Update following September 29th 2022 cooling measures announced by the government of Singapore.

- If you are a private property owner, or have been in the past, you now have to wait 15 months to be able to downgrade to an HDB flat.

- You can sell your private property, but will not be able to buy a resale HDB before the 15-month period.

- This is not applicable for people over 55 years old who look to move to a 4-room resale HDB flat or smaller.

So you’ve started thinking about maybe selling your condo and buying an HDB, but there are so many questions on your mind – “Am I eligible to own an HDB?”, “Do I need to pay extra fees?”, “How much time does all this take?”, “What should I do first?!”. The number of things to consider is honestly overwhelming for downgrading in 2022. To make your life a little easier, we’ve broken down and answered all the questions you might have in this Ultimate Guide.

In this article, we’ll discuss:

- Checking Your Eligibility

- Planning Your Financials

- What happens to my existing condo loan?

- What happens to my CPF?

- Do I need to pay Seller’s Stamp Duty (SSD)?

- How much loan can I get for my HDB purchase?

- Can I get a grant for buying an HDB?

- Do I need to pay Buyer’s Stamp Duty (BSD)?

- Do I need to pay Additional Buyer’s Stamp Duty (ABSD)?

- Do I need to pay Resale Levy?

- Making Decisions

- Taking Action

Singapore’s regulations for selling and buying are some of the most confusing, and you’re taking the right step to research first. If you need further help and advice, find Singapore’s best property agents experienced in downgrading, on Propseller. An accomplished agent will be key for you to get through this with minimal stress and maximum results.

1. Checking Eligibility

When downgrading from a condo to an HDB, the first thing to check is if you’re even eligible to own an HDB and if you are, when you can buy it.

a. Can I buy an HDB after selling private property?

Use the Housing Development Board’s HDB Eligibility Check tool as there are a number of eligibility schemes, as well as personal details (such as marital status, employment status and citizenship) and monthly income to verify against.

In addition, you need to NOT own another private residential property and NOT have sold one in the 30 months prior. HDB will also check if you are an essential occupier of an existing HDB flat, a DBSS flat or a resale flat. If so, further details such as whether the other property’s Minimum Occupancy Period (MOP) has been met, will be verified.

Based on the information provided, you will get a detailed recommendation generated by the system. Your marital status and your citizenship are the main factors considered.

If you’re single, you need to be at least 35 years old and a Singapore Citizen (SC) to buy a 2 room BTO flat or a bigger resale flat.

If you’re married, at least one of the two of you between you and your spouse needs to be an SC or both of you need to be Singapore Permanent Residents (SPR). If one of you is a foreigner (FR), the other must be an SC. See the table below for an overview of your eligibility to buy a new HDB flat vs a resale HDB flat.

| Couple’s Citizenship Status | Eligible to Buy New HDB Flat | Eligible to Buy Resale HDB Flat |

| SC – SC | Yes | Yes |

| SC – SPR | Yes | Yes |

| SC – FR | No | Yes |

| SPR – SPR | No | Yes |

| SPR – FR | No | No |

| FR – FR | No | No |

There are several other eligibility criteria such as income ceiling, ethnicity, ownership status of other private or foreign properties and so on when it comes to buying an HDB, which you can read about on HDB’s site. If you need someone to analyse your specific case, you can ask us for free (or you can use the chat icon on the bottom right of your screen).

b. When can I buy an HDB?

If you’re eligible to buy both a new HDB flat and a resale flat, which one should you go for and when can you buy it?

Most people in your position would buy a resale flat because of the differences listed below:

|

Buy New HDB Flat |

Buy Resale HDB Flat |

| Can only buy after 30 months of selling the condo | Can buy anytime, just need to sell the condo within 6 months of the purchase |

| May need to rent during the wait | Can control the timelines a lot more to avoid having to rent |

| Need to ballot for a new HDB flat and sell at least 30 months before it is ready | No need to ballot |

| Limited choice | Islandwide availability |

| Easier to resell | Harder to resell |

At this point, you need to decide if you want to wait a few years and get a new BTO flat or if you want something sooner and get a resale flat.

2. Planning the Financials

The second most important thing you need to do before making any decisions about downgrading from a condo to an HDB is to plan your finances.

a. What happens to my existing condo loan?

When you sell your condo, you have to pay off the loan that you took to purchase it. There are two things you need to take into account when it comes to your loan: the notice period and the lock-in period.

Notice Period

Typically, you need to give your bank 3 months notice that you will be paying your loan off early. If you provide less than 3 months notice, they may charge you a fee that is anywhere between $3,000 to a percentage (%) of your outstanding loan, for the shortfall in the notice period. However, this varies from bank to bank.

Lock-in Period

This is usually the first few years (1-5 years) of your loan during which the bank would give you specific interest rates (which could be flat, discounted or something else), but also would not allow you to pay it off early or switch banks. If you are still in your lock-in period for your loan, you may incur some prepayment penalties from your bank, which is typically 1.5% of the outstanding amount. If you are paying it off after your lock-in period, you do not have to pay any penalties. Note that the numbers and terms can vary bank to bank, so please check these in the Letter of Offer of your loan.

b. What happens to my CPF?

Every Singaporean wants to know what happens to their CPF, during each such transaction. Let’s demystify this below.

What happens to your CPF when you sell the condo

Many condo sellers overestimate the cash proceeds they will get from their condo sale. When your condo sale is executed, you have to “return” the CPF amount that you withdrew to make your condo purchase back to your CPF Account, with interest. However, it’s still your money and you can reuse it to purchase your HDB. The interest rates vary based on the amount in your account and your age.

| Amount in Ordinary Account | Interest Rate (as of June 2022) |

|

Up to $20,000 |

3.5% |

| Above $20,000 |

2.5% |

You can log in to my CPF Online Services to view your accrued interest (under “My Statement”).

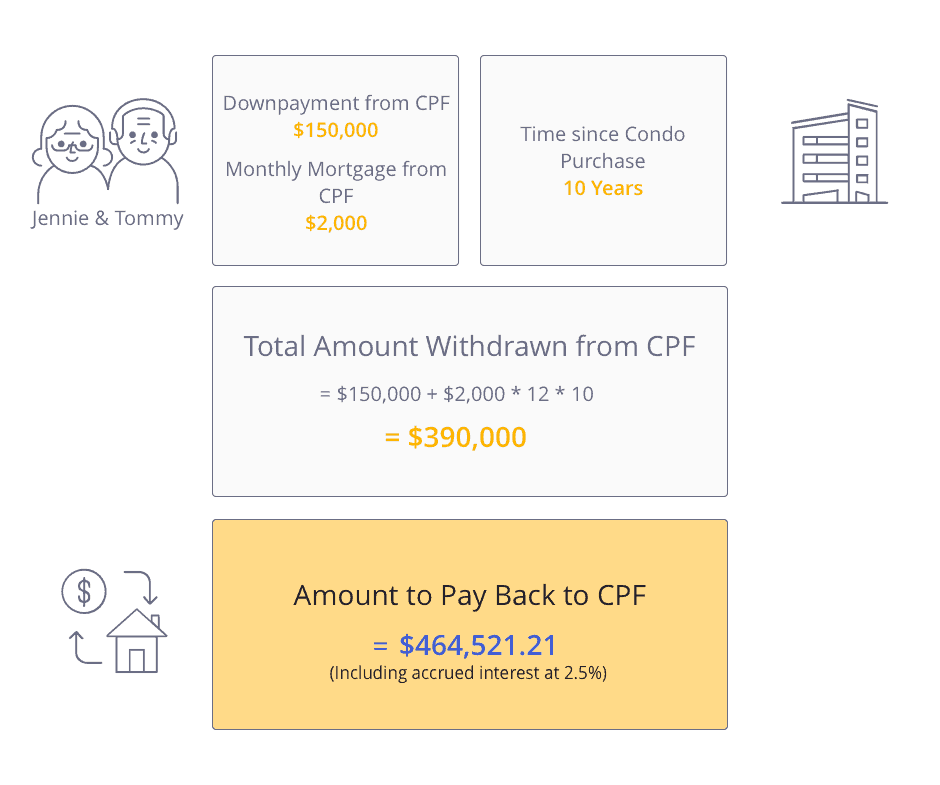

Case Study:

Let’s take the case of Jennie and Tommy, a married Singaporean couple, throughout this article. When Jennie (45 years old) and Tommy (50 years old) purchased their condo 10 years ago, they took money from CPF for the downpayment as well as for monthly mortgage payments. They had a minimum of $20,000 each still left in their accounts.

Hence, Jennie and Tommy will have to put almost $470,000 from the proceeds of their condo sale back into their CPF accounts, which they can use for purchasing their HDB or for retirement.

What happens to your CPF when you buy the HDB

On the 10th of May, 2019, the government passed new rules on how much CPF can be used for the purchase of your property.

The criteria are as shown below:

- The leasehold of the property must be such that the youngest owner of the property must be able to live up to the age of 95 years in it. If such a term can not be met, the amount of CPF available to be withdrawn will be pro-rated.

- You can withdraw up to 100% of the market value or the purchase price of the property from your CPF Ordinary Account (OA), whichever is lower.

c. Do I need to pay Seller’s Stamp Duty (SSD)?

Whether or not you have to pay any Seller’s Stamp Duty (SSD) when selling your condo depends on when you purchased your property and for how long you have held it. If you have held your private property for at least 3 years, you do not have to pay any SSD. SSD is calculated on the actual price or the market value of the condo, whichever is higher. Find out everything to know about Seller’s Stamp Duty (SSD) here.

|

Date of Purchase or Date of Change |

Holding Period | SSD Rate |

|

Before 14 Jan 2011 |

No SSD payable | |

| Between 14 Jan 2011 and 10 Mar 2017 (inclusive) | ≤ 1 year |

16% |

|

1 – 2 years |

12% | |

|

2 – 3 years |

8% | |

| 3 – 4 years |

4% |

|

| > 4 years | No SSD payable | |

| After 10 Mar 2017 | ≤ 1 year |

12% |

| 1 – 2 years | 8% | |

| 2 – 3 years |

4% |

|

| > 3 years |

No SSD payable |

d. How much loan can I get for my HDB purchase?

If you sell your condo first before buying the HDB, you would have 0 properties in your name at the time of buying, so you can get a higher loan amount. If you buy first, you would already have 1 property (i.e. your condo that you haven’t sold yet), so the HDB would be your 2nd property at the time of buying. Banks will give you a higher loan amount if you own 0 properties compared to if you already own 1 property.

The bank loan rates you can get are as shown below:

| Sell First (Own 0 properties at the time of buying) | Buy First (Already own 1 property at the time of buying) | |||

| Sum of Tenure and Age of Borrower | ≤ 65 Years | > 65 Years | ≤ 65 Years |

> 65 Years |

| Loan-to-Value (LTV) | 75% | 55% | 45% | 25% |

| Cash Downpayment | 5% | 10% | 25% | 25% |

| CPF / Cash Downpayment | 20% | 35% | 30% | 50% |

Bank loan LTV limits were updated on July 6, 2018. The above table assumes you do not own any additional properties. If you own more properties, check the rates here.

How does my age impact my loan?

Sellers can sometimes forget that their age matters a lot for their next purchase. The monthly mortgage for the property they want to buy next will be calculated based on it. You will be surprised at how high your mortgage can get when you’re older.

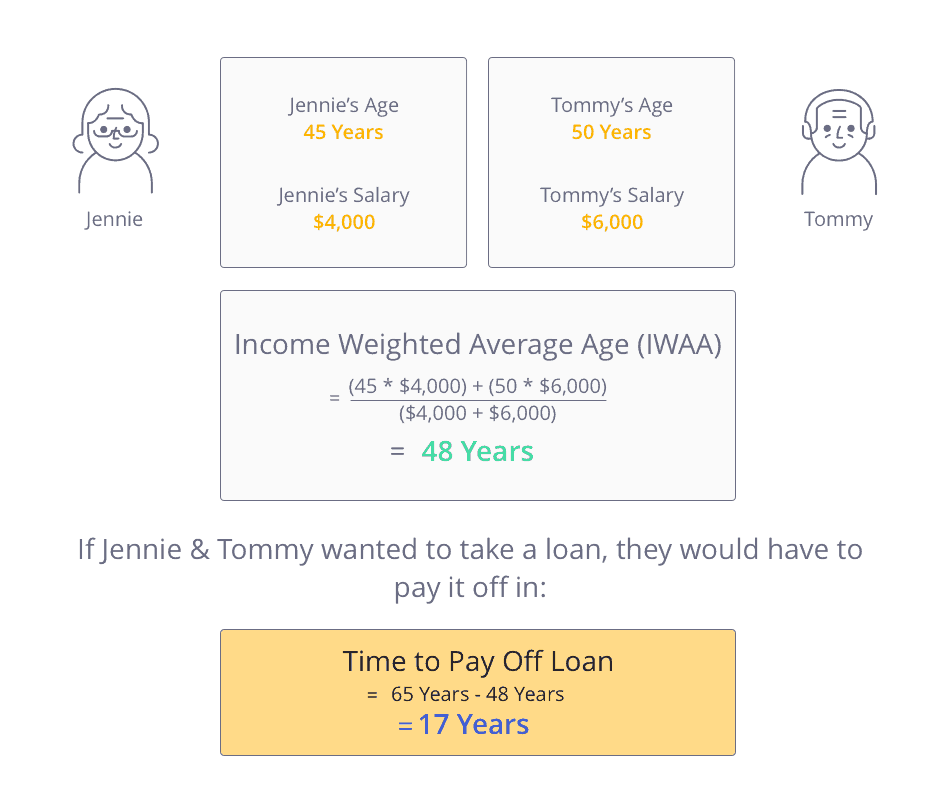

Since the “borrower” in your case is actually a couple, i.e. you and your spouse, your combined age is taken based on your income. It is called your Income Weighted Average Age (IWAA).

Case Study:

Jennie and Tommy’s “couple age” or their Income Weighted Average Age (IWAA) is based on their combined income and age as shown below:

If Jennie and Tommy take a 75% loan for their $500,000 HDB, this would mean:

Loan amount = $375,000

Assume interest rate = 2.0%

Since they only have 17 years to pay it off,

Their Monthly Mortgage Payment = $2,170

If they were younger and say they had 30 years to pay it off,

Their Monthly Mortgage Payment = $1,386

This is a difference of nearly $800 per month, which could have a huge impact on their cash flow. This calculation is hence crucial to complete, before making decisions on what you can afford to buy.

e. Can I get a grant for buying an HDB?

HDB offers many grants for making a purchase – for singles, orphans, first-time HDB applicants, families who want to live close to their parents or children and many others. They all have specific eligibility criteria which you can check on HDB’s site: for a resale HDB flat, for a new HDB flat.

Note that you can get a maximum of 2 such grants in a lifetime.

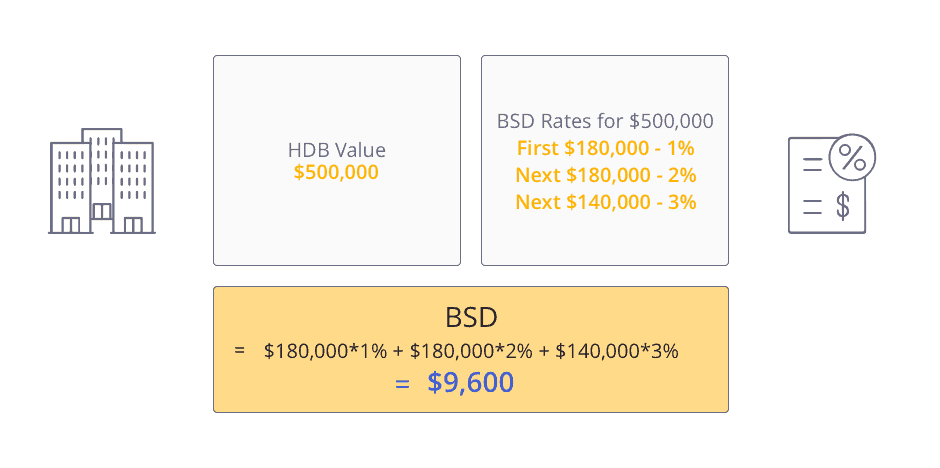

f. Do I need to pay Buyer’s Stamp Duty (BSD)?

Yes, you will have to pay a Buyer’s Stamp Duty (BSD) when you buy your HDB, which will be based on the purchase price or market value of the HDB you end up buying (whichever is higher). Find out everything you need to know about Buyer’s Stamp Duty (BSD) here.

|

Purchase Price or Market Value of the Property |

BSD Rates |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

The rates above were updated on February 20, 2018.

Case Study:

Jennie & Tommy want to know how much the BSD will cost them if they buy an HDB worth say $500,000.

Jennie and Tommy need to pay $9,600 to purchase an HDB worth $500,000.

g. Do I need to pay Additional Buyer’s Stamp Duty (ABSD)?

To rein in the rapid growth in home prices as well as maintain housing affordability for prospective home buyers who need a roof over their head, the government has increased the additional buyer’s stamp duty (ABSD) rates for both locals, permanent residents and foreigners.

The revised ABSD rates will apply to cases where the Option to Purchase (OTP) is granted on or after 16 December 2021. Singaporeans and Singapore permanent residents who are purchasing their first residential property will not be affected by the latest increase in stamp duty. Their ABSD rates will remain at 0% and 5% respectively.

Read more on IRAS website.

h. Do I need to pay Resale Levy?

The resale levy is meant to reduce the housing subsidy on the flat buyers’ second subsidised flat. It also ensures a fairer allocation of housing subsidies among flat buyers.

If you have already bought a subsidised housing, you will need to pay a resale levy when you buy a second subsidised flat. A subsidised housing is:

- A flat bought from HDB

- A resale flat bought with CPF housing grant

- A Design Build and Sell Scheme (DBSS) flat bought from a property developer

- An Executive Condominium (EC) unit bought from a property developer

- Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate etc.)

If you do not intend to buy a second subsidised flat from HDB, i.e., you are buying a resale flat or private residential property, you will not pay the resale levy.

The resale levy is a major factor to consider when buying your next HDB flat. To find out everything you need to know about it, have a look at our ultimate guide to the HDB and EC Resale Levy.

3. Making Decisions

Now that you have all these numbers ahead of you, what do you do with it?

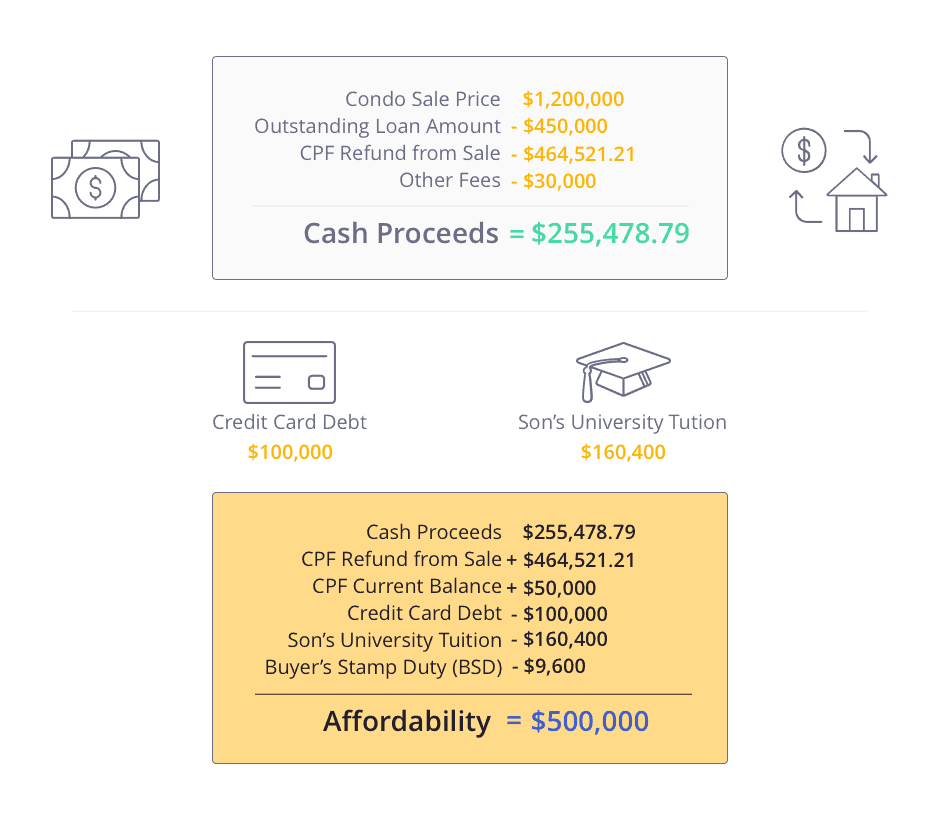

Your next step is to check what you can afford and make decisions on what you need. The amount of cash and CPF you have available will be the determining factors on whether you are able to buy first or not.

a. Which HDB can I afford?

You first have to calculate the amount of money you have for the purchase, and also determine if you need extra cash for renovation, other investments, paying off debts etc.

Potential Cash Proceeds =

Condo Sale Price

– Outstanding Loan Amount

– CPF Refund

– Other Fees (Legal, Property Agent, Taxes, etc.)

Amount Available for Purchase =

Total CPF Balance Amount

+ Cash Proceeds

+ Loan

+ HDB Grant

– Buyer’s Stamp Duty (BSD)

– Additional Buyer’s Stamp Duty (ABSD)

– Other financial commitments

Case Study:

Jennie and Tommy have made the below decisions:

- Since they are already in or close to their 50s, they do not want to take any additional loans and add to their debts

- They want to save some cash for paying off outstanding credit card debts

- They want to sponsor their son’s university tuition fee

- They want to use their CPF for the purchase

Below are the typical HDB prices:

- Avg. Price of 3 Room HDB = $290,000

- Avg. Price of 4 Room HDB = $400,000

- Avg. Price of 5 Room HDB = $480,000

- Avg. Price of Executive Condominium = $630,000

Note: These are average prices and can vary based on the location, the condition of the individual unit etc.

Based on their budget of $500,000, they can get a 4 or 5 Room HDB.

b. Should I sell my condo first or buy an HDB first?

The amount of money you have at hand plays a huge part in whether you sell first or buy first, but there are a few other pros and cons as listed below. They should help you decide on which one you should do first:

|

Sell Condo First |

Buy HDB First |

|

No time limit to sell the condo |

6 month time limit to sell the condo |

| Can wait for a preferred selling price |

May feel pressured to sell at a lower price due to time limit |

| Can use recycled CPF from the condo sale for the HDB purchase |

Can still use CPF for the HDB purchase, but need a higher balance |

|

Can get higher LTV from bank loan |

Can get lower LTV from bank loan |

| Need less cash for downpayment |

Need more cash for downpayment |

|

Stress of buying house quickly |

Can wait and buy preferred house |

| May have to stay in a rented house if your desired house is not available in time |

Can take your time to move into the new house |

4. Taking Action

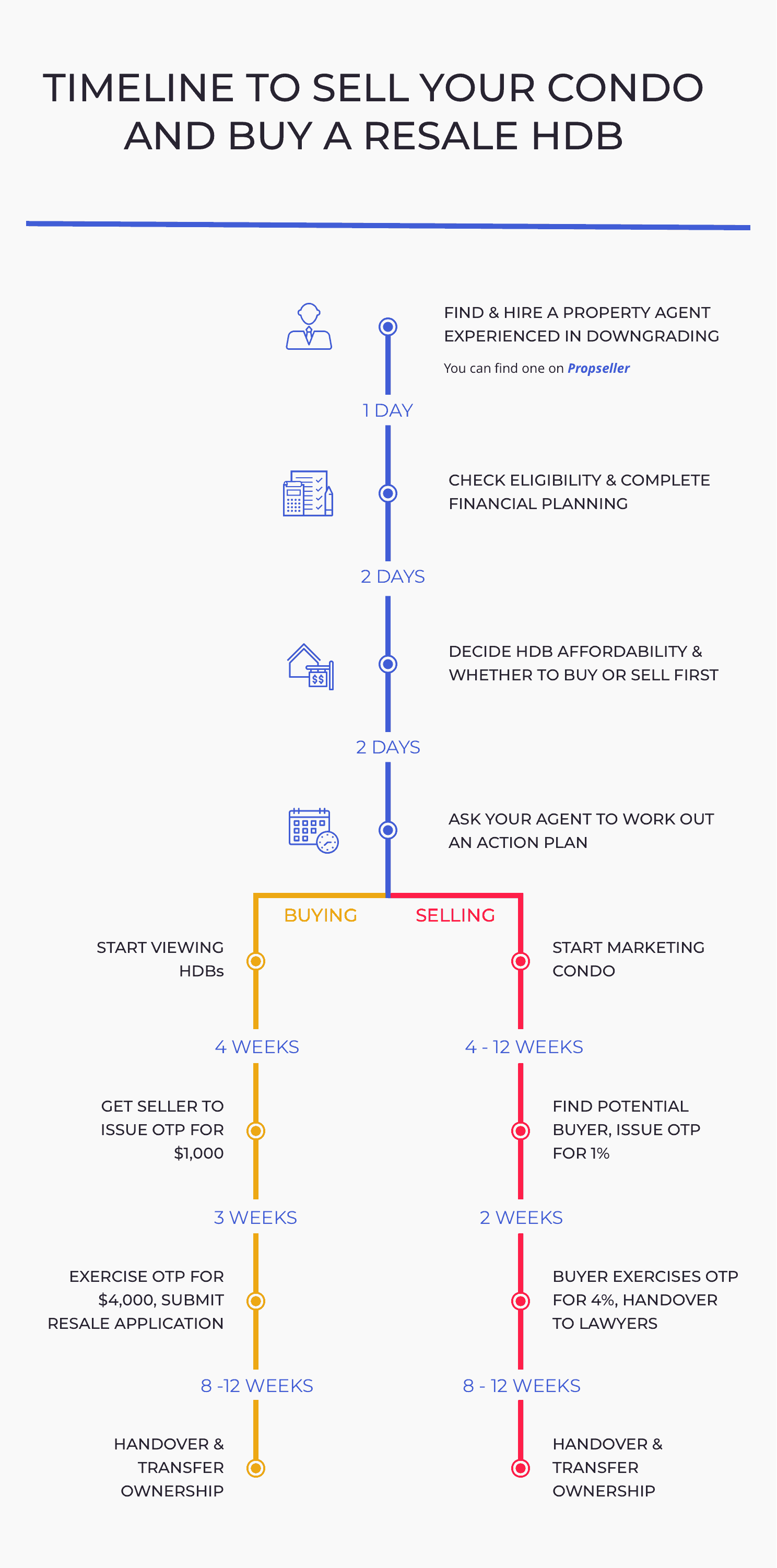

Depending on whether your eventual decision is to buy the HDB first or sell the condo first, the timeline of events may vary. However, the steps are the same and the most important ones are listed below.

a. Hire a property agent experienced in downgrading from a condo to an HDB

Your property agent’s skill is crucial to the success of your property sale and purchase. Given the number of frequently changing regulations there are to stay on top of, and the tight timelines you have to work with while downgrading from a condo to an HDB, you want someone who knows what they’re doing. Note that if you don’t already have one, you can find an experienced agent on Propseller.

Your agent will help you with:

- Checking your eligibility

- Completing your financial planning

- Determining which HDB to buy

- Deciding whether to sell your condo first or buy an HDB first

And everything that comes after.

b. Start marketing your condo for sale

A condo sale from start to completion can take anywhere between 3-6 months. Of course, there are the exceptional cases when it can be much earlier or much later based on the individual unit’s condition, the price set, the demand and supply in your area etc. The steps that take the most time are:

- Finding buyers (4-12 weeks)

- Handing over and transferring ownership (8-12 weeks )

See the timeline infographic below to see the individual steps to be taken during the sale and how long each step takes.

c. Start viewing HDBs to buy

A resale HDB purchase from start to completion can take anywhere between 2-3 months. The steps that take the most time are:

- Viewing, shortlisting and confirming the unit you want to buy (4 weeks)

- Handing over and transferring ownership (8-12 weeks)

- Optional: Renovation (8 weeks)

Note: If you need cash earlier because your purchase went through faster than your sale, you can get a bridging loan.

See the timeline infographic below to see the individual steps to be taken during the purchase and how long each step takes.

Note that these timelines are based on current market practice and regulations, and are subject to change case by case.

Conclusion

In conclusion, before you make any decisions on which home to buy, first check your eligibility, then calculate your finances, then check what you can afford and finally create an action plan. Downgrading from a condo to an HDB is a complex process with many regulations, but it can be simplified if you follow the steps above and have great professional help from agents and lawyers.

Have any questions about downgrading your condo? Ask us in the comments or on the chat icon on the bottom right of your screen!

Don’t have an agent yet? Find agents experienced in downgrading from a condo to an HDB on Propseller, to start your journey.

Disclaimer: All information and materials contained in these pages including the terms, conditions and descriptions are subject to change. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure.

Whilst every effort has been made to ensure the accuracy of information on the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials contained on the Site for any purpose.