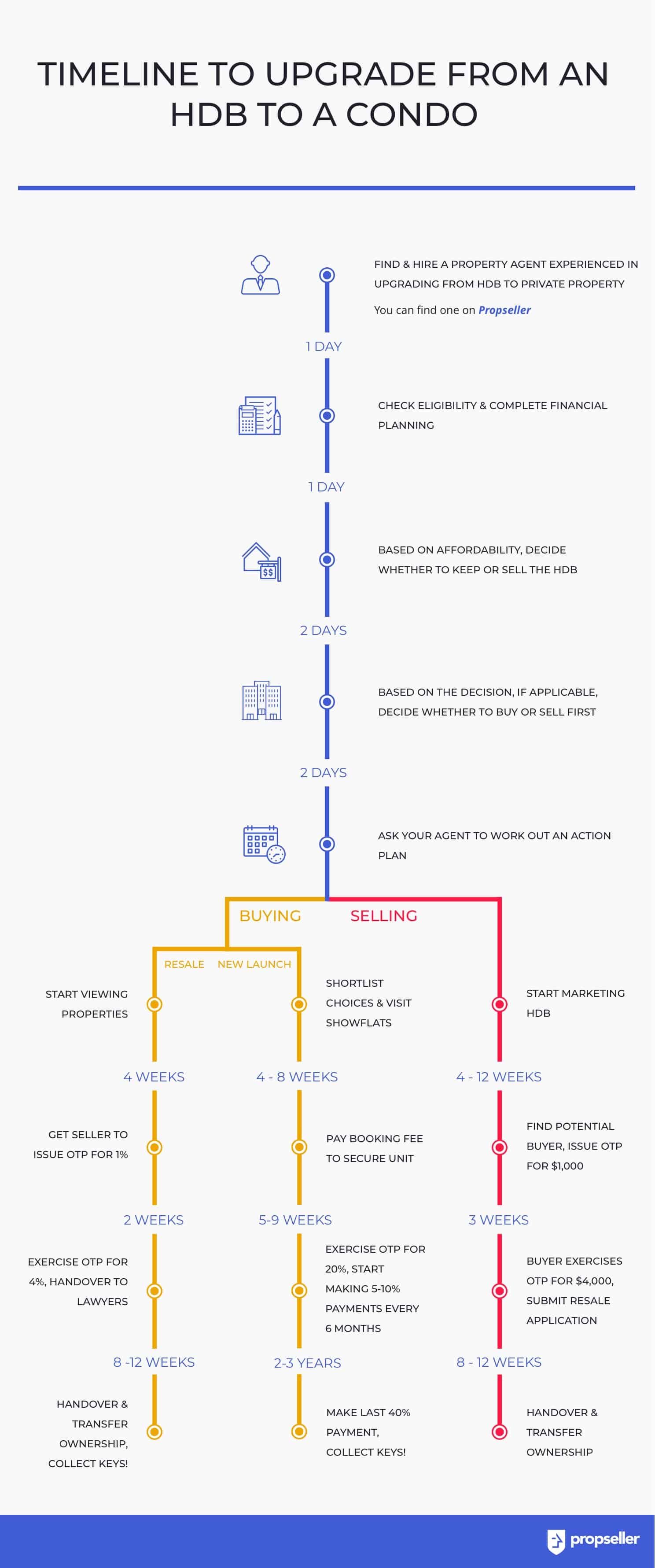

The upgrading process can vary based on whether you’re selling at all, selling first or buying first. Below, we’ll show you the steps to sell as well as buy.

a. Steps to sell an HDB flat

For selling your existing HDB to upgrade to a condo next, the steps that you and your property agent will follow will be as shown below:

- Register your ‘Intent to Sell’ on HDB’s website

- Calculate your flat’s sale and cash proceeds

- Appoint a good and reliable agent

- Start marketing your property for sale

- Grant an Option to Purchase (OTP) to the buyer for $1,000

- Wait for the buyer to exercise the OTP for another $4,000

- Submit the sale application to HDB

- Endorse the resale documents

- Pay the relevant fees online

- Receive the approval of the sale

- Attend the HDB appointment for the sale

Generally, it would take around 8 weeks from submitting the sale documents to getting an appointment with HDB.

b. Steps to rent an HDB flat

If you’re renting the HDB instead of selling, the process is a lot more straightforward.

- Ask HDB for approval to rent out your flat

- Find an experienced property agent to find you a tenant

- The tenant will register the Tenancy Agreement

And voila! You’re done. The main thing that takes time with rentals is the time to find a tenant. This could take anywhere from 2 weeks to 10 weeks, depending on the unit, the price, the demand and so on.

c. Steps to buy a private property

Buying takes a lot less time than selling. You would follow the steps shown below with your property agent (condo buyers typically don’t have to pay their property agents, so you can use this service for free).

- If you’re buying a resale condo

-

- Start viewing condos to buy

- Appoint a good and reliable agent

- Ask the condo owner to issue an OTP for 1%

- Hire a lawyer and finalise your loan

- Exercise the OTP for 4% and pay stamp duty

- Sign the Sale & Purchase agreement

- Handover to your lawyers

- Pay remaining 20% of downpayment

- Collect your keys!

- If you’re buying a new launch condo

-

- Shortlist your top choices

- Visit showflats

- Pay the booking fee to secure a unit

- Hire a lawyer and finalise your loan

- Exercise the OTP for 20% and pay stamp duty

- Sign the Sale & Purchase agreement

- Start making payments of 5-10% every 6 months up to TOP

- Pay remaining 40% when TOP is issued

- Collect your keys!

Looking for data-backed advice from trained professionals to guide you in finding the right property? Contact a Propseller Agent to help you.

10. Timeline for upgrading from an HDB flat to a condo

You can find the timeline of events for upgrading from an HDB flat to a private property such as a condo as shown in the infographic below. Note that the timeline to rent out your HDB is not covered below.

Conclusion

In conclusion, there are a few main things to remember when upgrading from an HDB flat to private property such as a condominium or landed property. First, check if you are eligible to buy a condominium. Second, check the financial implications of selling vs keeping your HDB. Third, calculate your affordability for buying a condo based on whether you want to keep or sell your HDB. Fourth, based on your affordability and loan eligibility, find the budget for your unit. Fifth, decide if you would like to proceed with a resale condo or a new launch, with clear reasons in your mind. And finally, start with the action steps for selling/renting and buying.

Have any questions about upgrading from an HDB to a condo? Ask us in the comments below or on the chat icon on the bottom right of your screen!

Don’t have an agent yet? Find agents experienced in downgrading HDB flats on Propseller, to start your journey.

Frequently Asked Questions

Can I buy a condo if I own an HDB?

Before you find out if you can afford to upgrade to a private property, you need to check if you’re even eligible to do so. Read about the two criteria to check for this: the MOP of your HDB flat and your citizenship.

Can ABSD and BSD be paid using CPF?

If you retain your HDB flat and purchase a condo, you have to pay an Additional Buyer’s Stamp Duty (ABSD), on top of the Buyer’s Stamp Duty (BSD). Both ABSD and BSD have to be paid in cash first, but can be reimbursed from CPF later.

When does ABSD and BSD need to be paid?

The payment deadline for ABSD and BSD depends on where the purchase agreement is signed. If you sign the contract in Singapore, the deadline is 14 days. If you sign the contract overseas, you have 30 days after the agreement is received in Singapore.

How much cash do I need if I keep my HDB and buy a condo?

In our example, you will now need $776,600 cash to buy a $1,000,000 condo if you choose to keep your HDB.

Can I upgrade from an HDB to an EC?

Before you find out if you can afford to upgrade to a private property, you need to check if you’re even eligible to do so. Similar to upgrading to a condo, there are two criteria to check for this: the MOP of your HDB flat and your citizenship.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.