Singapore’s Deputy Prime Minister and Minister for Finance, Mr Heng Swee Keat, delivered the Budget Statement for 2020 on the 18th of Feb outlining the upcoming fiscal year’s public expenditure priorities. In the article below, we will cover the key schemes that were recently launched that affect the property market.

- Enhanced CPF Housing Grant (EHG)

- Income Ceilings for BTO flats and Executive Condominiums (ECs)

- Seniors Monetising Flats for Retirement

1. Enhanced CPF Housing Grant (EHG)

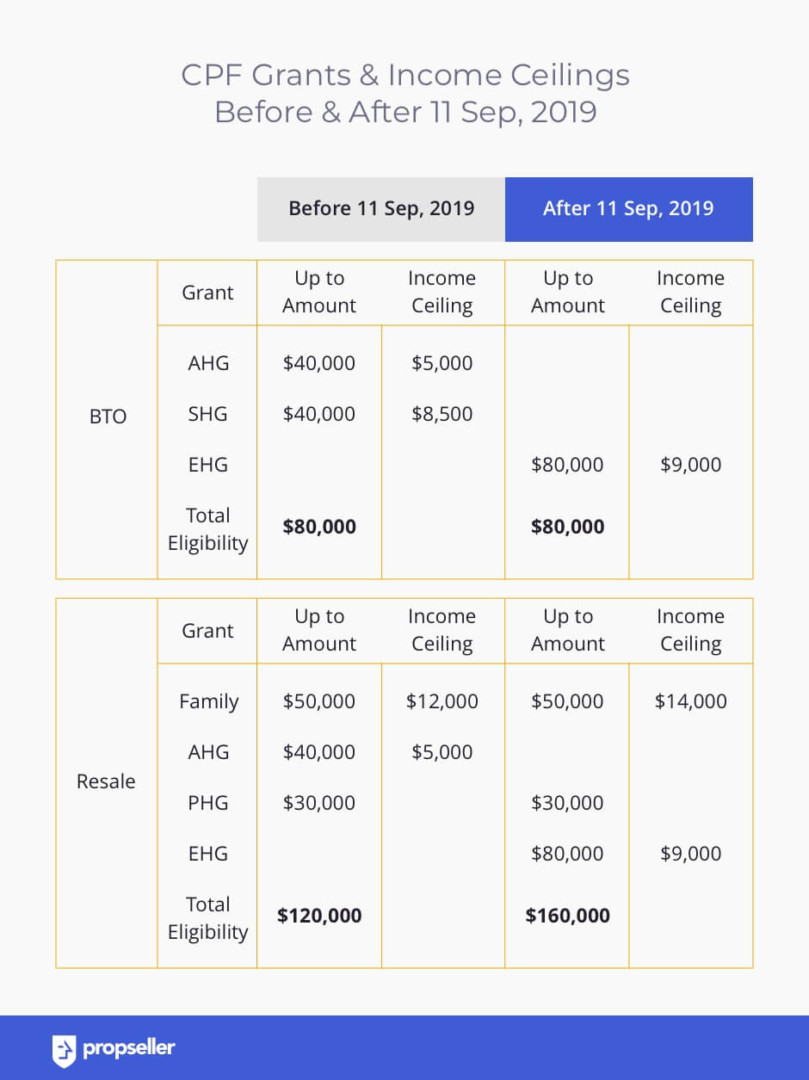

Budget 2020 highlighted this new scheme which was announced in late 2019, in which first-time HDB buyers can receive up to $40,000 more in grants for their HDB purchase, through the new Enhanced CPF Housing Grant (EHG).

With this, first-time flat buyers can enjoy up to $160,000 in housing grants.

If you’re buying a resale HDB, other CPF grants such as the Family Grant and the Proximity Housing Grant (PHG) will continue to be available to you along with the new Enhanced CPF Housing Grant (EHG). Additionally, the income ceilings for all grants have been increased for the first time since 2015, allowing more households to enjoy their benefits.

Read the Ultimate Guide About the Enhanced CPF Housing Grant (EHG) to learn whether you are eligible for this grant and if yes, how much of it you can claim.

2. Income Ceilings for BTO flats and Executive Condominiums (ECs)

Next, Budget 2020 highlighted the higher income ceilings for Built-To-Order (BTO) flats as well as Executive Condominiums (ECs) which were also announced in late 2019. The last time such an adjustment was made was in 2015, so this was long overdue due to the increase in median income in Singapore.

The monthly household income ceiling for BTOs was raised from $12,000 to $14,000, and the ceiling for ECs was raised from $14,000 to $16,000.

The Ministry of National Development (MND) expects 16,000 HDB households to benefit from this in the upcoming year, which would largely apply to upper-middle-income couples/families that want to afford public housing.

You can read more about the updated income ceilings and eligibility to buy a new flat or EC on HDB’s website.

3. Seniors Monetising Flats for Retirement

Budget 2020 highlighted the schemes with which senior citizens can help fund their retirement through their property.

a. Enhanced Silver Housing Bonus (SHB)

The Enhanced Silver Housing Bonus (SHB) scheme was launched to help elderly households with low-income, to supplement their retirement income.

If you belong to a household with:

- At least one owner who is a Singapore Citizen (SC) aged 55 years or above

- An income of $12,000 or less per month

- Owners who do not own any other property

You may receive up to $20,000 in your CPF Retirement Account (RA) upon downgrading to a 3-Room flat or something smaller than that. To receive this amount, you would have to transfer some of your HDB sale proceeds into your CPF RA account.

| Net HDB Sale Proceeds | How much Sale Proceeds you need to put in CPF RA | How much Sale Proceeds you can keep in Cash | Silver housing bonus amount |

| ≤ $60,000 | All net sale proceeds | $0 | 3x of the total top-up |

| $60,000 – $160,000 | $60,000 | $0 – $100,000 | $20,000 |

| > $160,000 | $60,000 + Further Top-up* | $100,000 + Remaining after Further Top-up* | $20,000 |

Further Top-up = Net Sale Proceeds – $60,000 – $100,000

b. Enhanced Lease Buyback Scheme (LBS)

The Enhanced Lease Buyback Scheme (LBS) is offered to senior citizen owners who are unable to or don’t want to sell their flat in the open market, and would rather earn by selling part of their remaining lease back to HDB.

If you belong to a household with:

- At least one owner who is a Singapore Citizen (SC)

- All owners aged at least 65 years

- An income of $14,000 or less per month

- Owners who do not own any other property

You may receive up to $20,000 in your CPF Retirement Account (RA) upon selling the tail-end of your lease. You can only sell the lease in excess of the number of years in which the youngest owner turns 95 years old.

Case Study:

Josephine and Tommy are joint owners of a 3-room HDB flat and are 65 and 70 years old respectively. They have a remaining lease of 50 years on their flat.

Since Josephine is younger and of age 65,

Number of years till age 95 = 95 years – 65 years = 30 years

Hence,

Years of Lease that can be sold back to HDB = 50 years – 30 years = 20 years

To read more about how much you can earn from the lease buyback scheme, how much of it needs to be put in your CPF Retirement Account (RA) and how much can be kept as cash, you can visit HDB’s site.

Conclusion

In summary, there are 3 main things to take note of in Budget 2020 if you are an aspiring or existing property owner. First, the Enhanced CPF Housing Grant for first-timers which offers up to $160,000 in housing grants, second, the increased income ceilings for BTO flats and ECs from developers, and finally, the options for senior citizens to fund their retirement with their properties through the Enhanced Silver Housing Bonus (SHB) or the Enhanced Lease Buyback Scheme (LBS).

Have any questions about any of the above schemes announced in Budget 2020? Ask us in the comments or on the chat icon on the bottom right of your screen!

Need an agent to help you sell, buy or rent an HDB? Contact an experienced agent today.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.