If you are researching about inheriting an HDB flat in Singapore, it is possible that you have been through something very difficult such as the death of a family member. While you are in this difficult period of your life, having to figure out HDB inheritance rules and laws is dauntingly complicated.

You might have a lot of questions such as “What happens to the HDB if the owner dies?”, “Can I inherit an HDB if I currently own private property?”, “What if the HDB has another owner?”, “Who gets the HDB if the deceased had parents, siblings and children?” and so many others. We want to help you crack this difficult topic.

We are always ready to help you in your unique situation and guide you through this difficult process. Schedule a call with Propseller for a free, no-obligation consultation.

In this article, we will discuss the HDB inheritance laws and rules that you need to know about:

- What are the first few things I should know about HDB inheritance?

- What if the HDB flat has other owners who are alive?

- How does the owner’s religion affect HDB inheritance law?

- Can I inherit an HDB flat if I already own an HDB?

- Can I inherit an HDB flat if I already own a private property?

- Can I inherit an HDB flat if I already own a commercial property?

- Do I need to pay any Inheritance Tax upon inheriting an HDB flat?

- Do I need to pay any other fees or duties?

- What is the timeline of events for inheriting an HDB flat?

- Frequently Asked Questions

1. What are the first few things I should know about HDB inheritance?

You need to empower yourself with the right knowledge when it comes to inheriting an HDB flat owned by a loved one, such as your parent or another family member, who passed away.

a. The Will

Whether the deceased owner left behind a Will or not plays a huge part in how the ownership of the HDB is passed down.

In essence, if the deceased owner left a Will, the court will need to verify and validate it, after which the ownership of the HDB will be transferred according to the Will. However, if there is no Will, the property will be distributed as per the governing laws based on the owner’s religion.

b. The Laws and the Court

When an HDB owner passes away, his property will be administered and distributed in accordance with the applicable laws.

For Non-Muslims

If the deceased owner is Non-Muslim, the Family Justice Court will govern the proceedings. Their HDB will be distributed as per the Will (also referred to as “Testate Succession”).

In the absence of a valid Will, the HDB flat will be passed in accordance with the “Intestate Succession Act”. We will discuss the acts in depth in a later part of this article.

For Muslims

If the owner is Muslim, the Syariah Court will govern it. When a Muslim owner passes away, their HDB will be distributed as per their Will (if there is one) and the “Islamic Inheritance Law”, also known as “Faraid”. We discuss more on how this works in a later part of the article.

c. The Executor of the Will

This only applies to Non-Muslim HDB owners.

An “executor” (aka a “trustee”) can, in theory, be anyone such as a child, a spouse or a friend of the deceased owner. This person is the one who will oversee the whole process, is in charge of the paperwork, ensures that the lawyers are paid and that the forms are filled, etc. The duties of an executor are mentioned in the “Probate & Administration Act”.

In case the deceased has left a Will, the Family Justice Court will issue a “Grant of Probate” to appoint an “executor” or “trustee” of the Will. The Grant of Probate is a court order, which entitles the executor to carry out the instructions and distribute the deceased owner’s HDB to the beneficiaries as per the Will. Generally, the deceased owner would mention the executor in his Will.

If the deceased owner did not make a Will, one of the beneficiaries, a relative or a trusted friend can apply to the court for the “Grant of Letter of Administration”. This court order will give legal authority to the executor to manage the deceased’s estate. Usually, one of the beneficiaries such as the spouse or the child of the owner is the executor.

However, if none of the owner’s relatives or friends wants to be an executor, the court will appoint an officer to become the executor.

d. The Application Process and the Lawyer

In theory, you can submit the applications related to the inheritance of an HDB flat with the court by yourself, without a lawyer. However, if you need a helping hand in doing so, you can engage a lawyer to help you with the related paperwork.

For Non-Muslims, the procedure for obtaining a Probate can be found on the Family Justice Court’s website under “Probate”. The forms pertaining to this process can be found here.

For Muslims, you can apply for the Inheritance Certificate on the Syariah Court Singapore’s website under “Inheritance”.

2. What if the HDB flat has other owners who are alive?

If the owner of the HDB flat, who has passed away, shares ownership with siblings, spouses or other individuals, there are further rules that apply on how the ownership is transferred.

When your parents (or anyone for that matter) applied for an HDB, they were given 2 options (also referred to as “Manner of Holding”) when it came to ownership:

- Joint Tenancy

- Tenancy-in-Common

These terms are explained below:

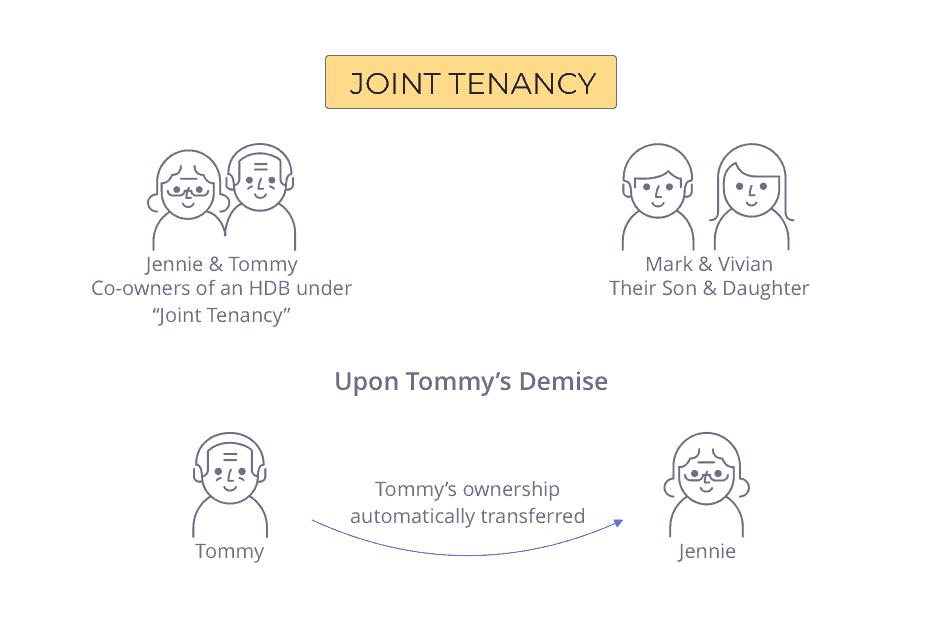

Joint Tenancy

In the case of a Joint Tenancy, all co-owners have an equal interest in the property and the “Right of Survivorship” applies. In such a case, upon the demise of one of the owners, the interest of the deceased person would automatically be passed on to the remaining co-owners, irrespective of whether the deceased owner has a Will or not. The remaining co-owners will still need to meet the eligibility conditions to own the inherited HDB flat.

Joint tenancy was more commonly opted for in earlier times by our parents’ and grandparents’ generation.

Case Study:

Tommy and Jennie chose “Joint Tenancy” when the two of them purchased an HDB together. This means they both have equal interest in the HDB. They have 2 children – Mark and Vivian.

Before his passing, Tommy wrote a Will to distribute his share of the HDB equally to Jennie, Mark and Vivian.

However, because Tommy and Jennie were under “Joint Tenancy”, Tommy’s Will is invalid. All of Tommy’s interest is transferred to Jennie automatically, who now has full ownership of the HDB.

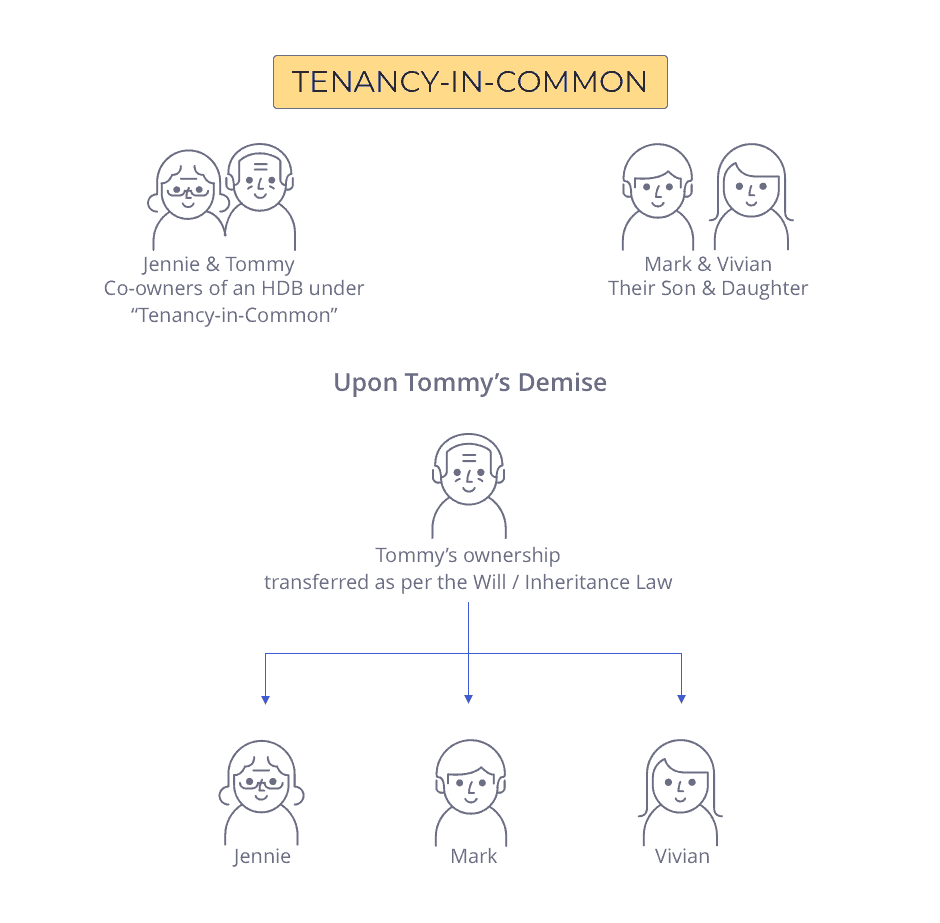

Tenancy-in-Common

In the case of a Tenancy-in-Common, each owner has a separate and distinct interest in the HDB flat and the “Right of Survivorship” does not apply. This means that upon one of the owners passing away, their part of the ownership will not automatically be transferred to the co-owner.

As mentioned above, if the deceased co-owner left behind a Will, the ownership will be passed down according to the Will. If there was no will, as mentioned above, the Intestate Succession Act will determine how the ownership of the HDB is passed down.

Tenancy-in-common is more commonly opted for by the current generation of HDB buyers.

Case Study:

When Tommy and Jennie purchased the HDB, they chose to hold 60% and 40% of the ownership respectively under “Tenancy-in-Common”. They have 2 children – Mark and Vivian.

Tommy wrote a Will to distribute his 60% share of the property equally to Jennie, Mark, and Vivian (which would mean 20% each).

Since the HDB was held under “Tenancy-in-common”, Tommy’s 60% is now distributed to his wife and kids as per his Will. The new ownership would be:

Jennie: 60% (Total Ownership = 40% + 20% = 60%)

Mark: 20%

Vivian: 20%

3. How does the owner’s religion affect HDB inheritance?

Inheritance laws vary for Muslims and Non-Muslims. It also depends on whether the owner wrote a Will or not. We will cover all these scenarios below.

a. If the owner is Non-Muslim

If the owner is Non-Muslim, we first check whether the deceased owner left a Will.

If there is no Will

In the absence of a valid Will, the ownership of the HDB will be distributed as per the “Intestate Succession Act”.

This act defines how the ownership of the HDB will be distributed if there is no Will. Some common cases are listed below:

| Owner | Spouse | Children | Parents | Siblings | Grandparents |

| Married, with children | 50% | 50% | x | x | x |

| Married, without children | 50% | x | 50% | x | x |

| Married, with children but without spouse | x | 100% | x | x | x |

| Married, without children or parents | 100% | x | x | x | x |

| Single | x | x | 100% | x | x |

| Single, without parents | x | x | x | 100% | x |

| Single, without parents or siblings | x | x | x | x | 100% |

If the HDB owner who passed away has no immediate family members, the ownership can go to their nieces, nephews, aunts or uncles. Finally, if the deceased owner has no living relatives, the ownership will be passed to the State (i.e. the Government).

Case Study:

Tommy and Jennie have 2 children – Mark and Vivian.

Unfortunately, Tommy recently passed away and did not leave behind a Will. Tommy was the sole owner of his HDB flat.

The ownership of HDB is distributed such that Jennie (Tommy’s wife) gets 50% and Mark and Vivian (Tommy’s children) get 25% each.

If there is a Will

First, the Will needs to be proved in court through a legal process known as “Probate”. In essence, the court will decide who the beneficiaries are based on the Will. Following this, if the Will is valid, the flat will be handed down to the owner’s chosen beneficiaries as per the Will. This transfer of ownership through a valid Will is called “Testate Succession”.

However, note that the beneficiary on the Will must be eligible to own an HDB.

Case Study:

Tommy has 100% ownership of his HDB flat and wrote a Will to give his wife 80% ownership of the HDB flat, and his two children Mark and Vivian 10% each.

Upon Tommy’s demise, the court proceeded to validate the Will. Upon validation of the Will, the ownership would be transferred as per Tommy’s instructions in his Will.

b. If the owner is Muslim

If the owner is Muslim, the execution of the Will would be in accordance with Syariah Law. To understand the distribution, you first need to understand the “Islamic Inheritance Law”, also referred to as “Faraid”.

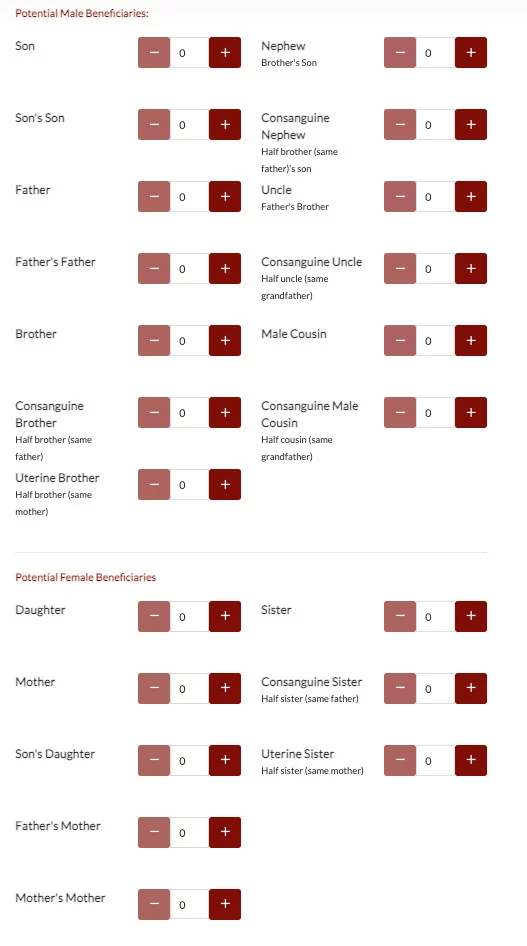

Islamic Inheritance Law (Faraid)

As per “Faraid”, the deceased owner’s spouse(s) and immediate family members will get larger portions of the property. The other eligible relatives would get a smaller portion compared to the immediate family members. Furthermore, the male members of the family will get twice the portion of ownership compared to a female member of the same relational level. For example, a son will receive twice the share of a daughter.

Image 3: A list of all the possible beneficiaries for HDB inheritance as per Islamic Inheritance Law (Faraid). The screenshot is taken from Syariah Court Singapore’s website.

The above image is taken from the Syariah Court Singapore’s website, where you can see all the possible beneficiaries of inheritance as per “Faraid”.

If you wish to calculate the distribution of inheritance based on your own family’s structure, visit the Online Trial Calculation on the Syariah Court Singapore’s website under “Inheritance”.

After this, you can choose the number of brothers, sisters, cousins, and other family members of the deceased family member, and see the number of shares each individual gets as an inheritance.

If there is no Will

If the owner did not write a Will, the court will distribute the ownership according to “Faraid”. The Syariah Court would then issue an Inheritance Certificate stating the distribution of the property according to Islamic inheritance laws.

If there is a Will

If the owner wrote a Will (or “Wasiat”), the Syariah Court would first need to validate it. Here, two important points need to be considered:

- The owner can only Will out a maximum of 1/3rd of the property

- The Will can not include someone who is already a beneficiary under “Faraid”

The court will distribute the remaining 2/3rd of the ownership according to Islamic inheritance laws.

4. Can I inherit an HDB flat if I already own an HDB?

In short, yes. You can inherit it, but you would have to sell your interest in one of the two HDBs. This is because anyone can own only one HDB flat at a time. You are considered an owner of an HDB flat whether you have full or partial ownership of the HDB. You have 2 options here – you either keep the inherited HDB or you keep your existing HDB.

Keeping the inherited HDB

If you decide to keep the inherited HDB, you will have to sell your existing HDB flat (subject to the eligibility conditions for sale, such as the Minimum Occupation Period (MOP)) within 6 months of taking ownership of the HDB flat you have inherited.

Proposed flat owners of the Will are only eligible to keep the inherited HDB if they meet the criteria, such as being an immediate member of the family or being at least 21 years old.

Keeping your existing HDB

If you decide to hold on to your existing HDB and not the inherited one, you would need to sell your inherited HDB within 6 months of taking ownership, either to other beneficiaries such as your siblings or in the open market.

This only applies if the Minimum Occupation Period (MOP) for the inherited HDB flat has been met. However, if the inherited HDB flat has yet to meet its MOP, you need to approach HDB for assistance and appeal to sell the HDB before its MOP.

Given the time limits to complete the sale, many sellers engage a property agent to help them complete it in time and at a good price. It would further benefit you to engage an agent who has experience in inheritance sale cases. If you don’t already have one, you can find an experienced agent on Propseller. If you have any questions, feel free to drop us a message here (or you can use the chat icon on the bottom right of your screen).

5. Can I inherit an HDB flat if I already own a private property?

Whether a private property owner can inherit an HDB or not depends on when the original owner purchased the HDB flat. If the HDB flat was purchased before 30th August 2010, then you can keep both the properties – the private residential property and the inherited HDB. If the HDB flat was originally purchased on or after 30th August 2010, then you would have to sell one of the two properties.

Inherited HDB flat was purchased before 30th August 2010

In this case, you can keep both properties. However, the following conditions apply:

If you are eligible to own an HDB flat

You have to meet the eligibility conditions to own the inherited HDB flat. If you meet the criteria and you have decided to transfer the ownership of the inherited HDB flat to yourself, you and your family will have to move out of your current private property and stay in the HDB flat.

If you are ineligible to own an HDB flat

In the scenario where you are ineligible to own an HDB flat, you have two options:

- If the Minimum Occupation Period (MOP) of the inherited HDB has been met, you can sell the flat in the open market.

- If the MOP has not yet been met, you should approach HDB for help and appeal to sell the HDB before its MOP, they will assess and see how best they can help.

Inherited HDB flat was purchased on or after 30th August 2010

Given that you own a private property, if the HDB you inherited was purchased on or after 30th August 2010 by the owner, you can only keep one property – either the HDB flat (provided you are eligible to own one) or the private property.

Keep the HDB flat

If you have decided to keep the inherited HDB flat, you must live in the HDB flat and sell your current private property within 6 months.

Keep the Private Property

If you have decided to keep your private property such as your condo, you must sell the HDB flat if it has completed its MOP, within 6 months. If it has not yet completed MOP, approach HDB for assistance and appeal to sell the HDB before its MOP.

Given the timeline restrictions, we recommend you engage a property agent experienced in inherited HDB flat sales. If you don’t already have one, you can find an experienced agent at Propseller.

Propseller’s Real Estate Consultants have a track record of selling properties at a high price despite a short time frame.

6. Can I inherit an HDB flat if I already own a commercial property?

Yes, you can inherit an HDB flat if you own a commercial property, provided that the commercial property does not have any residential component.

7. Do I need to pay any Inheritance Tax upon inheriting an HDB flat?

In Singapore, Inheritance Tax was abolished on 15 February 2008. Inheritance Tax is only applicable if the owner died after 28 February 1996 and before 15 February 2008.

8. Do I need to pay any other fees or duties?

You may have to pay a couple of duties depending on your scenario.

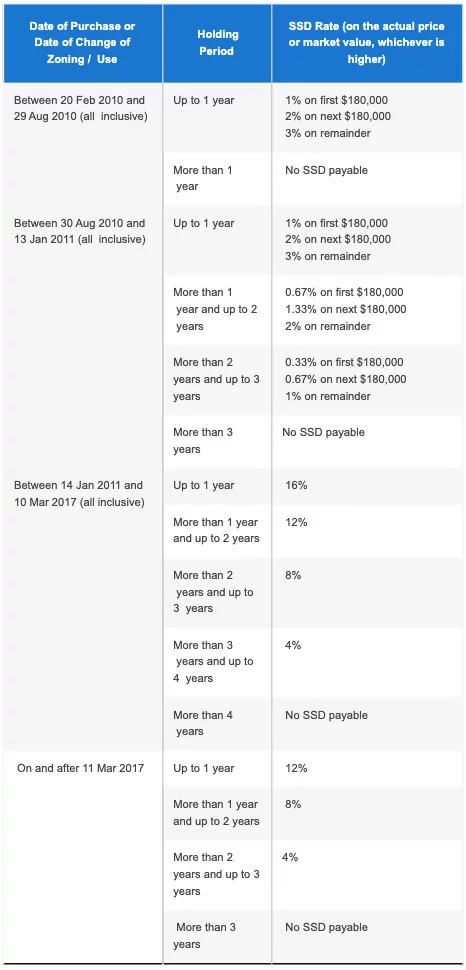

Seller’s Stamp Duty (SSD)

If the owner of HDB passed away, and he purchased the HDB flat you inherited before 20th February 2010, then you do not have to pay any SSD.

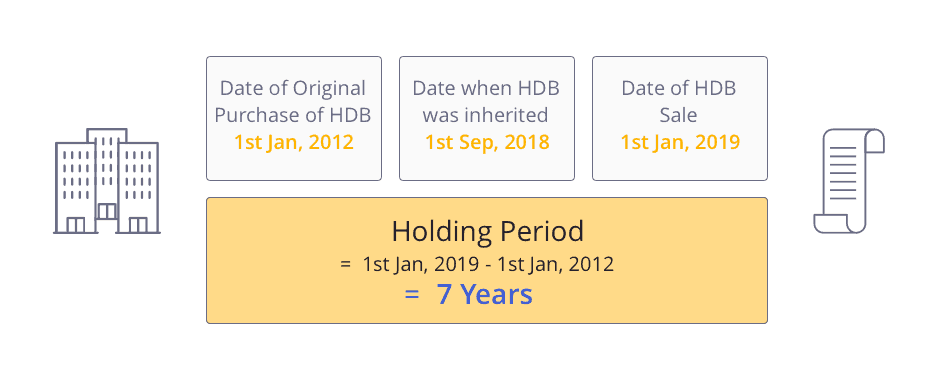

However, if the HDB flat was purchased on or after 20th February 2010, it may be subjected to SSD based on when it was purchased and how long it has been held for. The holding period is counted from the date the deceased owner purchased the HDB flat.

Image 4: Table with rates of Seller’s Stamp Duty (SSD) for Residential Property retrieved from IRAS.

Case Study:

Take the example below for how you can calculate the holding period.

Even though you inherited the HDB only 4 months before the sale date, the holding period is actually calculated from the original date of purchase of the HDB. Your SSD will be calculated based on this holding period.

In this example, you are not subject to any SSD as the Date of Original Purchase of HDB is between 14 January 2011 – 10 March 2017 and the holding period exceeds 4 years.

You can find more information on SSD rates in our comprehensive guide here.

Additional Buyer’s Stamp Duty (ABSD)

You do not need to pay ABSD (or Buyer’s Stamp Duty) on inherited residential properties. Even in the case where you already own a condo and inherit an HDB flat, and you are eligible to keep both properties, you will not need to pay ABSD.

For any additional property you purchase, the inherited HDB will count towards the total number of properties you own and you will need to pay ABSD for the new property.

You can check the ABSD rates here.

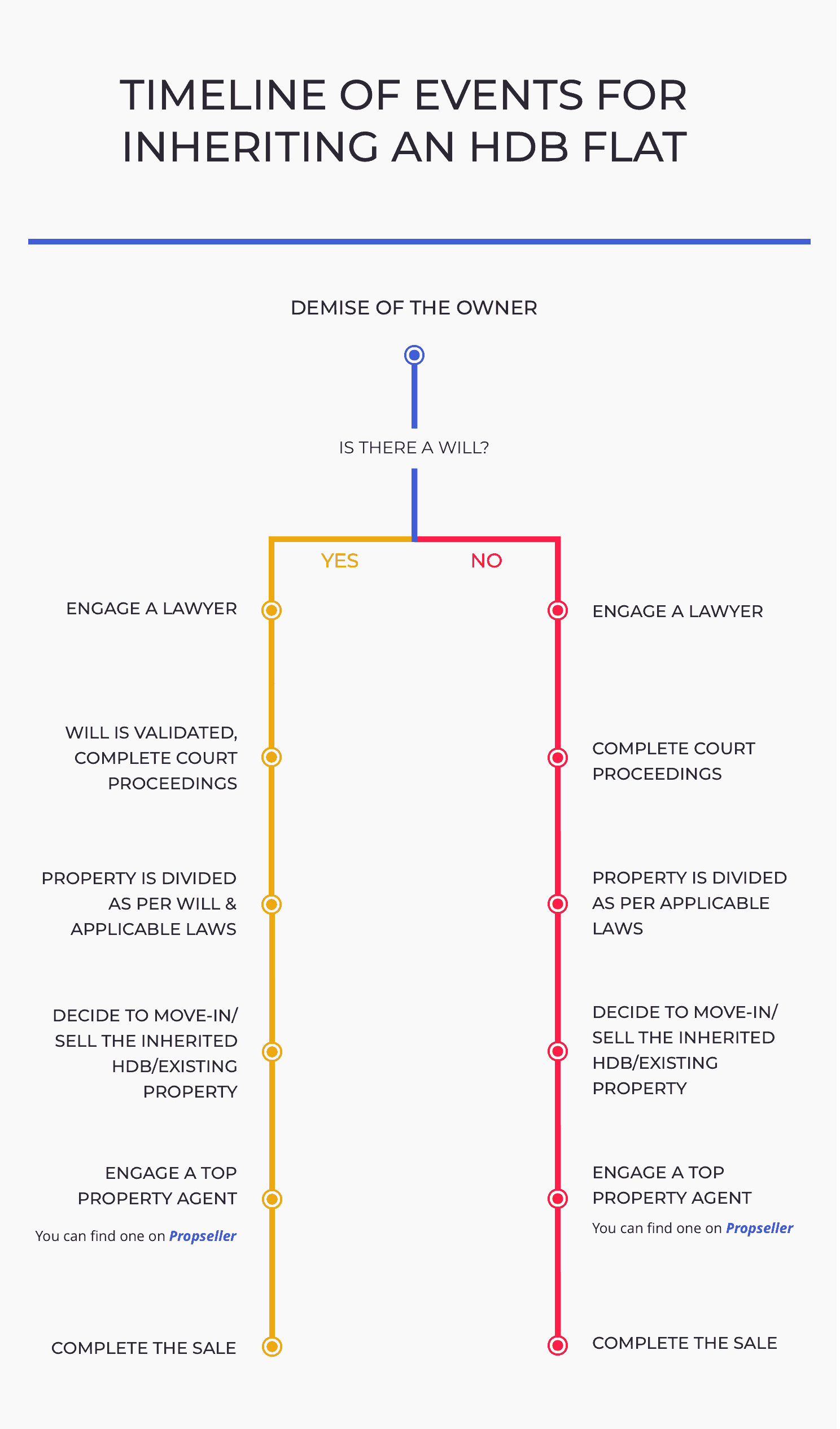

9. What is the timeline of events for inheriting an HDB flat?

The timeline of events when it comes to inheritance is shown in the image below.

Conclusion

In conclusion, inheritance is a complicated subject and there are many scenarios that can play out, but you can follow the steps in this guide to simplify it.

Firstly, a couple of important things to address are the Will and engaging a lawyer, if you don’t want to handle all the paperwork by yourself. Secondly, read about the inheritance laws based on whether the HDB owner who passed away was Muslim or Non-Muslim. Thirdly, you need to determine if you need to sell either your existing property or the inherited one, in a situation where you own both. Finally, if you need to sell, engage a property agent experienced with inheritance cases, as they take into account the time constraints.

Have any questions about HDB inheritance? Ask us in the comments or use the chat icon on the bottom right of your screen!

Don’t have an agent yet? Find agents experienced in inheritance HDB cases at Propseller, to start your journey.

Frequently Asked Questions

What happens when you inherit an HDB flat?

In essence, if the deceased owner left a Will, the court will need to verify and validate it, after which the ownership of the HDB will be transferred according to the Will. However, if there is no Will, the property will be distributed as per the governing laws based on the owner’s religion. You can read more about inheritance laws here.

What happens if the HDB flat owner dies?

If the deceased owner is Non-Muslim, the Family Justice Court will govern the proceedings. Their HDB will be distributed as per the Will (also referred to as “Testate Succession”). However, if they do not leave behind a valid Will, it will be passed in accordance with the “Intestate Succession Act”.

If the owner is Muslim, the Syariah Court will govern it. When a Muslim owner passes away, their HDB will be distributed as per their Will (if there is one) and the “Islamic Inheritance Law”, also known as “Faraid”.

You can read more about inheritance laws here.

Can a minor inherit an HDB flat?

Proposed flat owners of the Will are only eligible to keep the inherited HDB if they meet the criteria, such as being an immediate member of the family or being at least 21 years old.

Can I keep an inherited HDB flat if I own an HDB?

You cannot keep both HDB flats. If you decide to keep the inherited HDB, you will have to sell your existing HDB flat within 6 months of taking ownership of the HDB flat you have inherited.

Can I keep an inherited HDB flat if I own a private property?

Whether a private property owner can inherit an HDB or not depends on when the original owner purchased the HDB flat. If the HDB flat was purchased before 30th August 2010, then you can keep both the properties – the private residential property and the inherited HDB.

If the HDB flat was bought after 30th August 2010, then you can only keep one of the properties – either the HDB flat (provided you are eligible to own one) or the private property.

Can an HDB flat be willed?

If the deceased owner is Non-Muslim, their HDB will be distributed as per the Will (also referred to as “Testate Succession”). If the deceased owner did not leave a Will behind, the ownership of the HDB will be distributed as per the “Intestate Succession Act”.

If the deceased owner is Muslim, the owner can only Will out a maximum of 1/3rd of the property and cannot include someone who is already a beneficiary under “Faraid”.

Can an HDB be willed to grandchildren?

Proposed flat owners of the Will are only eligible to keep the inherited HDB if they meet the criteria, such as being an immediate member of the family or being at least 21 years old.

Do I need to pay stamp duty on inherited HDB?

You do not need to pay ABSD (or Buyer’s Stamp Duty) on inherited residential properties. However, once you have inherited the HDB flat, if you choose to buy another property, then you would be liable to pay ABSD on that new property.

How long do I have to sell my existing HDB flat after inheriting an HDB?

If you decide to keep the inherited HDB, you will have to sell your existing HDB flat within 6 months of taking ownership of the HDB flat you have inherited. If you decide to hold on to your existing HDB and not the inherited one, you would need to sell your inherited HDB within 6 months of taking ownership, either to other beneficiaries such as your siblings or in the open market.

Can I rent out my inherited HDB flat?

You will first have to determine if you can keep the inherited HDB flat.

If you already own an HDB flat, you cannot keep both flats and will have to decide which HDB flat you want to keep. If you own a private property and the inherited HDB flat was purchased before 30th August 2010, you can keep both properties. Otherwise, you would have to decide whether to keep the HDB flat or your private property.

Once you have determined whether you can keep the inherited HDB flat, the normal rules apply for renting out an HDB flat. You can visit HDB’s website for more information on the eligibility criteria and regulations for renting out your inherited flat.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.