When transacting property in Singapore, whether you are buying, selling or renting, a Stamp Duty could be applicable to your transaction. This is something not everyone is aware of, which could lead to buyers underestimating their total cost or sellers overestimating their sale proceeds.

This guide aims to take you through the different types of Stamp Duties applicable in Singapore, whether you have to pay it, if yes, how much you’d have to pay and explain how each of them works in detail. Now, let’s dive right in!

- Residential Property

- Seller’s Stamp Duty (SSD) for Residential Property

- Buyer’s Stamp Duty (BSD) for Residential Property

- Additional Buyer’s Stamp Duty (ABSD) for Residential Property

- Stamp Duty on Lease of Residential Property (Lease Duty)

- Mortgage Stamp Duty for Residential Property

- Can you use CPF to make payment for Stamp Duty on Residential Property?

- Commercial Property

- Seller’s Stamp Duty (SSD) for Commercial Property

- Buyer’s Stamp Duty (BSD) for Commercial Property

- Additional Buyer’s Stamp Duty (ABSD) for Commercial Property

- Stamp Duty on Lease of Commercial Property (Lease Duty)

- Mortgage Stamp Duty for Commercial Property

- Can you use CPF to make payment for Stamp Duty on Commercial Property?

- How to make payment for Stamp Duty?

- When to pay Stamp Duty?

1. Residential Property

So what exactly is Stamp Duty? It is a tax imposed by the Inland Revenue Authority of Singapore (IRAS) when you transact a property. The term “residential properties” refers to flats, condominiums, terrace houses, etc. which are used as living spaces.

a. Seller’s Stamp Duty (SSD) for Residential Property

When you buy a property in Singapore, you have to keep it for a minimum “holding period” (the period after you claim ownership of the property and before you sell it) to avoid paying a Seller’s Stamp Duty (SSD). However, should you choose to sell it within the minimum holding period, you would be liable to pay an SSD.

SSD is applicable to either the selling price or the market value of the property you are selling, whichever is higher.

Below, we will go through:

- What are the Seller’s Stamp Duty (SSD) Rates?

- Do I have to pay SSD when selling an HDB?

- How to calculate SSD?

- Are there any special cases where SSD is not applicable?

- Am I eligible to get SSD remission?

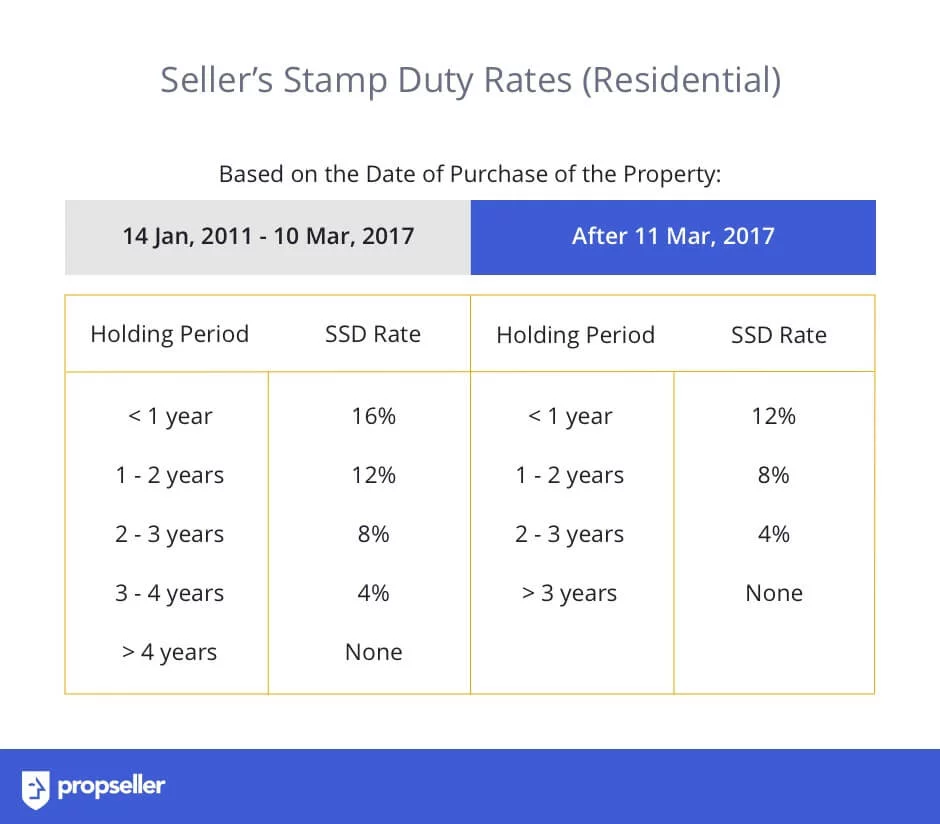

What are the applicable rates of Seller’s Stamp Duty (SSD) for Residential Property?

For transactions made after the 14th of January, 2011, based on the exact date of your purchase, the Seller’s Stamp Duty is applicable as per the below table.

Do I have to pay Seller’s Stamp Duty (SSD) when I sell my HDB?

When it comes to selling HDB flats, you are only allowed to sell it after 5 years of purchasing, hence SSD will not apply to you. However, if you have been granted an exemption to sell it before the minimum holding period, then in such special cases, SSD would apply to you.

How to calculate the Seller’s Stamp Duty (SSD) payable for Residential Property?

Let’s say you bought a property on the 15th of March, 2017. The market value of the property is at $920,000, but you manage to sell it at $1,000,000. Following the rules of SSD, the higher amount which is $1,000,000 will be the amount that is used in the calculations of how much SSD is payable.

Are there any special cases where Seller’s Stamp Duty (SSD) is not applicable?

Yes, there are some special circumstances when SSD is not applicable even if you sell within the minimum holding period. These are listed below:

- You and your fiancé own an HDB flat each, and are required to dispose of either one upon getting married. Either of you can dispose of your flat without having to pay any SSD.

- You were declared bankrupt and are disposing of the property due to that.

- You’re an existing HDB flat owner and you inherited an HDB flat. You will be required by HDB to dispose of either the inherited HDB flat or the existing HDB flat.

- You’re an existing non-HDB flat owner and you inherited an HDB flat which you do not have permission to keep, and hence have to dispose of the flat.

- You are returning your flat to HDB after repossession by HDB or under the Selective Enbloc Redevelopment Scheme (SERS).

- Your flat has been identified for SERS and you have decided to sell your HDB flat in the market before HDB claims it.

Am I eligible to get Seller’s Stamp Duty (SSD) remission?

SSD remission is allowed for aborted Sale and Purchase agreements, Matrimonial Proceedings (e.g. ownership transfer due to divorce), Conveyance Directions (e.g. ownership transfer to an incorporated company) and transfer of HDB flats within the family (not including EC units) as long as you are eligible based on the rules.

b. Buyer’s Stamp Duty (BSD) for Residential Property

Buyer’s Stamp Duty (BSD) is a tax paid upon exercising of the Option to Purchase (OTP) a property (for resale properties) or signing the Sale & Purchase Agreement (S&P) (for new developments). The BSD is applicable to either the purchase price or the market value, whichever is higher.

Below, we will go through:

- What are the Buyer’s Stamp Duty (BSD) Rates?

- How to calculate BSD?

- Am I eligible to get BSD remission?

What are the applicable rates of Buyer’s Stamp Duty (BSD) for Residential Property?

With effect from the 20th of February, 2018, the below rates are applicable when calculating the BSD applicable to residential property.

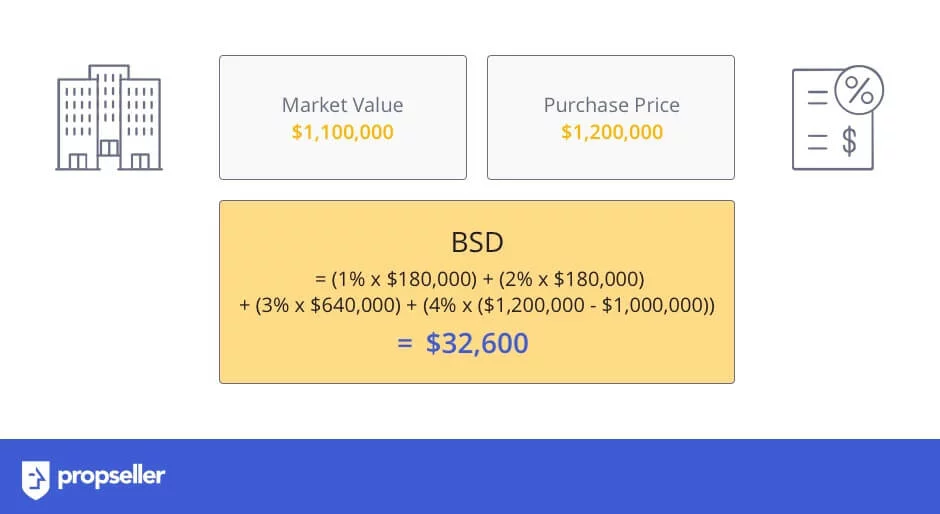

How to calculate the Buyer’s Stamp Duty (BSD) payable for Residential Property?

Let’s say you purchased a property at $1,200,000, but the market value of the property is $1,100,000. In this case, you would use the price the property was bought for i.e. the Purchase Price for the calculations.

Am I eligible to get Buyer’s Stamp Duty (BSD) remission?

BSD remission is allowed for aborted Sale and Purchase agreements, Matrimonial Proceedings (e.g. ownership transfer due to divorce), Conveyance Directions (e.g. ownership transfer to an incorporated company) and transfer of HDB flats within the family (not including EC units) as long as you are eligible based on the rules.

c. Additional Buyer’s Stamp Duty (ABSD) for Residential Property

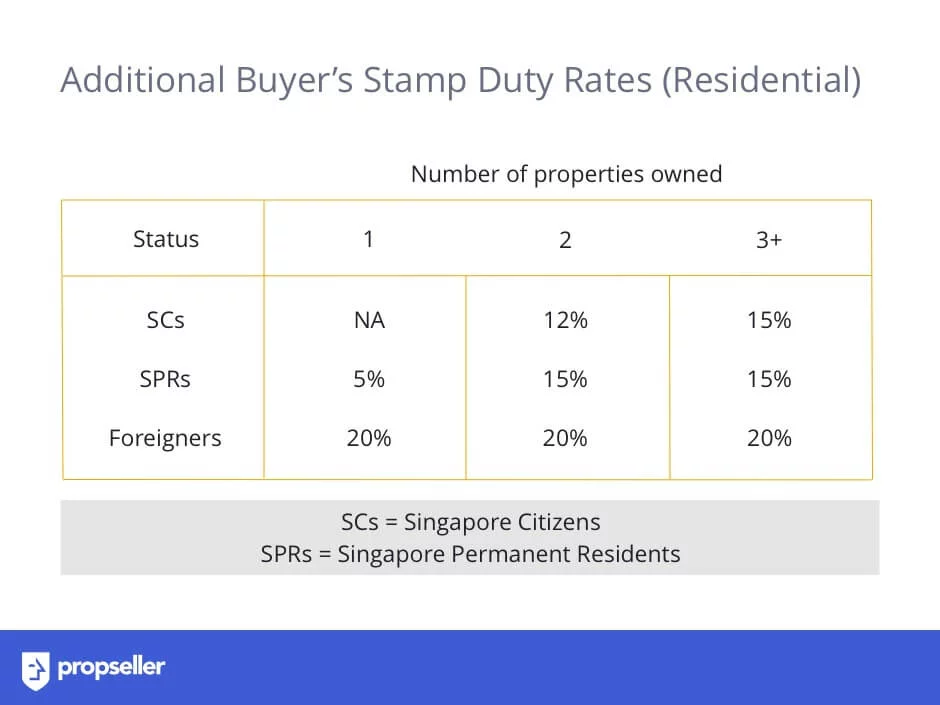

Additional Buyer’s Stamp Duty (ABSD) is an additional duty that has to be paid on top of the BSD, but it is only applicable to some buyers. Just like BSD, the amount of ABSD to be paid is based on the property’s purchase price or market value, whichever is higher.

The ABSD rates are dependent on the buyer’s residency status, i.e. whether you are a Singapore Citizen (SC), Singapore Permanent Resident (SPR) or a foreigner. It is also dependent on the number of properties you concurrently own at the time of purchase.

Below, we will go through:

- What are the Additional Buyer’s Stamp Duty (ABSD) Rates?

- Who is exempted from paying ABSD and who is eligible for ABSD remission?

- How to calculate ABSD?

What are the applicable rates of Additional Buyer’s Stamp Duty (ABSD) for Residential Property?

On the 6th of July, 2018, the ABSD rates were adjusted and it is at present at the rates shown in the table below.

Who is exempted from paying ABSD? Am I eligible to get ABSD remission?

i. Due to the Free Trade Agreement that Singapore has signed with the below countries, citizens and permanent residents from the below countries will pay the same rate of ABSD as a Singaporean:

-

-

-

- The United States of America (citizens only)

- Norway

- Switzerland

- Iceland

- Liechtenstein

-

-

ii. Married couples may also be eligible for ABSD remission, provided they fulfil the eligibility criteria set forth by IRAS. These criteria include:

-

-

-

- The couple has at least one Singapore Citizen

- They either do not own any other properties at the time of purchase or are purchasing the second property but will sell the first one within 6 months

-

-

iii. In the case of an aborted Sale and Purchase Agreement

iv. Matrimonial Proceedings (e.g. ownership transfer due to divorce)

v. Conveyance Directions (e.g. ownership transfer to an incorporated company)

vi. Purchase of HDB Flats and new Executive Condominium (EC) Units (not applicable to eesale EC units and remission will be automatically granted by HDB upon approval of purchase)

vii. Transfer of HDB flats within the family (not including EC units)

How to calculate the Additional Buyer’s Stamp Duty (ABSD) payable for Residential Property?

Case Study:

Tommy and Josephine are a married couple. They are both Singapore Citizens (SCs) and intend to buy a new property, we’ll call it Condominium 2, at $1,000,000. However, they are existing owners of an HDB and a Condominium 1 as shown below. Their ABSD is calculated based on the higher rate of the two of them.

d. Stamp Duty on Lease of Residential Property (Lease Duty)

By default, the tenant is responsible for paying Stamp Duty when renting a residential property.

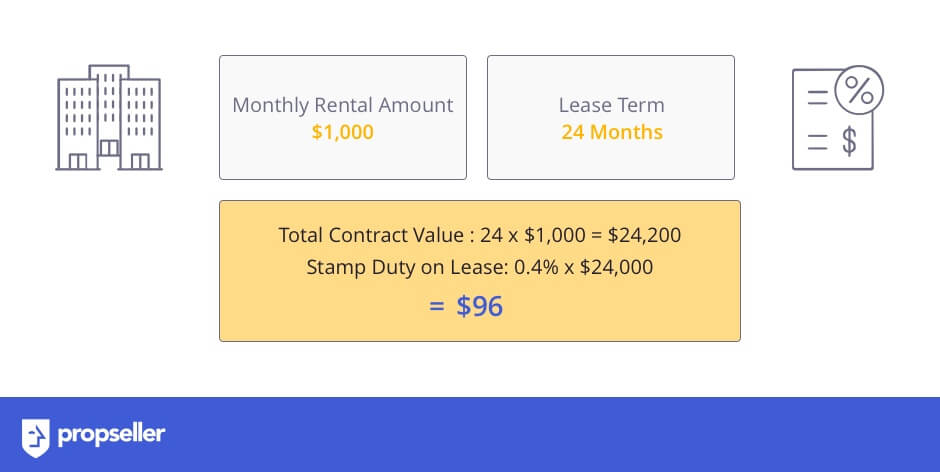

What are the applicable rates of Stamp Duty on Lease (Lease Duty) for Residential Property?

As of the 28th of December, 2019, it is 0.4% of the contract value of the lease.

How to calculate the Stamp Duty on Lease payable for Residential Property?

If you had a monthly rental amount of $1,000 for a lease term of 2 years, i.e. 24 months, then you would calculate it as shown below.

e. Mortgage Stamp Duty for Residential Property

When buying property, most people borrow a percentage of the property’s value from a lender to do so, typically a bank. A mortgage is a legal agreement by which a bank lends this money at interest. A mortgage duty of 0.2% to 0.4% on the loan amount is payable, subject to a maximum duty of $500. The percentage of mortgage duty payable is subjected to the loan amount borrowed.

f. Can you use CPF to make payment for Stamp Duty on Residential Property?

Yes, you can use your CPF Ordinary Account (CPF OA) to make payment for Stamp Duty on Residential Property.

Simply apply for a one-time reimbursement from your CPF account together with your application to use your CPF savings to pay for stamp duty after having made the initial payment with cash.

2. Commercial Property

The term “commercial properties” is used to refer to properties that are used for business activities e.g. offices, malls, warehouses, etc.

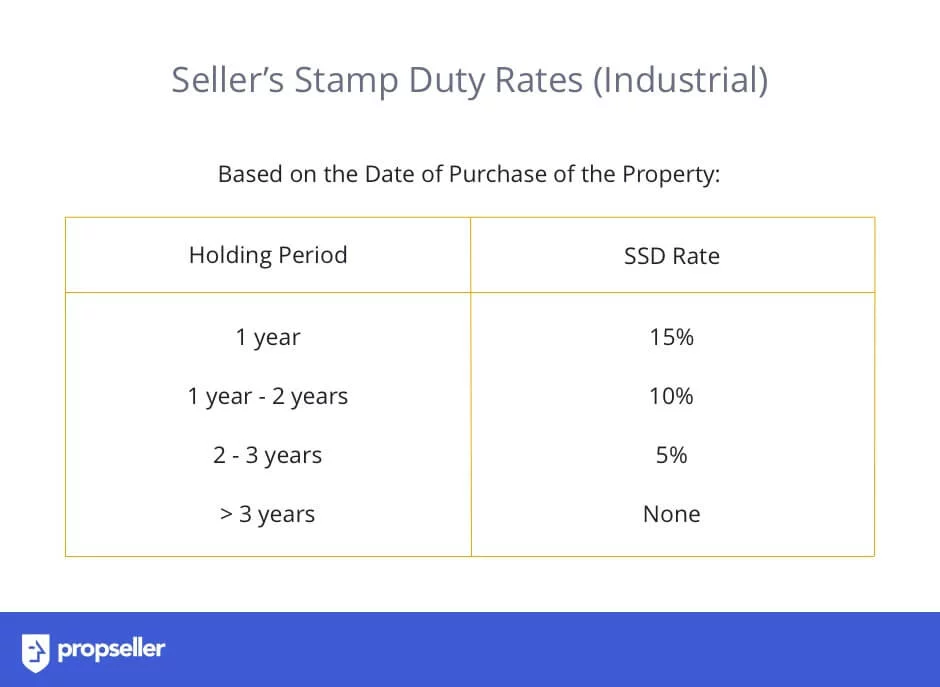

a. Seller’s Stamp Duty (SSD) for Commercial Property

There is no Seller’s Stamp Duty (SSD) for commercial properties like offices or malls but there is an SSD for industrial properties (e.g. factories) based on the holding period (the period after you claim ownership of the property and before you sell it).

The SSD is applicable on the market value of the property or on the selling price, whichever is higher.

What are the applicable rates of Seller’s Stamp Duty (SSD) for Commercial Property?

With effect from the 12th of Jan, 2013, the rates of SSD for commercial property are as shown in the table below.

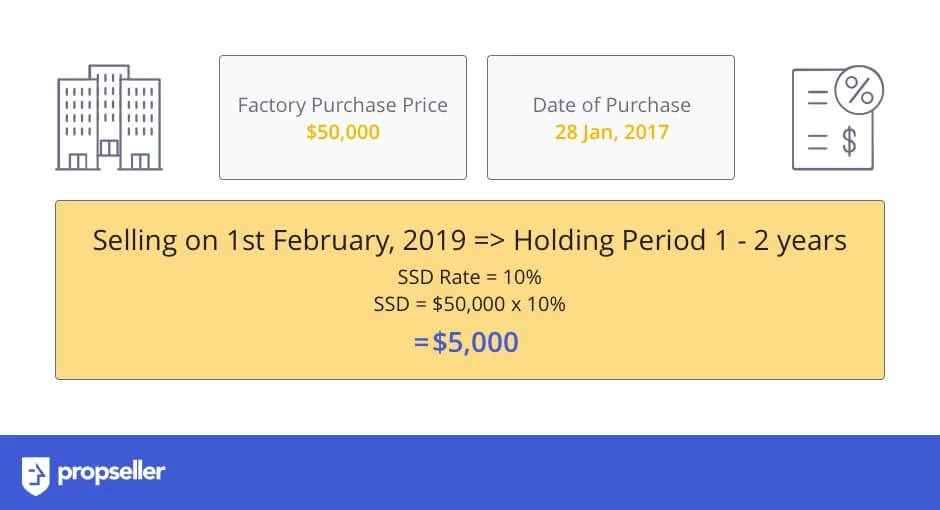

How to calculate the Seller’s Stamp Duty (SSD) payable for Industrial Property?

Let’s say you bought a factory for $50,000 on the 28th of January, 2017. You decided to sell it on the 1st of February, 2019.

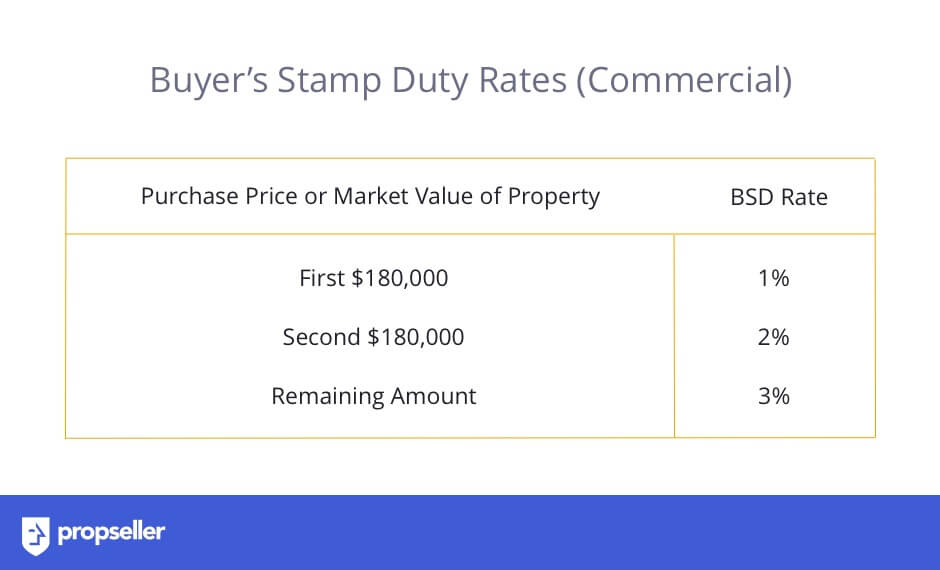

b. Buyer’s Stamp Duty for Commercial Property

Similar to residential properties, Buyer’s Stamp Duty (BSD) for commercial properties is a tax paid upon exercising of the Option to Purchase (OTP) a property (for resale properties) or signing the Sale & Purchase Agreement (S&P) (for new developments). The BSD is applicable on either the purchase price or the market value, whichever is higher.

What are the rates of Buyer’s Stamp Duty (BSD)?

With effect from the 20th of Feb, 2018, the below rates are applicable when calculating the BSD applicable on commercial property.

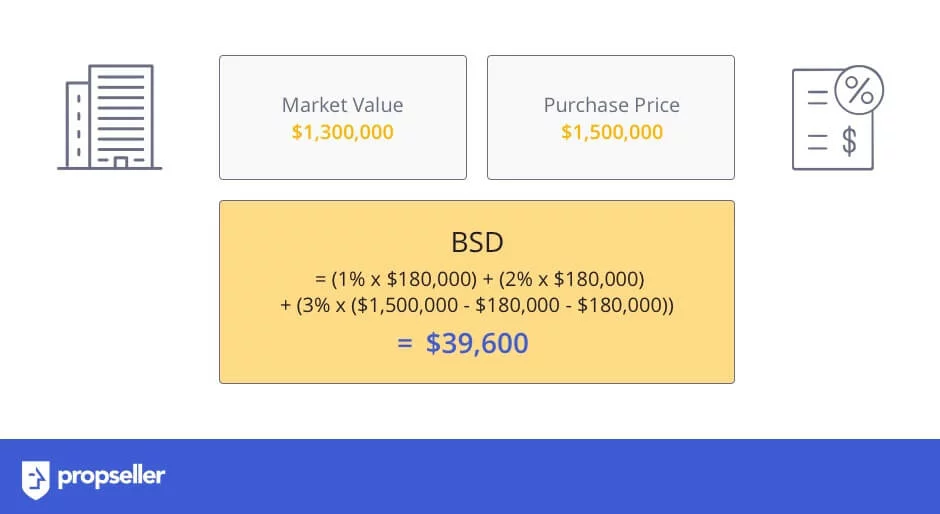

How to calculate the Buyer’s Stamp Duty (BSD) payable for Commercial Property?

Let’s say you purchased an office space which has a market value of $1.3M for $1.5M. The BSD can be calculated based on the Office Purchase Price, as it is the higher value of the 2.

c. Additional Buyer’s Stamp Duty (ABSD) for Commercial Property

If you buy commercial property, you are not required to pay any Additional Buyer’s Stamp Duty (ABSD). However, you are subjected to 7% GST (Goods and Services Tax) on the property price, additional to the Buyer’s Stamp Duty.

d. Stamp Duty on Lease of Commercial Property (Lease Duty)

The same stamp duty rate applies to the Lease (i.e. Rental) of Residential as well as Commercial Properties, i.e. 0.4% of the rental contract value.

e. Mortgage Stamp Duty for Commercial Properties

The same Mortgage Stamp Duty rate applies to Residential as well as Commercial Properties, i.e. 0.2% to 0.4% of the loan amount, with a cap of a maximum of $500.

f. Can you use CPF to make payment for Stamp Duty on Commercial Property?

Unfortunately, you cannot use your CPF to make payment for stamp duty on commercial property.

3. How to make payment for Stamp Duty

Paying Stamp Duty has been made easier for you with both online and offline modes of payment. Here are some of the modes of payment that you can consider:

| Payment Options | Mode of Payment | |

| a. | ibanking/Bank Transfer | FAST via DBS/POSB Account |

| AXS (Nets only) | ||

| GIRO | ||

| b. | e-stamping portal (online) | eNETS, cheque, cashier’s order |

| c. | IRAS Center Surf Terminals | eNETS, NETS, cashcard |

| d. | SingPost Service Bureaus (at Chinatown, Novena, Raffles Place and Shenton Way) | cash, cheque, cashier’s order, NETS |

Payment of Stamp Duty by iBanking/Bank Transfer

i. AXS/Nets

At the e-Stamping portal, generate a payment slip and quote the 14-digit Payment Slip Number (without the spaces) under My initials/Name field. For DBS/ POSB account holders, please omit the first two digits of the Payment Slip Number (without spaces), e.g. for Payment Slip Number 01901234567890, enter 901234567890 under My initials/Name field. Each fund transfer can only be for one payment slip. IRAS’s Bank account details are as follows:

Payee: Commissioner of Inland Revenue or IRAS

Account Type: DBS Current Account

Account No.: 0010468600

Disclaimer: Please verify the above details on IRAS’ site before proceeding, Propseller is not liable for any issues occurring with respect to the payment of your Stamp Duty.

Your payment via fund transfer will be posted to the respective Document Reference Number within two working days. Once the payment is cleared, a notification to download the Stamp Certificate will be sent to your email address.

ii. GIRO

You must have a dedicated e-Stamping GIRO account. You have to mail the completed GIRO Application Form for Stamp Duty to:

Commissioner of Stamp Duties

55 Newton Road, Revenue House, Singapore 307987

Disclaimer: Please verify the above details on IRAS’ site before proceeding, Propseller is not liable for any issues occurring with respect to the payment of your Stamp Duty.

You will be notified once your GIRO facility with e-Stamping is activated. Once the payment is cleared, a notification to download the Stamp Certificate will be sent to your email address.

4. When to pay for Stamp Duty?

You are required to stamp a document such as the OTP, S&P, Tenancy or Lease agreement or Share Transfer Agreement (whichever applicable) before you sign it, or within the below-mentioned timeframe to avoid having to pay any penalty:

- Within 14 days from the date of execution if the document was signed in Singapore (i.e. 14 days from the date the OTP is exercised or the day you signed and returned the S&P).

- Within 30 days after receiving the document in Singapore if the document is signed overseas.

If you do not make payment by the due date,

- You will receive a note that demands payment that summarises the details of your penalty i.e. the amount payable, the fine payable, payment date, etc.

- You will be fined a penalty of $10 or an amount equal to the duty payable (whichever is greater) for a late payment not exceeding three months from the due date.

- For late payment exceeding three months from the due date, you will be fined a penalty is $25 or four times of the duty payable (whichever is greater).

Note: What does duty payable mean?

Duty payable is fixed at 5% per annum. For example, let’s say the Stamp Duty payable is $50,000. Here is how we will calculate the penalty:

5% x $50,000 = $2,500 penalty a year

$2,500 / 365 days = $6.85 penalty per day

$6.85 x 3 days late = $20.55 (duty payable)

In this case, the duty payable is higher than $10, therefore, the fine will be $20.55.

Conclusion

Stamp duty is complicated and tedious with so many different details to take note of, but this guide simplifies all that for you. First, you can check if you’re eligible to pay any stamp duty. Second, you can find out how to calculate it. Third, you can find out if you’re eligible for remission. Fourth, you can find out how to make the payment, and finally, you can check when to make it by to avoid penalties.

Have any questions about Stamp Duty? Ask us in the comments or on the chat icon on the bottom right of your screen!

Looking for an experienced agent to help you sell, buy or rent property? Contact one now!

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.