In an effort to maintain a stable and sustainable property market, the Singapore government has introduced new cooling measures aimed at ensuring housing affordability for Singaporeans. New rules apply to resale applications received on or after 20 August 2024. This includes applications where both the buyer and seller parts have been submitted to HDB.

If you’re planning to buy a home or are curious about how these changes might affect you, here’s a simple breakdown of what’s new and when these changes will take effect.

Tighter Loan Limits for HDB Flats

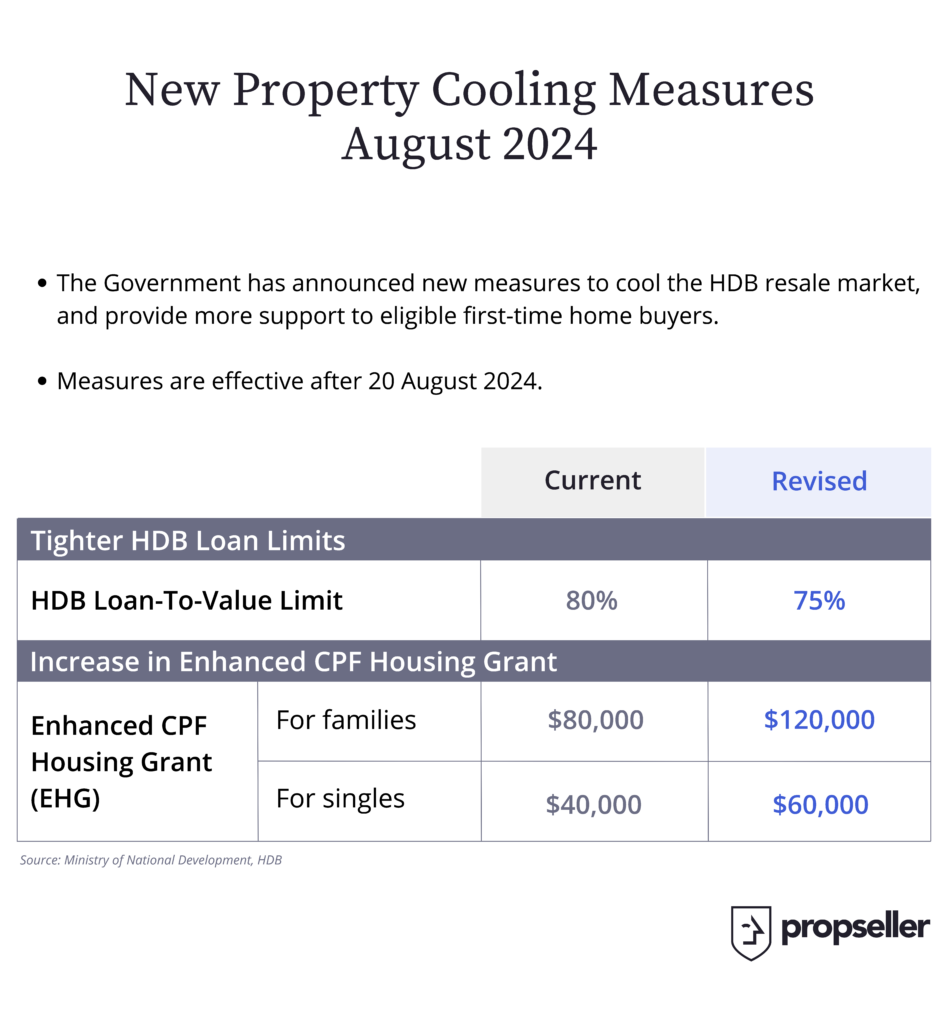

Starting from 20 August 2024, one of the key changes is the tightening of LTV limits for those purchasing HDB flats, from 80% to 75% . This means the maximum loan amount you can take from HDB will be reduced.

“This brings the LTV limit for HDB loans in line with loans granted by financial institutions, which remains at 75 per cent,” MND and HDB said.

This is the fourth set of property cooling measures since December 2021 when the LTV for HDB loans was lowered from 90 per cent to 85 per cent.

Increase in Enhanced CPF Housing Grants (EHG)

On the brighter side, from 20 August 2024, lower-income buyers could benefit from larger grants. The government is increasing the Enhanced CPF Housing Grant (EHG) to up to $120,000 for families and $60,000 for singles.

Currently, the EHG gives a maximum of $80,000 in grants for families and $40,000 for singles buying their first new or resale flat.

Are you eligible for the revised EHG?

Wondering if you’re eligible for the revised Enhanced CPF Housing Grant (EHG)? Here’s what you need to know:

- For New Flat Applications: The revised grant will apply to eligible first-timer households who apply for a new flat from the October 2024 Build-To-Order (BTO) exercise onwards. If you have an HDB Flat Eligibility (HFE) letter but haven’t applied for a flat in a sales exercise yet, HDB will update your letter via the Flat Portal to reflect the revised EHG amount. You’ll be notified individually by email. There’s no need to re-submit your HFE application.

- For Resale Flat Applications: If you submit a resale flat application on or after 20 August 2024, you could be eligible for the revised additional grant. Eligible first-timers with pending resale transactions will receive the revised grant amount, which will be credited into their CPF accounts within two months from the date of resale completion. If you have an HFE letter but haven’t yet submitted a resale application, HDB will update your letter via the Flat Portal and notify you by email.

- For HFE Letter Applications: If you apply for an HFE letter on or after 20 August 2024, you’ll be eligible for the revised EHG amount. If you’ve already submitted your HFE letter application before 20 August 2024, HDB will automatically extend the revised EHG amount to you when issuing your HFE letter—no need to apply for a fresh letter.

Next Steps

Whether you’re planning to buy soon or just exploring your options, it’s important to stay informed about how these changes might impact you. At Propseller, we’re here to help you navigate these changes and find the best home for your needs. Our team of experienced property advisors is ready to assist you with personalized advice and insights. Reach out to a top Buyer Agent here.

Source: HDB, Ministry of National Development (MND).