Singapore’s private property market, a consistent beacon of growth and security in the past, appears to be undergoing a slight shift in Q2-2023. In a recent government data release, indicators point towards a cooling down in the private property landscape.

As a leading real estate agency, we are here to dissect the Q2-2023 private property market resale data and guide you towards making the most informed decisions.

A Slight Dip in Private Property Prices

For the first time since Q1-2020, the overall private property housing price has exhibited a slight decline. Specifically, resale prices dipped by 0.2% in Q2-2023, signaling a moderation of the property market’s bullish trend witnessed over the last three years.

Interestingly, this downward pressure was not uniform across the market. While non-landed properties witnessed a price decrease of 0.6%, landed properties bucked the trend with a 1.1% price increase, albeit slower than the 5.9% surge seen in Q1-2023.

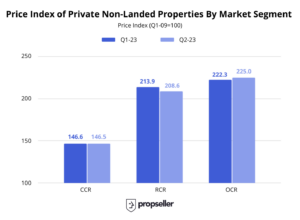

A Closer Look: Regional Price Variations For Non-Landed Properties

Delving deeper into non-landed private price changes, we observe some regional discrepancies. The Core Central Region (CCR) and Rest of Central Region (RCR) experienced price decreases of 0.1% and 2.5% respectively. However, the Outside Central Region (OCR) fared slightly better, recording a 1.2% price increase.

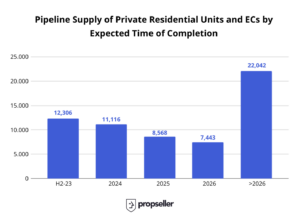

Record Private Housing Supply Completion

Despite the moderate cooling of prices, 2023 is set to witness the highest annual private housing supply completion since 2017. Private housing supply completions in the first half of 2023 more than doubled compared to the same period in 2022. Approximately 20,500 private residential units are expected to be completed this year, with over half of this supply (12,306 units including Executive Condominiums) expected in the second half of this year (H2-2023). This will put further pressure on the prices, reducing the likelihood of them going back up quickly.

Propseller’s Perspective

In light of the current market dynamics, we recognise that the slight dip in private property prices might not be an isolated event. There’s a distinct possibility that this could be an early indicator of a trend that might extend into Q3-2023. Therefore, we believe that this presents an opportune moment for private property owners considering selling. While prices may have dipped marginally, they remain near historical highs, ensuring that potential sellers can still secure considerable returns on their assets.

Furthermore, at Propseller, we’ve noticed a wider gap between seller and buyer expectations, as compared to earlier this year. For example, buyers are waiting for price drops and are not willing to up their initial offers as much as before. This misalignment in expectations results in lower viewings per listing, which leads to longer sale times, affecting the property selling timeline. Should you be currently selling a unit, we strongly recommend getting professional assistance from real estate agents for accurate timeline planning

In addition to this, the supply of private housing units is poised to hit its highest level since 2017. This significant increase in supply could create a slight shift in the market dynamic. Economically speaking, when supply outpaces demand, prices tend to soften. The increase in housing unit supply may place downward pressure on prices, giving potential buyers more bargaining power. As a property owner, this implies that acting promptly and capitalising on the current market conditions may yield more favourable outcomes.

With these factors in mind, we strongly encourage private property owners to consider listing their properties now. Waiting for another quarter might see a further softening of prices.

Propseller is committed to offering expert advice and reliable services to help you navigate these evolving market conditions. If you’re looking to sell your property, contact us here.