Buying or selling an HDB or Executive Condominium (EC) in Singapore is a complex process as it is, but one thing many buyers and sellers are confused about is, what exactly is the Resale Levy? Do you have to pay for it when you buy? Or is it when you sell? How to avoid paying Resale Levy? Can the levy be waived?

This is an important topic to understand for all HDB and EC owners because it can hugely impact your finances when selling and buying property.

But you no longer have to worry – we’ve got you covered. In this comprehensive guide, we will take you through everything about the Resale Levy for HDBs and ECs in Singapore. What it is, whether you need to pay it, if yes, how much you will need to pay and every other necessary detail. Without further ado, let’s dive right in!

- What is the HDB and Executive Condo (EC) Resale Levy?

- Do I need to pay Resale Levy?

- How much is the Resale Levy amount for HDB Flats?

- How much is the Resale Levy amount for Executive Condominiums (ECs)?

- Do I need to pay Resale Levy if I am a Singles Grant recipient?

- When do I make payment for Resale Levy?

- How to make payments for Resale Levy?

- Frequently asked questions about Resale Levy

1. What is the HDB and Executive Condo (EC) Resale Levy?

The HDB and EC Resale Levy is essentially a payment you make for buying a second subsidised property.

To understand this, we first need to understand:

a. What is a “subsidised” property?

According to HDB’s guidelines, a subsidised property is any of the following:

- A Built-To-Order (BTO) flat from HDB

- A Sales of Balance Flat (SBF) from HDB

- An Executive Condominium (EC) from a developer

- A resale flat purchased with CPF Housing Grants

For the first 3 types of properties above, they are considered to be “subsidised” even if you did not take up any housing grants to pay for them. This is because they are already priced lower than the market rate due to the subsidy the Government gives on the original land price.

If you bought an HDB Resale flat with CPF Housing Grants, the property will also be considered as “subsidised”. The following grants are applicable to this situation:

- Family Grant

- Singles Grant

- Special CPF Housing Grant (SHG)

- Additional CPF Housing Grant (AHG)

- Enhanced CPF Housing Grant (EHG)

The only grant that is not considered under this is the Proximity Housing Grant (PHG), i.e. if you bought your HDB Resale flat with only the PHG, then your flat will not be considered as “subsidised”.

Now that we know what a “subsidised” property is, let’s find out HDB’s rationale for charging a Resale Levy.

b. Why does the Resale Levy exist?

HDB has imposed the Resale Levy in order to allocate public housing subsidies fairly between first-time users of a subsidy and other buyers who have already taken advantage of such a subsidy before. In short, it is to make sure every eligible individual or household can get the subsidy a maximum of 1 time in their lifetime. The Resale Levy serves to regulate the total amount of subsidy given out.

2. Do I need to pay Resale Levy?

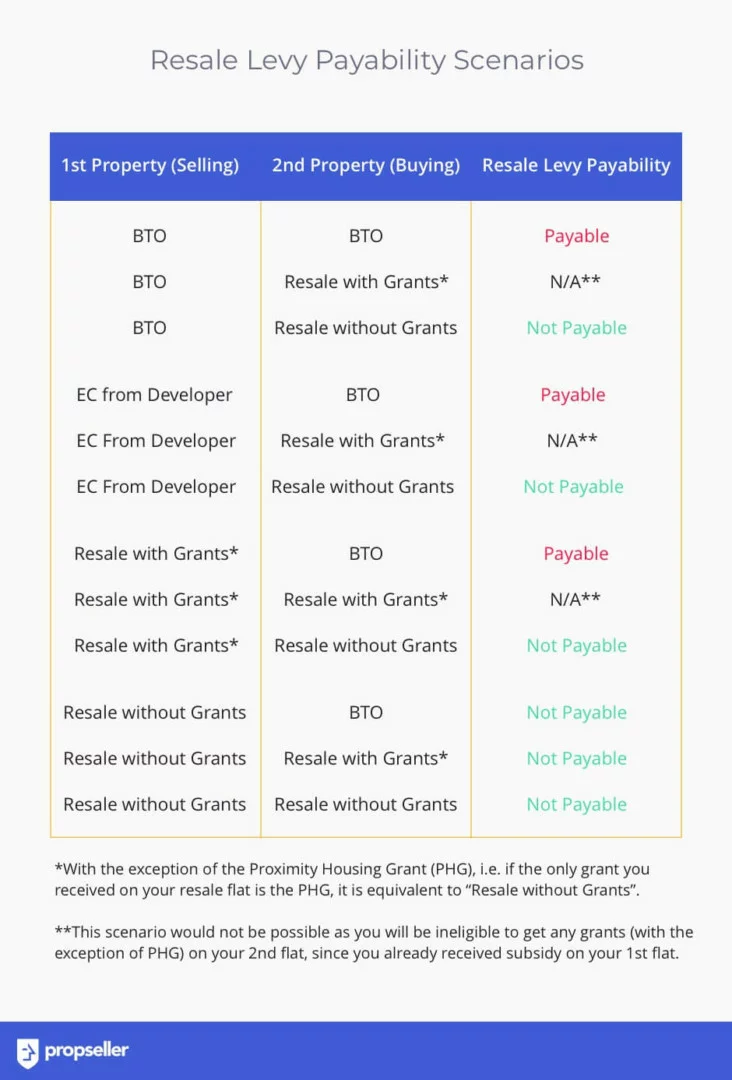

Put simply, you will need to pay the HDB Resale Levy if you are a second-time buyer of subsidised public housing. You will not need to pay the Resale Levy if you have never purchased a subsidised property before, or if the next property you are buying is unsubsidised.

Situations when you have to pay Resale Levy:

- You are selling your first-subsidised flat and looking to buy a second-subsidised flat from HDB

- You are selling your first-subsidised flat and looking to buy an Executive Condo (EC) from a developer

- Your first property was subsidised and you sold it and bought an unsubsidised property (e.g. a private condo). Now, you are selling the unsubsidised property and looking to buy a BTO flat, SBF or EC from a developer.

Note that in the final case, it does not matter what the second property was. Even if your second property was unsubsidised, as long as you have ever bought a subsidised property before and intend to buy another one, the Resale Levy will be applicable to you.

Situations when you will not have to pay Resale Levy:

- You have sold your first flat which was a private property and are looking to buy a subsidised flat next

- You have bought and owned a subsidised flat before, but want to buy any of the following types of property:

- Design, Build and Sell Scheme (DBSS) flat from a developer

- An HDB Resale flat without grants*

- Private residential property

*The Proximity Housing Grant (PHG) is an exception. Buyers are ineligible to receive other CPF housing grants available if they have already purchased a subsidised property before, but they can still get the PHG.

Note: Looking to downgrade your HDB? Read this Step-by-Step guide on downgrading your HDB flat.

3. How much is the Resale Levy amount for HDB Flats?

How much Resale Levy you will need to pay when you buy your second-subsidised flat now, depends on when you sold your first-subsidised flat.

- If you sold your first-subsidised flat before the 19th of May, 1997

- If you sold your first-subsidised flat between the 19th of May, 1997 and the 3rd of March, 2006

- If you sold your first-subsidised flat on or after the 3rd of March, 2006

a. If you sold your first-subsidised flat before the 19th of May, 1997

If you purchased and sold your first-subsidised flat before the 19th of May, 1997 and intend to buy a second subsidised flat now (2020 onwards), you may have to pay a “Premium” rather than a “Resale Levy”.

This would be applicable to you if you meet the following conditions:

- You bought a subsidised flat in one of the two ways below:

- A BTO directly from HDB

- A resale flat from the open market under the CPF Housing Grant scheme then

- You did not pay a Premium when you sold your flat in the open market

- You are now buying a second-subsidised flat from HDB in or after 2020

If you meet all the above conditions, you will have to pay the following Premium to HDB on buying your second-subsidised flat:

- 10% of the purchase price of the second-subsidised flat, if you sold your first-subsidised flat before October, 1994

- 20% of the purchase price of the second-subsidised flat, if you sold your first-subsidised flat between November, 1994 to the 19th of May, 1997

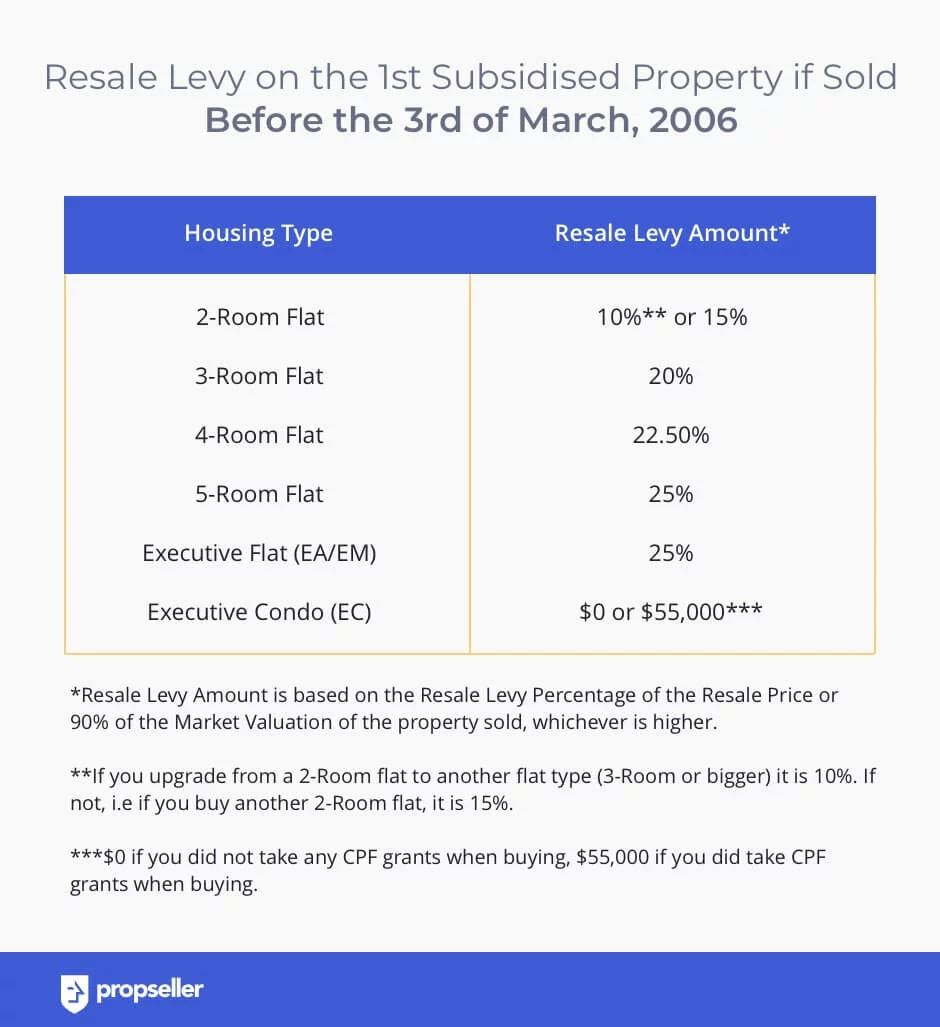

b. If you sold your first-subsidised flat between the 19th of May, 1997 and the 3rd of March, 2006

If you sold your first-subsidised property after the 19th of May, 1997 but before the 3rd of March, 2006 and are planning to buy another subsidised flat now (2020 onwards), you will need to pay a percentage graded Resale Levy.

The Resale Levy Amount is based on the percentage of the resale price of the sold flat, or 90% of its market valuation, whichever is higher.

Under the previous policy, you would have had to pay the percentage graded Resale Levy immediately upon selling your first-subsidised property, back when you sold it between the 19th of May, 1997 and the 3rd of March, 2006. You would also have had the option to defer the payment until you bought your next subsidised flat under HDB.

If you had chosen to defer the payment then and have waited until you bought another flat from HDB, you would be charged interest on the levy at a prevailing rate of 5% per annum.

To better visualise how much you would need to pay in this situation, let’s look at a case study.

Case Study:

Maria and Alex bought their first property together 20 years ago, in 2000. It was a 4-room BTO flat and is hence considered subsidised. They sold it on the 3rd of February, 2006 for $250,000. The market valuation at that time was lower than the sale price. They also chose to defer the payment of the Resale Levy until they decided to buy another flat from HDB.

They then bought a private property and have lived in it ever since. Now, in 2020, they are looking to sell their private property and downgrade to a 3-room BTO flat for their retirement.

Following HDB regulations, they will have to pay a percentage graded Resale Levy, since they sold their first-subsidised flat between the 19th of May, 1997 and the 3rd of March, 2006. Given that their first-subsidised flat was a 4-room and they deferred payment of the Resale Levy, the following calculations would be applicable to them:

As you can see, not only do Alex and Maria have to pay a substantial Resale Levy ($56,250) due to the date on which their first-subsidised flat was sold, but also a hefty interest (compounded at 5% annually) on top of that since they deferred the payment of the Resale Levy. However, if they are an elderly couple where both of them are over 55 years in age, they may request HDB to waive off the extra interest.

Note: If you’re looking to downgrade from a private property to an HDB, you can read our Ultimate Guide to downgrade from a Condo to an HDB to help you with it.

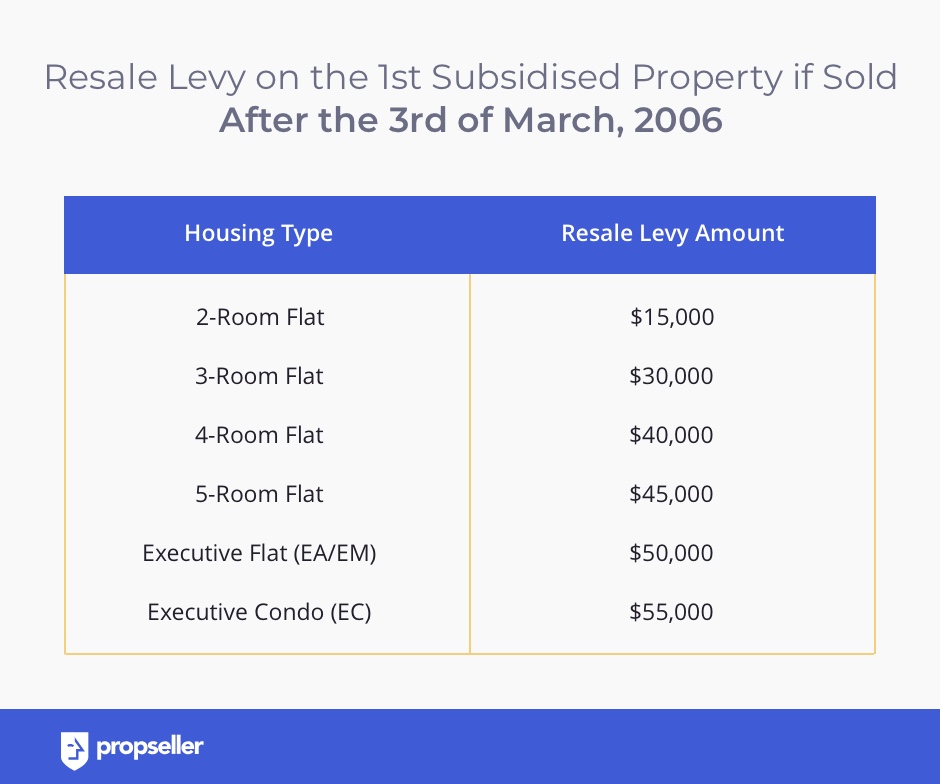

c. If you sold your first-subsidised flat on or after the 3rd of March, 2006

If you have sold your first-subsidised flat on or after the 3rd March 2006, you will need to pay a fixed amount of Resale Levy when buying your next subsidised flat.

HDB changed this from the initial “percentage graded” levy in order to give buyers greater certainty during their financial planning. Whether you are upgrading to a larger subsidised flat or right-sizing (downgrading) to a smaller subsidised flat, the fixed amount will make calculations less complex for you. Also, unlike the initial “percentage graded” resale levy, you would only need to pay the levy when you purchase your second subsidised property. There will be no interest accrued.

To better visualise how much you would need to pay in this case, let’s look at a case study together.

Case Study:

Roy and Samantha currently own a 4-room HDB flat. They bought the flat 10 years ago from the HDB resale market with CPF grants and hence, it is considered a subsidised flat. They used to live with their children, but their children have since grown up and moved out, so Roy and Samantha are now looking to right-size their home and downgrade to a smaller 3-room HDB BTO flat in a quiet district of their choice.

Following HDB’s regulations, they will have to pay a Resale Levy. Since their first-subsidised flat was a 4-room and they plan to sell it after the 3rd of March, 2006, the amount applicable to them would be $40,000.

4. How much is the Resale Levy amount for Executive Condominiums (ECs)?

How much Resale Levy you will need to pay when you buy your next subsidised property, depends on when you sold your first-subsidised Executive Condominium (EC).

- If you sold your first-subsidised flat before the 3rd of March, 2006

- If you sold your first-subsidised flat on or after the 3rd of March, 2006

a. If you sold your first-subsidised EC before the 3rd of March, 2006

If you have sold your first-subsidised EC before the 3rd of March, 2006, you would have bought and owned an EC from one of the very first few EC batches ever developed. Assuming you took grants back when you bought it, you will have to pay a fixed amount of $55,000 as Resale Levy when buying your next subsidised flat.

If you bought an EC without grants from one of the early batches and sold it before the 3rd of March, 2006, it will be considered as an unsubsidised property and you will not have to pay the Resale Levy.

b. If you sold your first-subsidised EC on or after the 3rd of March, 2006

If you have sold your first-subsidised EC on or after the 3rd of March 2006, you will also need to pay a fixed amount of $55,000 as Resale Levy when buying your next subsidised flat (whether or not it is an EC).

5. Do I need to pay Resale Levy if I am a Singles Grant recipient?

If you are a Singles Grant recipient, you only need to pay half of the Resale Levy amount when you subsequently buy your second-subsidised flat.

The same rules as explained above apply to you, i.e. the amount depends on the date when your first-subsidised property was sold.

6. When do I make payment for Resale Levy?

There are two situations available, based on the timeline of the sale of your first-subsidised flat. Either you sell first before taking possession of the new unit, or buy first and take possession of the new unit first before selling.

a. If you sell first

If you sell your first-subsidised flat before taking possession of your second, you will need to pay the Resale Levy fully in cash to HDB upon taking possession of your second-subsidised flat. You will need to pay it between the period of signing the Agreement for Lease and the key collection for the flat you’re buying.

b. If you buy first

On the other hand, if you first bought and took possession of your second-subsidised property, and subsequently sold your first-subsidised property, the following will be applicable to you:

- The Resale Levy amount will be deducted by HDB from the cash proceeds upon the sale of the first-subsidised flat.

- If necessary, any shortfall will need to be paid in cash to HDB. HDB will send you a Payment Notice as a reminder beforehand.

Take note that you can only pay the Resale Levy in cash (including with cash from sale proceeds). You will not be able to pay for it using CPF or using HDB Mortgage Financing.

7. How to make payments for Resale Levy?

HDB deducts the Resale Levy amount directly from the sales proceeds upon the sale of your first-subsidised flat, if you buy first.

Any cash payments to be paid to HDB for the Resale Levy are to be paid by cashier’s order, which is a cheque issued by the banks directly, and submitting it along with the Payment Notice to HDB Hub or any of the HDB Branch Offices nearby your area. You can request for the cashier’s order by speaking directly with your personal bank.

If, however, you are looking to buy an EC from a developer as your second-subsidised property, the payment of the resale levy will be made through the developer of the EC. The developer will then liaise directly with HDB.

8. Frequently asked questions about Resale Levy

There are many specific questions people have regarding the Resale Levy. We will try to answer as many of them as we can below.

a. Who is eligible to get their Resale Levy Waived?

If you are a couple and both of you are aged 55 and above, you may be entitled to a “Waiver of Interest”, if you:

- Sold your first-subsidised flat between the 19th of May, 1997 and the 3rd of March, 2006

- Intend to right-size to a new 3-room or smaller flat

In this case, you will only need to pay the Percentage Graded Resale Levy amount, and the interest accrued on delayed payment will be waived. This can potentially sum up to significant cost-savings, as seen in the Case Study mentioned above.

If you sold your first-subsidised flat on or after the 3rd of March, 2006, the same fixed amount Resale Levy will be applied to you, as explained in the earlier section. There will be no waivers in this case.

b. Can I appeal to have my Resale Levy waived?

In this article, the Ministry of National Development stated that in two-thirds of the cases, they do not accept an HDB Resale Levy waiver request. In the remaining one-third of the cases in which they had accepted, they did not give a full waiver of the Resale Levy. The MND tries to tailor each waiver specifically by assessing every request on a case-by-case basis (e.g. if the family requesting it is going through severe financial hardship). In some cases, they have helped add the Resale Levy into the purchase price of the property so that it can be paid in instalments. However, do note that the article in reference is 4 years old and the proportion of accepted cases may be different now.

c. Can I pay Resale Levy with CPF?

Unfortunately, you cannot use your CPF to pay for Resale Levy. You can only pay it with cash. In the case where you buy your second-subsidised flat before you sell your first-subsidised flat, you can only use the cash proceeds from the sale of your first-subsidised flat to pay the Resale Levy. You will have to pay any shortfall in cash.

d. How to avoid paying HDB Resale Levy?

You do not have to pay any Resale Levy if:

- You are purchasing your first-subsidised HDB flat

- You have only received the Proximity Housing Grant on your previous flat purchase and no other grants (in which case your property will not be considered a subsidised flat)

- You are buying a resale flat from the open market without grants

- You are buying a resale Executive Condominium (EC)

- You are buying a DBSS flat

- You are buying a private property

However, if you are purchasing your second-subsidised flat, there is no way to avoid having to pay Resale Levy, unless your family is facing extreme financial hardship. In such a case, you can make an appeal to HDB.

e. Do I have to pay Resale Levy if I am divorced from the person who I purchased the first-subsidised flat with?

If you are divorced from the person you purchased and owned your first-subsidised HDB flat with and are buying the second one with someone else who is a first-timer, it means only one out of the two buyers purchasing is eligible to pay a Resale Levy. In this case, you would only need to pay half the Resale Levy amount.

To understand this situation, let’s make it easier with a case study.

Case Study:

Mark and Vivian were married in the past and they purchased a 5-room resale flat with the Family Grant in March, 2007. They got divorced 5 years later and sold their flat.

Mark later married Kaira, who had never purchased any property before. They intend to buy a 3-room BTO together.

In this case, it would be Mark’s second subsidy, but only Kaira’s first. Hence, Mark has to pay half the Resale Levy amount and Kaira doesn’t have to pay any Resale Levy.

In this case, Mark’s Resale Levy payable = $45,000/2 = $22,500

f. Do I need to pay Resale Levy if I am going to be an Essential Occupier in another subsidised flat?

If you have bought and sold your first-subsidised property and are now going to be an essential occupier in another subsidised property, you do not need to pay the Resale Levy. The key thing to note about the Resale Levy is ownership – if you do not buy and own the second-subsidised property, you do not need to pay it. Let’s take a look at a quick example to illustrate this.

Case Study:

Mei Ting’s mother purchased a subsidised flat directly from HDB as a co-owner many years back. She then went on to sell it and moved to a private property with Mei Ting. Now that Mei Ting has grown up and is eligible, she wants to buy a BTO for herself as the owner and register her mother as the Essential Occupier. In this case, her mother does not need to pay her share of the Resale Levy, as she is not a co-owner of the new BTO flat.

g. Do I need to pay Resale Levy if my first-subsidised flat falls under the Selective En-Bloc Redevelopment Scheme (SERS)?

If your first property falls under the involuntary Selective En-bloc Redevelopment Scheme (SERS), you do not need to pay a Resale Levy when you buy a replacement subsidised flat from the HDB. This applies even if your property was subsidised when you first bought it. HDB does this as a special concession under the SERS.

However, if your flat under the SERS is not your first subsidised property, you might need to pay the Resale Levy if you want to buy a second-subsidised property now. As a concession from HDB, your Resale Levy will be capped at $30,000, regardless of the size of your first-subsidised flat.

If this sounds confusing, fret not. Let’s take a look at an example to better understand this.

Case Study:

Keith and Linda’s very first property was a 4-room BTO flat. They subsequently sold it and bought their second property, an old resale flat, which recently came under the SERS. Hence, they’re looking to buy a replacement 3-room BTO flat which is due to be developed in a nearby district. Since Keith and Linda’s first property is subsidised, they will have to pay the Resale Levy.

However, they will only have to pay $30,000, instead of the fixed amount of $40,000 which would have been applied to the sale of their first 4-room flat, due to the concession given by HDB.

Conclusion

In conclusion, Resale Levy is a payment you make to HDB when you buy your second-subsidised property. There are four key things to understand about this. First, what a subsidised flat is and why Resale Levy exists. Second, whether you are eligible to pay the Resale Levy in the first place. Third, if you are, then how much you need to pay, and finally, how to pay it.

Have any questions about HDB or EC Resale Levy? Ask us in the comments below or on the chat icon on the bottom right-hand corner of your screen!

Don’t have an agent yet? Contact an agent experienced in transacting the sale and purchase of HDB and EC flats to start your journey.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.